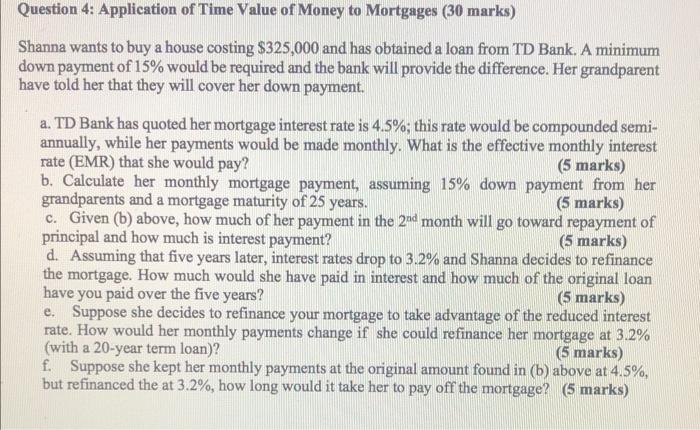

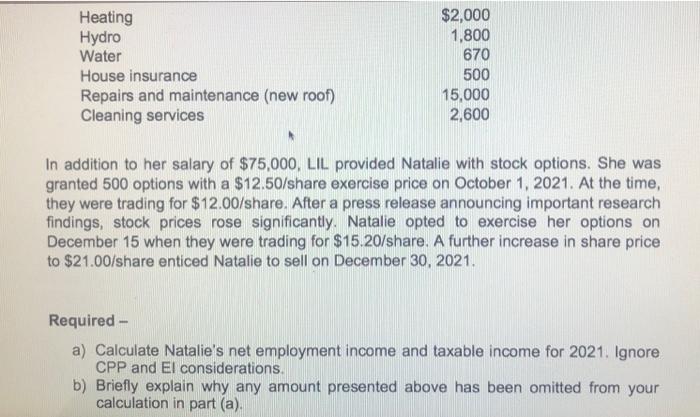

Question 4: Application of Time Value of Money to Mortgages (30 marks) Shanna wants to buy a house costing $325,000 and has obtained a loan from TD Bank. A minimum down payment of 15% would be required and the bank will provide the difference. Her grandparent have told her that they will cover her down payment. a. TD Bank has quoted her mortgage interest rate is 4.5%; this rate would be compounded semi- annually, while her payments would be made monthly. What is the effective monthly interest rate (EMR) that she would pay? (5 marks) b. Calculate her monthly mortgage payment, assuming 15% down payment from her grandparents and a mortgage maturity of 25 years. (5 marks) c. Given (b) above, how much of her payment in the 2nd month will go toward repayment of principal and how much is interest payment? (5 marks) d. Assuming that five years later, interest rates drop to 3.2% and Shanna decides to refinance the mortgage. How much would she have paid in interest and how much of the original loan have you paid over the five years? (5 marks) e. Suppose she decides to refinance your mortgage to take advantage of the reduced interest rate. How would her monthly payments change if she could refinance her mortgage at 3.2% (with a 20-year term loan)? (6 marks) f. Suppose she kept her monthly payments at the original amount found in (b) above at 4.5%, but refinanced the at 3.2%, how long would it take her to pay off the mortgage? (5 marks) Heating Hydro Water House insurance Repairs and maintenance (new roof) Cleaning services $2,000 1,800 670 500 15,000 2,600 In addition to her salary of $75,000, LIL provided Natalie with stock options. She was granted 500 options with a $12.50/share exercise price on October 1, 2021. At the time, they were trading for $12.00/share. After a press release announcing important research findings, stock prices rose significantly. Natalie opted to exercise her options on December 15 when they were trading for $15.20/share. A further increase in share price to $21.00/share enticed Natalie to sell on December 30, 2021. Required - a) Calculate Natalie's net employment income and taxable income for 2021. Ignore CPP and El considerations. b) Briefly explain why any amount presented above has been omitted from your calculation in part (a)