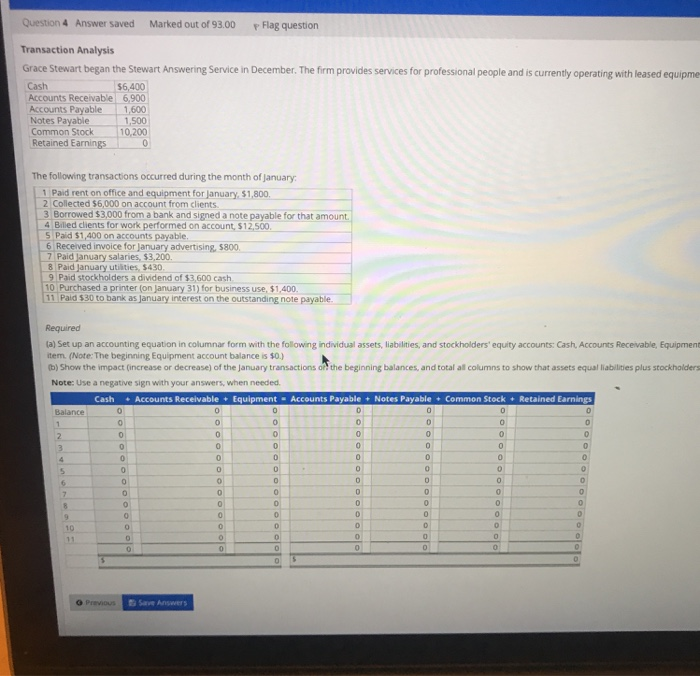

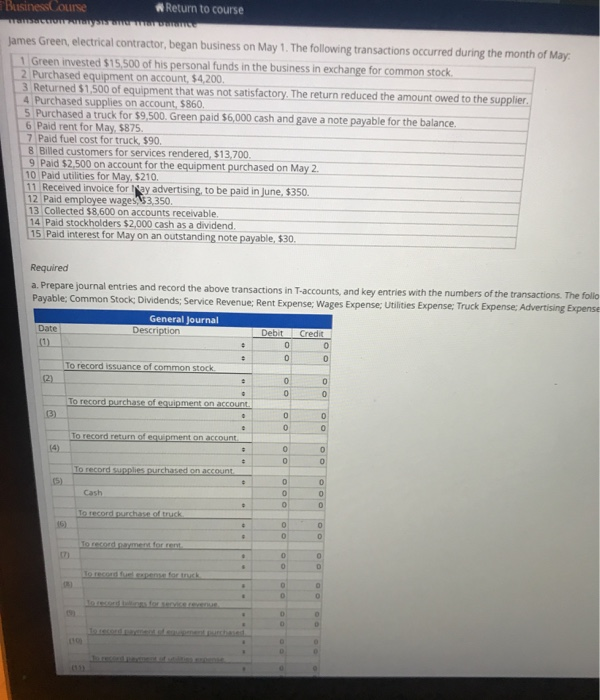

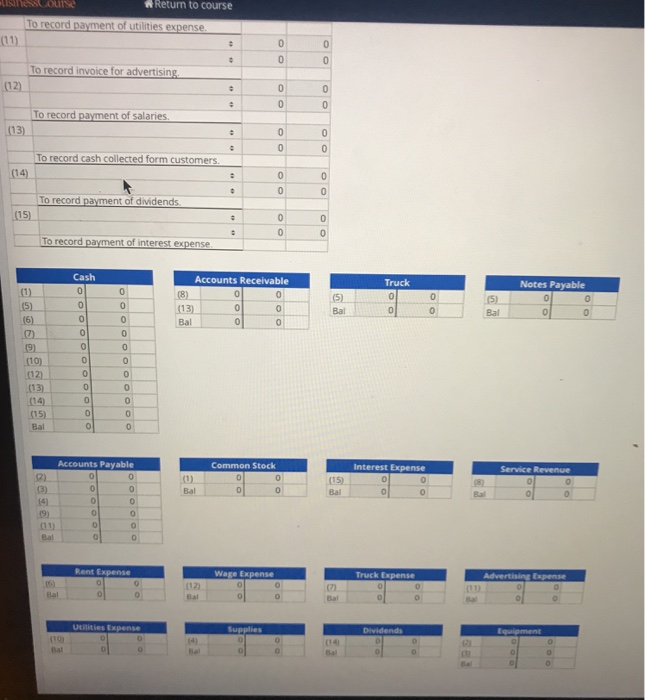

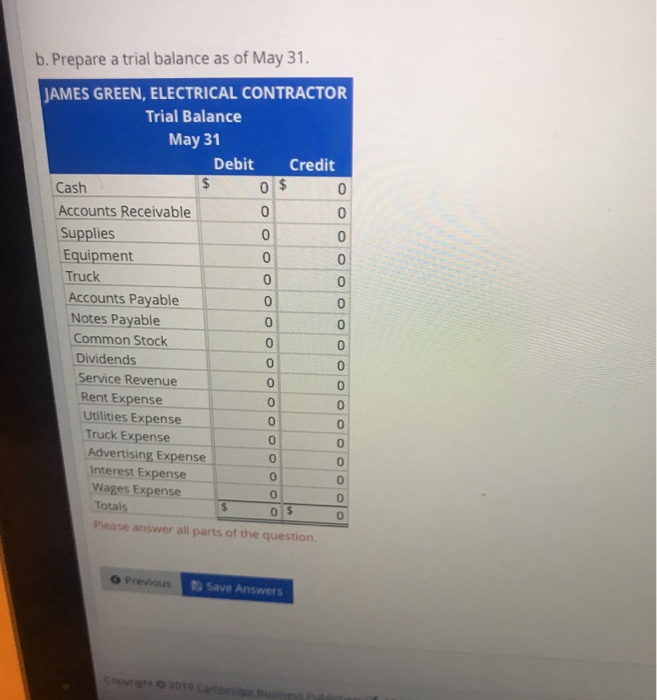

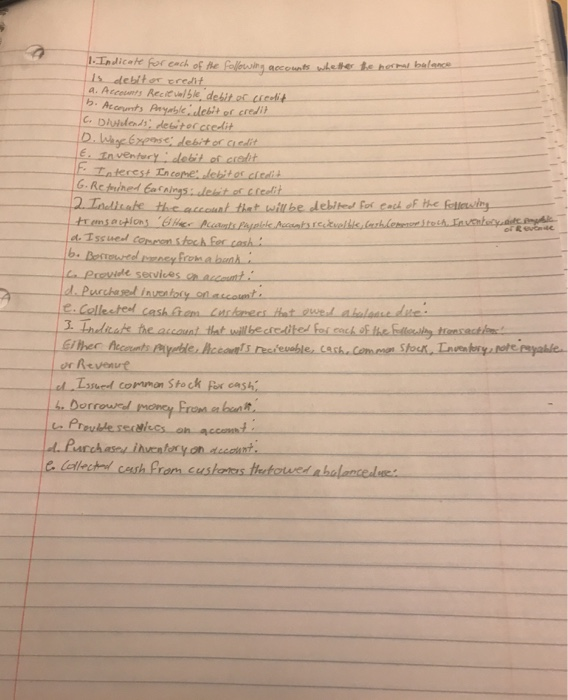

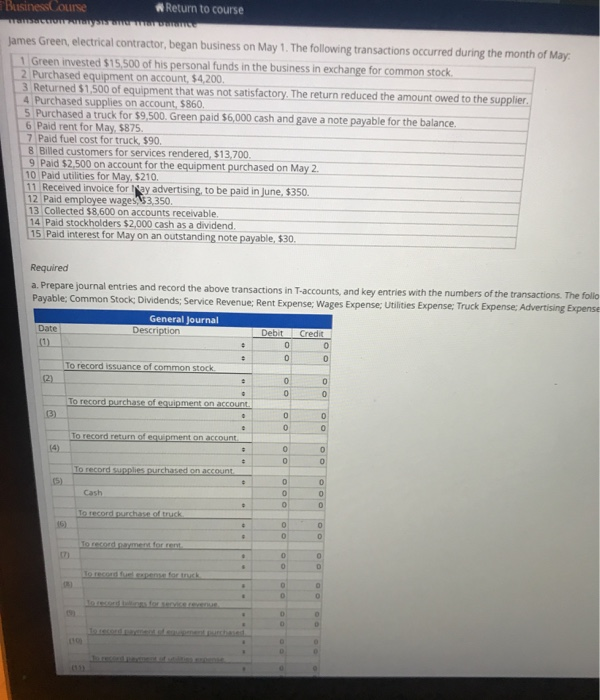

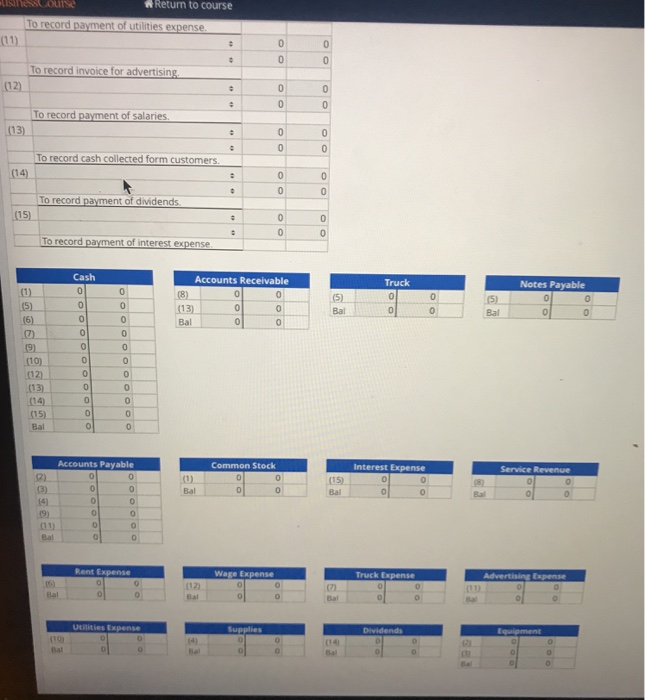

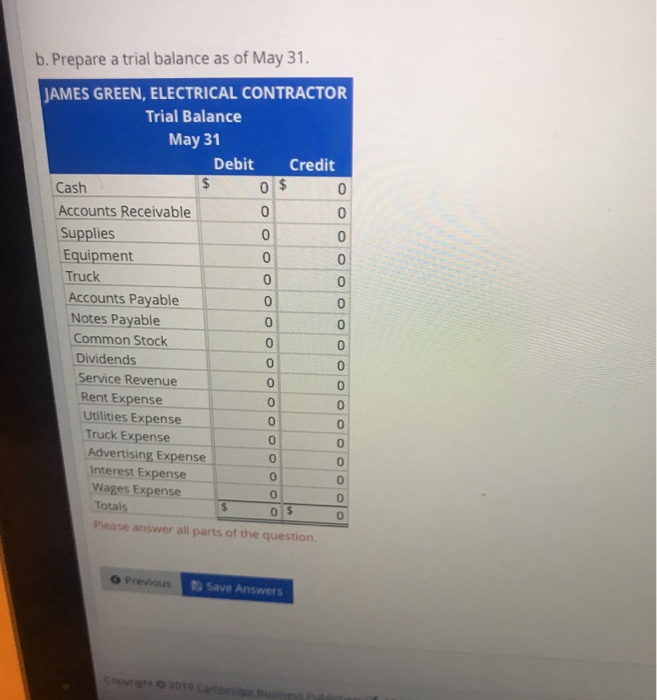

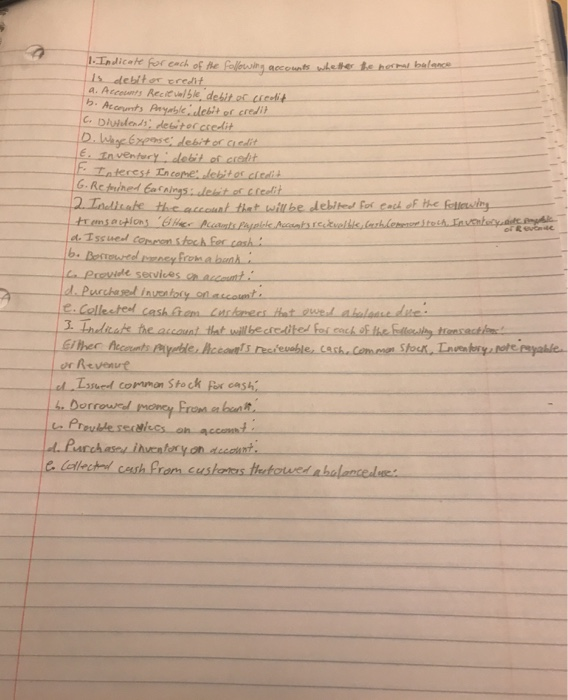

Question 4 Answer saved Marked out of 93.00 Flag question Transaction Analysis Grace Stewart began the Stewart Answering Service in December. The firm provides services for professional people and is currently operating with leased equipme Cash $6,400 Accounts Receivable 6.900 Accounts Payable 1,600 Notes Payable 1.500 Common Stock 10,200 Retained Earnings The following transactions occurred during the month of January 1 Paid rent on office and equipment for January $1,800 2 Collected $6,000 on account from clients 3 Borrowed $3,000 from a bank and signed a note payable for that amount 4 Billed clients for work performed on account, $12.500 5 Paid $1,400 on accounts payable. 6 Received invoice for January advertising, 5800 7 Paid january salaries, $3,200. 8 Pad January utilities 5430 9 Paid stockholders a dividend of $600 cash 10 Purchased a printer on January 31) for business use. 51.400 11 Paid 530 to bank as january interest on the outstanding note payable O