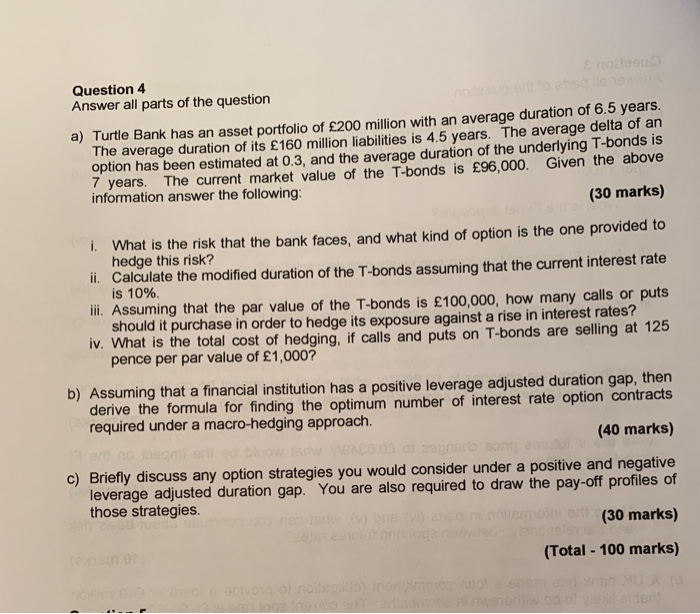

Question 4 Answer all parts of the question a) Turtle Bank has an asset portfolio of 200 million with an average duration of 6.5 years. The average duration of its 160 million liabilities is 4.5 years. The average delta of an option has been estimated at 0.3, and the average duration of the underlying T-bonds is 7 years. The current market value of the T-bonds is 96,000. Given the above information answer the following: (30 marks) 1. What is the risk that the bank faces, and what kind of option is the one provided to hedge this risk? il. Calculate the modified duration of the T-bonds assuming that the current interest rate is 10% ill. Assuming that the par value of the T-bonds is 100,000, how many calls or puts should it purchase in order to hedge its exposure against a rise in interest rates? iv. What is the total cost of hedging, if calls and puts on T-bonds are selling at 125 pence per par value of 1,000? b) Assuming that a financial institution has a positive leverage adjusted duration gap, then derive the formula for finding the optimum number of interest rate option contracts required under a macro-hedging approach. (40 marks) ONDO c) Briefly discuss any option strategies you would consider under a positive and negative leverage adjusted duration gap. You are also required to draw the pay-off profiles of those strategies. P a nimoinen (30 marks) (Total - 100 marks) Question 4 Answer all parts of the question a) Turtle Bank has an asset portfolio of 200 million with an average duration of 6.5 years. The average duration of its 160 million liabilities is 4.5 years. The average delta of an option has been estimated at 0.3, and the average duration of the underlying T-bonds is 7 years. The current market value of the T-bonds is 96,000. Given the above information answer the following: (30 marks) 1. What is the risk that the bank faces, and what kind of option is the one provided to hedge this risk? il. Calculate the modified duration of the T-bonds assuming that the current interest rate is 10% ill. Assuming that the par value of the T-bonds is 100,000, how many calls or puts should it purchase in order to hedge its exposure against a rise in interest rates? iv. What is the total cost of hedging, if calls and puts on T-bonds are selling at 125 pence per par value of 1,000? b) Assuming that a financial institution has a positive leverage adjusted duration gap, then derive the formula for finding the optimum number of interest rate option contracts required under a macro-hedging approach. (40 marks) ONDO c) Briefly discuss any option strategies you would consider under a positive and negative leverage adjusted duration gap. You are also required to draw the pay-off profiles of those strategies. P a nimoinen (30 marks) (Total - 100 marks)