Answered step by step

Verified Expert Solution

Question

1 Approved Answer

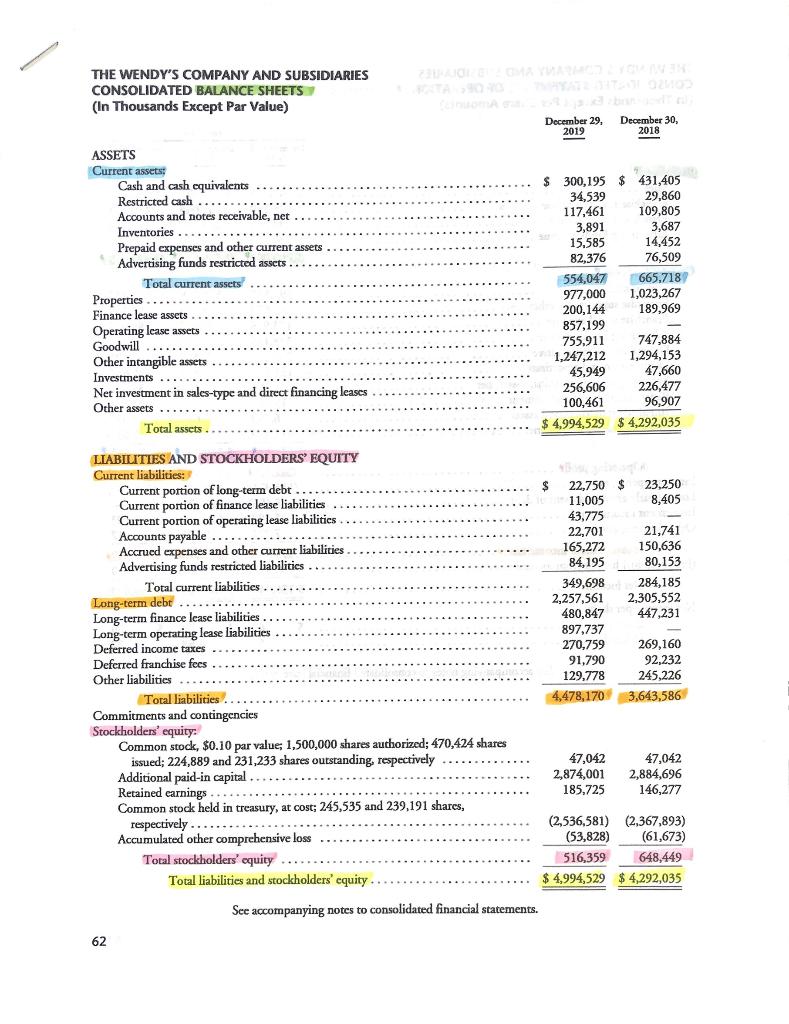

In 2019, what percentage of total assets is fixed assets, such as plant and equipment? My belief is that you just simply divide properties by

In 2019, what percentage of total assets is fixed assets, such as plant and equipment?

My belief is that you just simply divide properties by total assets ($997,000 / $4,994,529) = .1956 or 19.56%

But I'm not sure if Finance and Operating lease assets are supposed to be included or not.

THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thousands Except Par Value) December 29, December 30, 2019 2018 3,687 ASSETS Current assets: Cash and cash equivalents Restricted cash.... Accounts and notes receivable, net Inventories.... Prepaid expenses and other current assets Advertising funds restricted assets Total current assets Properties Finance lease assets Operating lease assets Goodwill Other intangible assets Investments ... Net investment in sales-type and direct financing leases Other assets Total assets $ 300,195 $ 431,405 34,539 29,860 117,461 109,805 3,891 15.585 14,452 82,376 76,509 554.047 665,718 1,023,267 200,144 189.969 857,199 755.911 747,884 1,247,212 1,294,153 45,949 47,660 256,606 96,907 $ 4,994,529 $ 4,292,035 977,000 226,477 100,461 23.250 8,405 22,750 $ 11,005 43,775 22,701 165.272 84.195 21,741 150,636 80,153 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Current portion of finance lease liabilities Current portion of operating lease liabilities Accounts payable Accrued expenses and other current liabilities Advertising funds restricted liabilities Total current liabilities Long-term debt ......... Long-term finance lease liabilities Long-term operating lease liabilities Deferred income taxes Deferred franchise fees Other liabilities Total liabilities Commitments and contingencies Stockholders' equity: Common stock, $0.10 par value; 1,500,000 shares authorized: 470,424 shares issued: 224,889 and 231,233 shares outstanding, respectively Additional paid-in capital Retained earnings Common stock held in treasury, at cost; 245,535 and 239,191 shares, respectively ........... Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' cquity. 349,698 284,185 2,257,561 2,305,552 480,847 447,231 897,737 270,759 269,160 91,790 92,232 129,778 245.226 4,478,170 3,643,586 47,042 2,874,001 185,725 47,042 2,884,696 146,277 (2,536,581) (2,367,893) (53,828) (61,673) 516,359 648,449 4,994,529 $ 4,292,035 See accompanying notes to consolidated financial statements. 62 THE WENDY'S COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In Thousands Except Par Value) December 29, December 30, 2019 2018 3,687 ASSETS Current assets: Cash and cash equivalents Restricted cash.... Accounts and notes receivable, net Inventories.... Prepaid expenses and other current assets Advertising funds restricted assets Total current assets Properties Finance lease assets Operating lease assets Goodwill Other intangible assets Investments ... Net investment in sales-type and direct financing leases Other assets Total assets $ 300,195 $ 431,405 34,539 29,860 117,461 109,805 3,891 15.585 14,452 82,376 76,509 554.047 665,718 1,023,267 200,144 189.969 857,199 755.911 747,884 1,247,212 1,294,153 45,949 47,660 256,606 96,907 $ 4,994,529 $ 4,292,035 977,000 226,477 100,461 23.250 8,405 22,750 $ 11,005 43,775 22,701 165.272 84.195 21,741 150,636 80,153 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Current portion of finance lease liabilities Current portion of operating lease liabilities Accounts payable Accrued expenses and other current liabilities Advertising funds restricted liabilities Total current liabilities Long-term debt ......... Long-term finance lease liabilities Long-term operating lease liabilities Deferred income taxes Deferred franchise fees Other liabilities Total liabilities Commitments and contingencies Stockholders' equity: Common stock, $0.10 par value; 1,500,000 shares authorized: 470,424 shares issued: 224,889 and 231,233 shares outstanding, respectively Additional paid-in capital Retained earnings Common stock held in treasury, at cost; 245,535 and 239,191 shares, respectively ........... Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' cquity. 349,698 284,185 2,257,561 2,305,552 480,847 447,231 897,737 270,759 269,160 91,790 92,232 129,778 245.226 4,478,170 3,643,586 47,042 2,874,001 185,725 47,042 2,884,696 146,277 (2,536,581) (2,367,893) (53,828) (61,673) 516,359 648,449 4,994,529 $ 4,292,035 See accompanying notes to consolidated financial statements. 62Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started