Question 4

Based on the following information, apply the course materials to develop a method to estimate the weighted average costs of capital (WACC) of Sun Hung Kei & Co. Limited (Stock Code: 0086). You may want to focus on those highlighted essential items. Please elaborate on your estimation logic and assumptions. [33 marks]

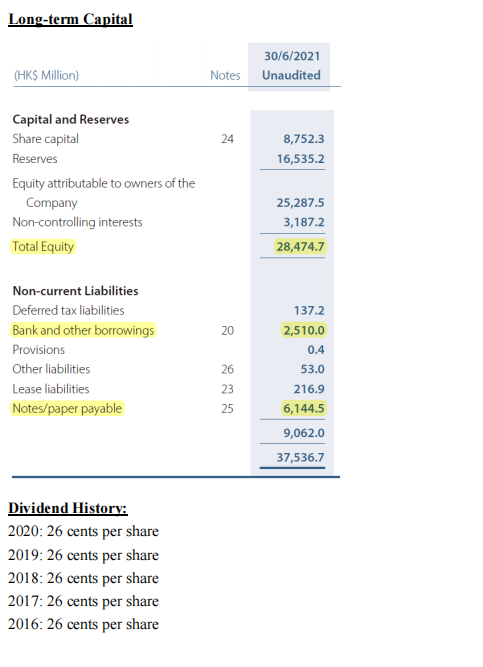

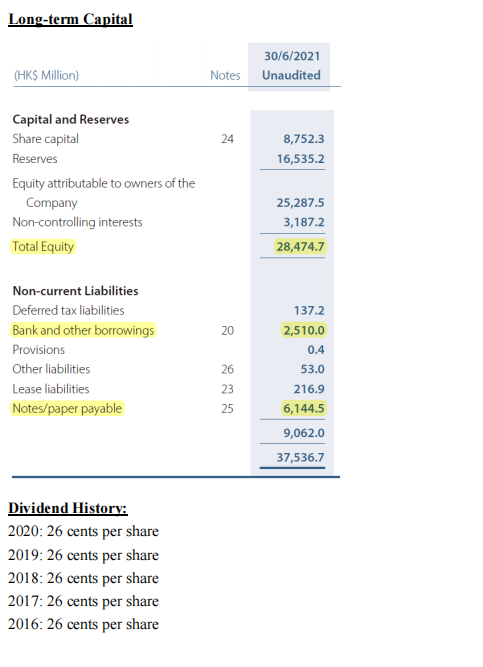

The following information is extracted from the 2021 Interim report of Sun Hung Kei & Co. Limited.