Required (a) Set up an accounting equation in columnar form with the following individual assets, liabilities, and stockholders' equity accounts: Cash, Accounts Receivable Equipment item. (Note: The beginning Equipment account balance is 10) b) Show the impact increase or decrease of the January transactions of the beginning balances, and total al columns to show that assets equal liabilities plus stockholders Note: Use a negative sign with your answers, when needed Cash Accounts Receivable - Equipment Accounts Pa Notes Payable. Common Stock Retained Earnings 0 0 OOOOOOOOOOOO OOOOOOOOOOOOOO OOOOOOOOOOOOO SOOOOOOOOOOOOO JoooOOOOOOOOOO OOOOOOOOOOOOOO Previous Business Course Return to course James Green, electrical contractor, began business on May 1. The following transactions occurred during the month of May 1 Green invested $15.500 of his personal funds in the business in exchange for common stock 2 Purchased equipment on account, $4,200 3 Returned $1,500 of equipment that was not satisfactory. The return reduced the amount owed to the supplier. 4 Purchased supplies on account, $860 5 Purchased a truck for $9.500. Green paid $6,000 cash and gave a note payable for the balance. 6 Paid rent for May $875. 7 Paid fuel cost for truck, 590. 8 Billed customers for services rendered, $13,700. 9 Paid $2.500 on account for the equipment purchased on May 2. 