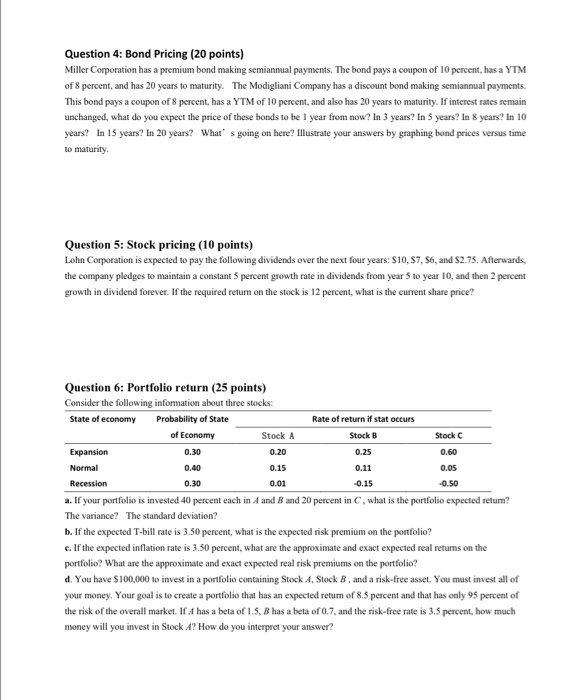

Question 4: Bond Pricing (20 points) Miller Corporation has a premium bond making semiannual payments. The bond pays a coupon of 10 percent, has a YTM of 8 percent, and has 20 years to maturity. The Modigliani Company has a discount bond making semiannual payments. This bond pays a coupon of 8 percent, has a YTM of 10 percent, and also has 20 years to maturity. If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 3 years? In 5 years? In 8 years? In 10 years? In 15 years? In 20 years? What' s going on here? Illustrate your answers by graphing bond prices versus time to maturity Question 5: Stock pricing (10 points) Lohn Corporation is expected to pay the following dividends over the next four years: S10, $7, S6, and $2.75. Afterwards the company pledges to maintain a constant 5 percent growth rate in dividends from year 5 to year 10, and then 2 percent growth in dividend forever. If the required return on the stock is 12 percent, what is the current share price? Question 6: Portfolio return (25 points) Consider the following information about three stocks: State of economy Probability of State of Economy 0.30 0.40 0.30 Stock A 0.20 0.15 0.01 Rate of return if stat occurs Stock B 0.25 0.11 0.15 Stock C 0.60 0.05 0.50 Expansion Normal a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected retum? The variance? The standard deviation? b. If the expected T-bil rate is 3.50 percent, what is the expected risk premium on the portfolio? e. If the expected inflation rate is 3.50 percent, what are the approximate and exact expected real retums on the portfolio? What are the approximate and exact expected real risk premiums on the portfolio? d. You have $100,000 to invest in a portfolio containing Stock A, Stock B, and a risk-free asset. You must invest all of your money. Your goal is to create a portfolio that has an expected retum of 8.5 percent and that has only 95 percent of the risk of the overall market. If has a beta of 1.5, B has a beta of 0.7, and the risk-free rate is 3.5 percent, how much money will you invest in Stock A? How do you interpret your