Answered step by step

Verified Expert Solution

Question

1 Approved Answer

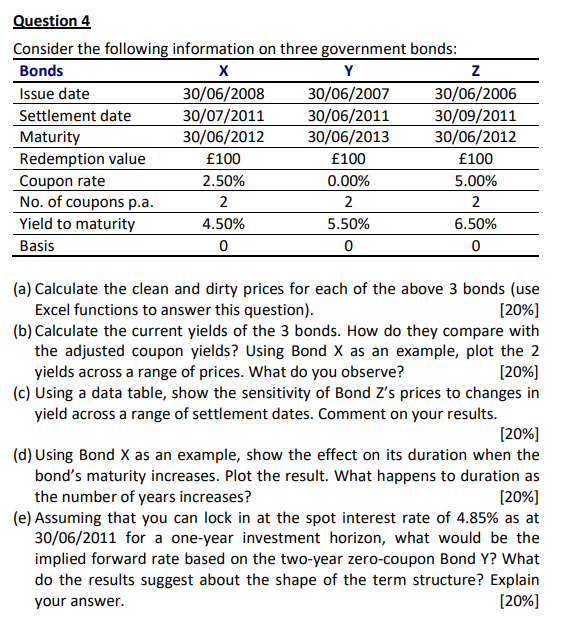

Question 4 Consider the following information on three government bonds: ( a ) Calculate the clean and dirty prices for each of the above 3

Question

Consider the following information on three government bonds:

a Calculate the clean and dirty prices for each of the above bonds use

Excel functions to answer this question

b Calculate the current yields of the bonds. How do they compare with

the adjusted coupon yields? Using Bond as an example, plot the

yields across a range of prices. What do you observe?

c Using a data table, show the sensitivity of Bond Zs prices to changes in

yield across a range of settlement dates. Comment on your results.

d Using Bond as an example, show the effect on its duration when the

bond's maturity increases. Plot the result. What happens to duration as

the number of years increases?

e Assuming that you can lock in at the spot interest rate of as at

for a oneyear investment horizon, what would be the

implied forward rate based on the twoyear zerocoupon Bond Y What

do the results suggest about the shape of the term structure? Explain

your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started