10 Paid utilities for May, $210. 11 Received invoice for Nay advertising, to be paid in June, $350. 12 Paid employee wages 53,350. 13 Collected $8,600 on accounts receivable. 14 Paid stockholders $2,000 cash as a dividend. 15 Paid interest for May on an outstanding note payable, $30. Required a. Prepare journal entries and record the above transactions in T-accounts, and key entries with the numbers of the transactions. The follo Payable: Common Stock Dividends: Service Revenue; Rent Expense; Wages Expense; Utilities Expense; Truck Expense: Advertising Expense General Journal Date Description Debit Credit 0 0 To record issuance of common stock To record purchase of equipment on To record return of equipment on acco OOOOOOOOOOOO To record supplies purchased on account Cash To recordurchase of truck To recordinament for rent wreturn to course To record payment of utilities expense To record invoice for advertising (12) . To record payment of salaries. (13) .. To record cash collected form customers .. To record payment of dividends (15) To record payment of Interest expense Accounts Receivable Truck Notes Payable (13 Accounts Payable Common Stock Interest Expense Service Revenue (15) OOOOOO Wage Expense Advertising Expense 0 Truck Expense 0 0 o staties ense b. Prepare a trial balance as of May 31. 0 JAMES GREEN, ELECTRICAL CONTRACTOR Trial Balance May 31 Debit Credit Cash $ 0 $ 0 Accounts Receivable Supplies Equipment Truck Accounts Payable Notes Payable Common Stock Dividends Service Revenue Rent Expense Utilities Expense Truck Expense Advertising Expense Interest Expense Wages Expense Totals Please answer all parts of the question OOOOOOOOOOOO Previous Save Answers 1. Indicate for each of the following counts whether the normal balance Is debit or treat a. Accounts Recrevalble debit or credit 15. Accounts Payable debit or credit C. Dividends, debitor credit D. Wege expose debitor credit (E. Inventory debit or credit Interest Income lebitor credit 16. Referired Earnings: lebit or credit 2. Indicate the account that will be clebited for each of the following tres actions Hec. Acces Palk Accantsrecituellte Gerhleet Invoeren d. Issue common stock for cash! b. Bestowed any from a bank 2. Provide services on account d. Purchased inventory on account e. Collected cash ft am curred that owed a balodie die 3. tredicate the account that will be credited for each of the following transactions Either Recounts payable. Accos recevable, coche.commes Stock Inventory, pole payable. or Revenue d Issued common stock for cash, b. Dorrowed money from a bank 6. Provide secuies on account. L. Purchase inventory on decount C. Collected ceish from customers thertowed a balance des