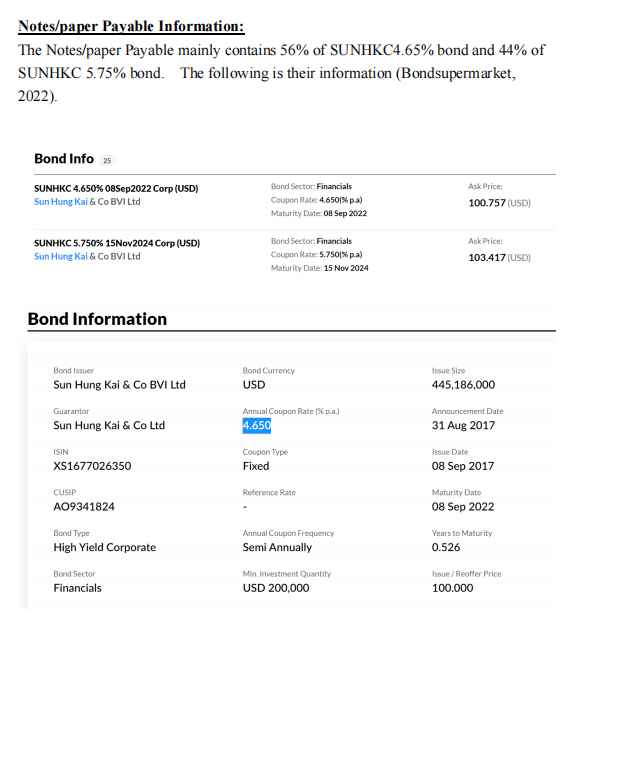

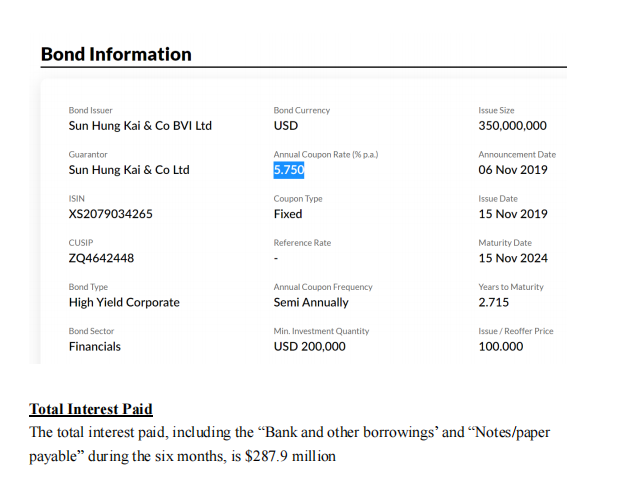

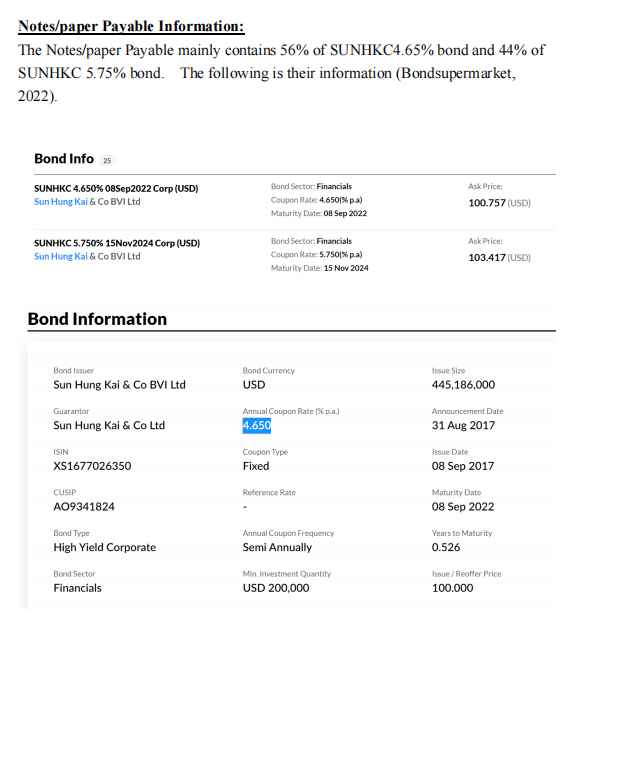

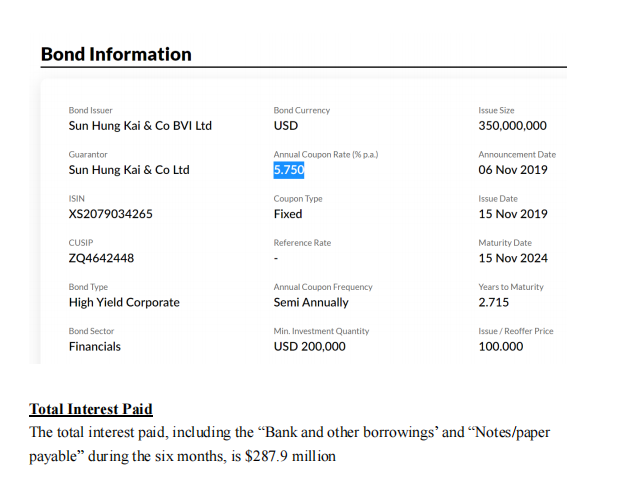

Long-term Capital (HK$ Million) 30/6/2021 Notes Unaudited 24 8,752.3 16,535.2 Capital and Reserves Share capital Reserves Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 26 23 137.2 2,510.0 0.4 53.0 216.9 6,144.5 9,062.0 37,536.7 25 Dividend History: 2020: 26 cents per share 2019: 26 cents per share 2018: 26 cents per share 2017: 26 cents per share 2016: 26 cents per share Notes/paper Payable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Infos SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kai & Co BVI Ltd Bond Sector: Financials Coupon Rate: 4.650%p.a) Maturity Date: 08 Sep 2022 Ask Price: 100.757 (USD) SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kai & Co BVI Ltd Bond Sector: Financials Coupon Rate: 5.750% p.a) Maturity Date: 15 Nov 2024 Ask Price: 103.417 (USD) Bond Information Bond issuer Sun Hung Kai & Co BVI Ltd Bond Currency USD Issue Size 445,186,000 Announcement Date Guarantor Sun Hung Kai & Co Ltd Annual Coupon Ratep.a.) 4.650 31 Aug 2017 ISIN X51677026350 Coupon Type Fixed Issue Date 08 Sep 2017 Reference Rate CUSIP AO9341824 Maturity Date 08 Sep 2022 Bond Type High Yield Corporate Annual Coupon Frequency Semi Annually Years to Maturity 0.526 Bond Sector Issue / Reoffer Price Financials Min. Investment Quantity USD 200,000 100.000 Bond Information Bond Issuer Sun Hung Kai & Co BVI Ltd Bond Currency USD Issue Size 350,000,000 Guarantor Sun Hung Kai & Co Ltd Annual Coupon Rate(% p.a.) 5.750 Announcement Date 06 Nov 2019 ISIN XS2079034265 Coupon Type Fixed Issue Date 15 Nov 2019 CUSIP Reference Rate ZQ4642448 Maturity Date 15 Nov 2024 Annual Coupon Frequency Semi Annually Years to Maturity 2.715 Bond Type High Yield Corporate Bond Sector Financials Min. Investment Quantity USD 200,000 Issue / Reoffer Price 100.000 Total Interest Paid The total interest paid, including the Bank and other borrowings and Notes/paper payable" during the six months, is $287.9 million Long-term Capital (HK$ Million) 30/6/2021 Notes Unaudited 24 8,752.3 