Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Financial Instruments (10 marks) XYZ Ltd, a company listed on the Australian Stock Exchange, issued $10 million of convertible notes on 1 July

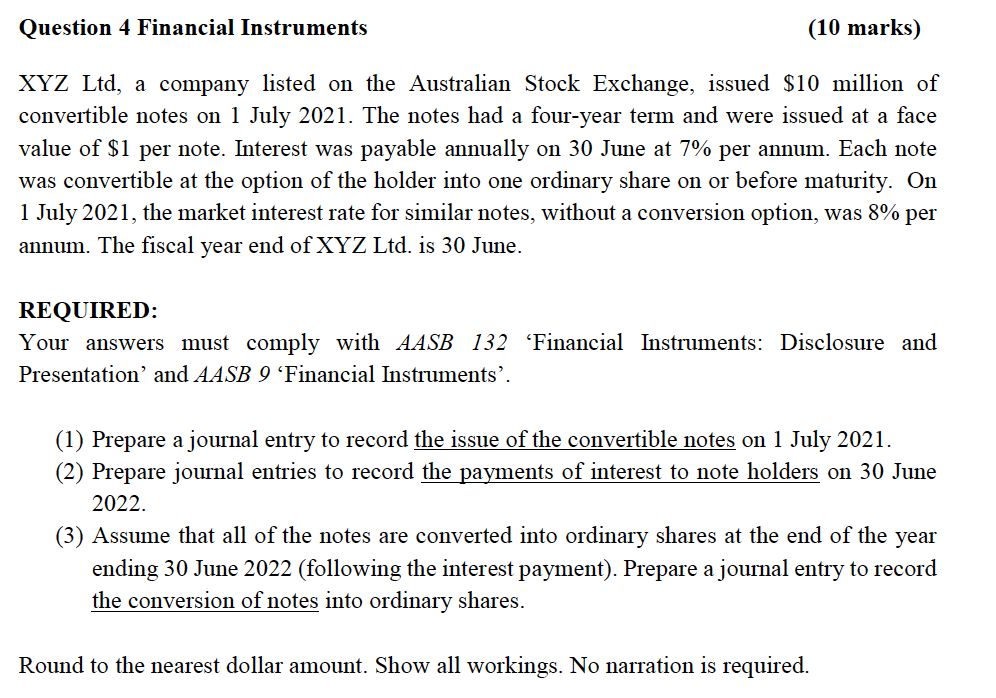

Question 4 Financial Instruments (10 marks) XYZ Ltd, a company listed on the Australian Stock Exchange, issued \$10 million of convertible notes on 1 July 2021. The notes had a four-year term and were issued at a face value of $1 per note. Interest was payable annually on 30 June at 7% per annum. Each note was convertible at the option of the holder into one ordinary share on or before maturity. On 1 July 2021, the market interest rate for similar notes, without a conversion option, was 8% per annum. The fiscal year end of XYZ Ltd. is 30 June. REQUIRED: Your answers must comply with AASB132 'Financial Instruments: Disclosure and Presentation' and AASB9 'Financial Instruments'. (1) Prepare a journal entry to record the issue of the convertible notes on 1 July 2021. (2) Prepare journal entries to record the payments of interest to note holders on 30 June 2022. (3) Assume that all of the notes are converted into ordinary shares at the end of the year ending 30 June 2022 (following the interest payment). Prepare a journal entry to record the conversion of notes into ordinary shares. Round to the nearest dollar amount. Show all workings. No narration is required

Question 4 Financial Instruments (10 marks) XYZ Ltd, a company listed on the Australian Stock Exchange, issued \$10 million of convertible notes on 1 July 2021. The notes had a four-year term and were issued at a face value of $1 per note. Interest was payable annually on 30 June at 7% per annum. Each note was convertible at the option of the holder into one ordinary share on or before maturity. On 1 July 2021, the market interest rate for similar notes, without a conversion option, was 8% per annum. The fiscal year end of XYZ Ltd. is 30 June. REQUIRED: Your answers must comply with AASB132 'Financial Instruments: Disclosure and Presentation' and AASB9 'Financial Instruments'. (1) Prepare a journal entry to record the issue of the convertible notes on 1 July 2021. (2) Prepare journal entries to record the payments of interest to note holders on 30 June 2022. (3) Assume that all of the notes are converted into ordinary shares at the end of the year ending 30 June 2022 (following the interest payment). Prepare a journal entry to record the conversion of notes into ordinary shares. Round to the nearest dollar amount. Show all workings. No narration is required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started