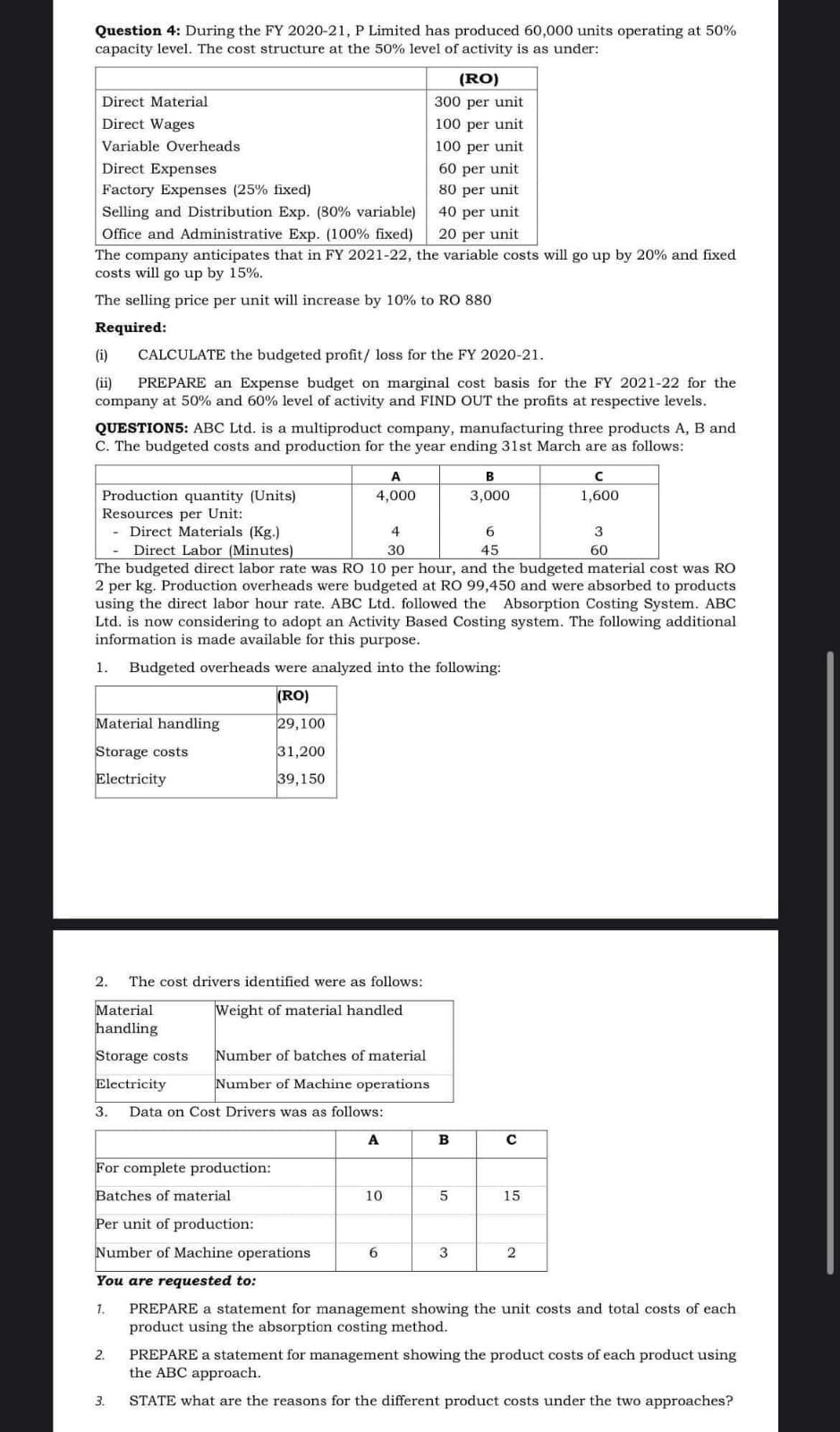

Question 4: During the FY 2020-21, P Limited has produced 60,000 units operating at 50% capacity level. The cost structure at the 50% level of activity is as under: Required: (i) CALCULATE the budgeted profit/ loss for the FY 2020-21. PREPARE an Expense budget on marginal cost basis for the FY 2021-22 for the

(ii) company at 50% and 60% level of activity and FIND OUT the profits at respective levels.

QUESTION5: ABC Ltd. is a multiproduct company, manufacturing three products A, B and C. The budgeted costs and production for the year ending 31lst March are as follows:

You are requested to: PREPARE a statement for management showing the unit costs and total costs of each product using the absorption costing method. T. 2

. PREPARE a statement for management showing the product costs of each product using the ABC approach.

