Answered step by step

Verified Expert Solution

Question

1 Approved Answer

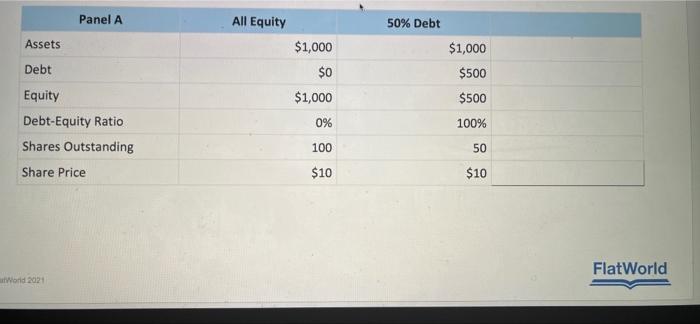

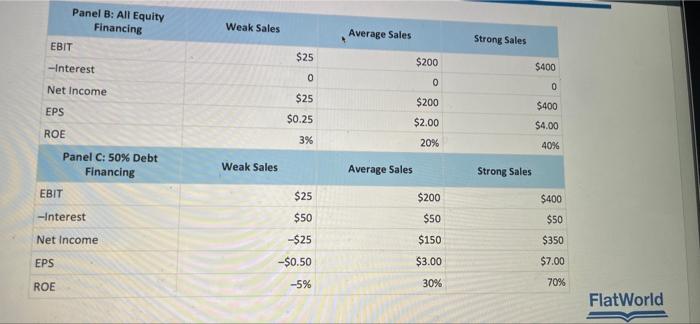

use the charts pictured to answer the question in the third picture Panel A Assets Debt Equity Debt-Equity Ratio Shares Outstanding Share Price World 2021

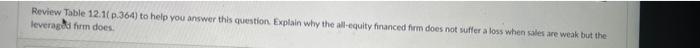

use the charts pictured to answer the question in the third picture

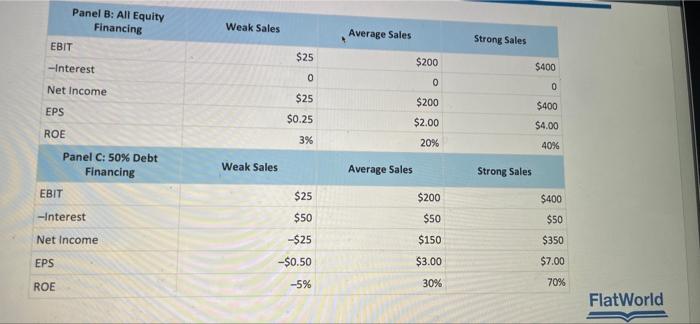

Panel A Assets Debt Equity Debt-Equity Ratio Shares Outstanding Share Price World 2021 All Equity $1,000 $0 $1,000 0% 100 $10 50% Debt $1,000 $500 $500 100% 50 $10 FlatWorld Panel B: All Equity Financing EBIT -Interest Net Income EPS ROE Panel C: 50% Debt Financing EBIT -Interest Net Income EPS ROE Weak Sales Weak Sales $25 0 $25 $0.25 3% $25 $50 -$25 -$0.50 -5% Average Sales Average Sales $200 0 $200 $2.00 20% $200 $50 $150 $3.00 30% Strong Sales Strong Sales $400 0 $400 $4.00 40% $400 $50 $350 $7.00 70% FlatWorld Review Table 12.1(p.364) to help you answer this question. Explain why the all-equity financed firm does not suffer a loss when sales are weak but the leveraged firm does

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started