16,535.2 Capital and Reserves Share capital Reserves Equity attributable to owners of the Company Non-controlling interests Total Equity 25,287.5 3,187.2 28,474.7 20 Non-current Liabilities Deferred tax liabilities Bank and other borrowings Provisions Other liabilities Lease liabilities Notes/paper payable 26 23 137.2 2,510.0 0.4 53.0 216.9 6,144.5 9,062.0 37,536.7 25 Dividend History: 2020: 26 cents per share 2019: 26 cents per share 2018: 26 cents per share 2017: 26 cents per share 2016: 26 cents per share Notes/paper Payable Information: The Notes/paper Payable mainly contains 56% of SUNHKC4.65% bond and 44% of SUNHKC 5.75% bond. The following is their information (Bondsupermarket, 2022). Bond Infos SUNHKC 4.650% 08Sep2022 Corp (USD) Sun Hung Kai & Co BVI Ltd Bond Sector: Financials Coupon Rate: 4.650%p.a) Maturity Date: 08 Sep 2022 Ask Price: 100.757 (USD) SUNHKC 5.750% 15Nov 2024 Corp (USD) Sun Hung Kai & Co BVI Ltd Bond Sector: Financials Coupon Rate: 5.750% p.a) Maturity Date: 15 Nov 2024 Ask Price: 103.417 (USD) Bond Information Bond issuer Sun Hung Kai & Co BVI Ltd Bond Currency USD Issue Size 445,186,000 Announcement Date Guarantor Sun Hung Kai & Co Ltd Annual Coupon Ratep.a.) 4.650 31 Aug 2017 ISIN X51677026350 Coupon Type Fixed Issue Date 08 Sep 2017 Reference Rate CUSIP AO9341824 Maturity Date 08 Sep 2022 Bond Type High Yield Corporate Annual Coupon Frequency Semi Annually Years to Maturity 0.526 Bond Sector Issue / Reoffer Price Financials Min. Investment Quantity USD 200,000 100.000 Bond Information Bond Issuer Sun Hung Kai & Co BVI Ltd Bond Currency USD Issue Size 350,000,000 Guarantor Sun Hung Kai & Co Ltd Annual Coupon Rate(% p.a.) 5.750 Announcement Date 06 Nov 2019 ISIN XS2079034265 Coupon Type Fixed Issue Date 15 Nov 2019 CUSIP Reference Rate ZQ4642448 Maturity Date 15 Nov 2024 Annual Coupon Frequency Semi Annually Years to Maturity 2.715 Bond Type High Yield Corporate Bond Sector Financials Min. Investment Quantity USD 200,000 Issue / Reoffer Price 100.000 Total Interest Paid The total interest paid, including the Bank and other borrowings and Notes/paper payable" during the six months, is $287.9 million