3. STATE what are the reasons for the different product costs under the two approaches?

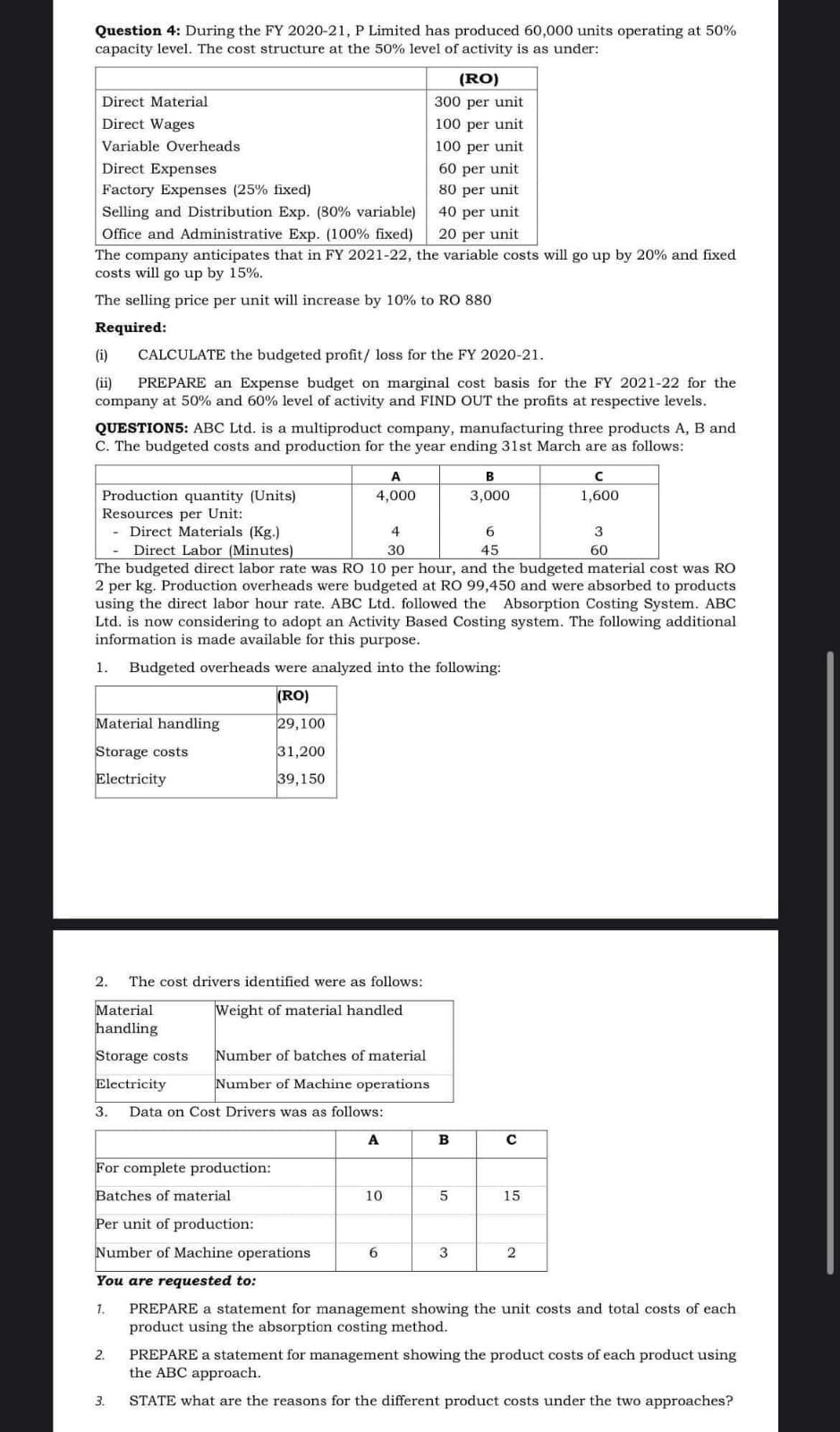

Question 4: During the FY 2020-21, P Limited has produced 60,000 units operating at 50% capacity level. The cost structure at the 50% level of activity is as under: (RO) Direct Material 300 per unit Direct Wages 100 per unit Variable Overheads 100 per unit Direct Expenses 60 per unit Factory Expenses (25% fixed) 80 per unit Selling and Distribution Exp. (30% variable) 40 per unit Office and Administrative Exp. (100% fixed) 20 per unit The company anticipates that in FY 2021-22, the variable costs will go up by 20% and fixed costs will go up by 15%. The selling price per unit will increase by 10% to RO 880 Required: (i) CALCULATE the budgeted profit/ loss for the FY 2020-21. (ii) PREPARE an Expense budget on marginal cost basis for the FY 2021-22 for the company at 50% and 60% level of activity and FIND OUT the profits at respective levels. QUESTIONS: ABC Ltd. is a multiproduct company, manufacturing three products A, B and C. The budgeted costs and production for the year ending 31st March are as follows: A B Production quantity (Units) 4,000 3,000 Resources per Unit: Direct Materials (Kg.) 4 6 3 Direct Labor (Minutes) 30 45 60 The budgeted direct labor rate was RO 10 per hour, and the budgeted material cost was RO 2 per kg. Production overheads were budgeted at RO 99,450 and were absorbed to products using the direct labor hour rate. ABC Ltd. followed the Absorption Costing System. ABC Ltd. is now considering to adopt an Activity Based Costing system. The following additional information is made available for this purpose. 1. Budgeted overheads were analyzed into the following: (RO) 1,600 Material handling 29,100 31,200 Storage costs Electricity 39,150 2. The cost drivers identified were as follows: Material Weight of material handled handling Storage costs Number of batches of material Electricity Number of Machine operations 3. Data on Cost Drivers was as follows: B For complete production: Batches of material 10 5 15 6 3 Per unit of production: Number of Machine operations 2 You are requested to: 1. PREPARE a statement for management showing the unit costs and total costs of each product using the absorption costing method. 2. PREPARE a statement for management showing the product costs of each product using the ABC approach. 3. STATE what are the reasons for the different product costs under the two approaches