Answered step by step

Verified Expert Solution

Question

1 Approved Answer

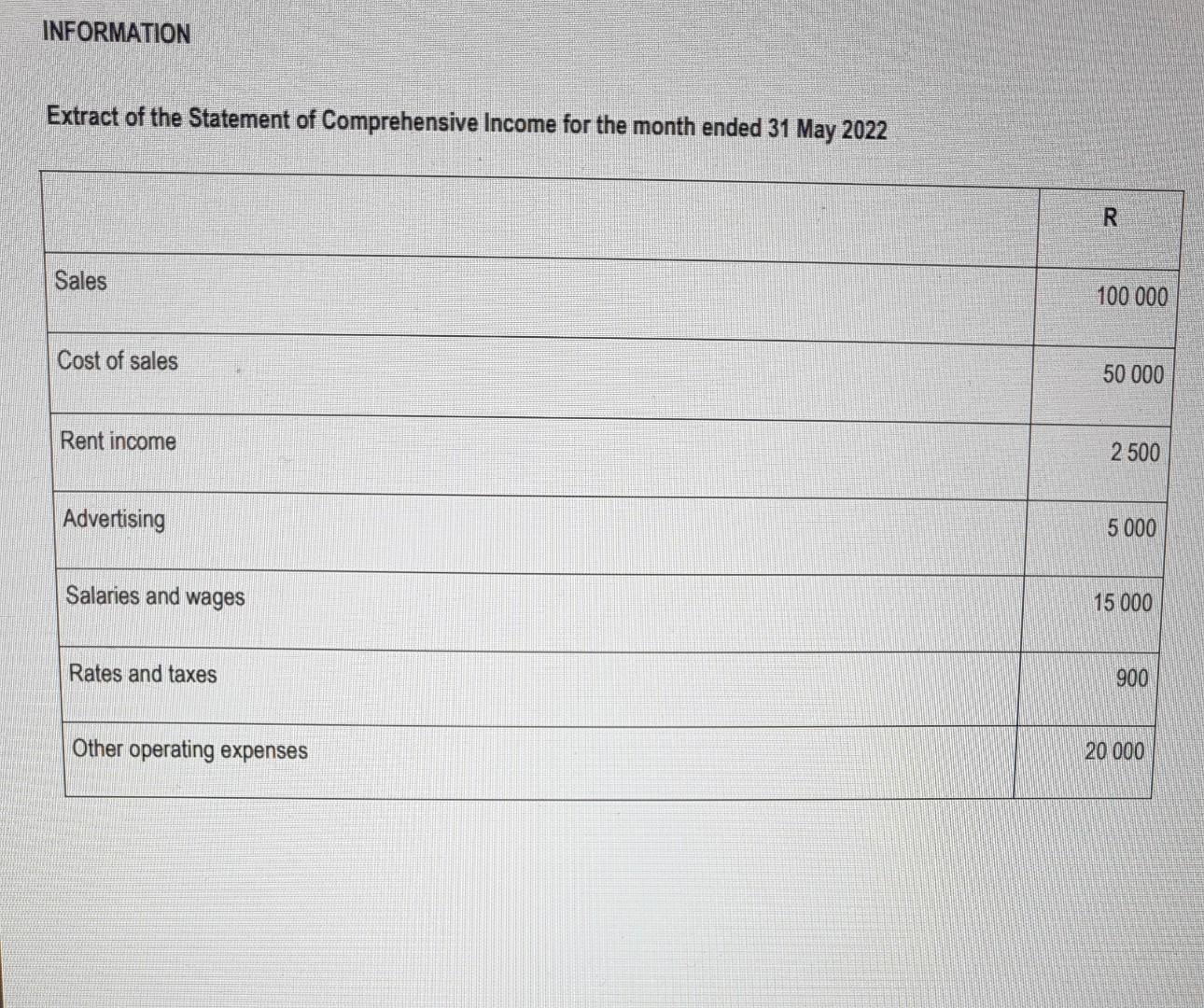

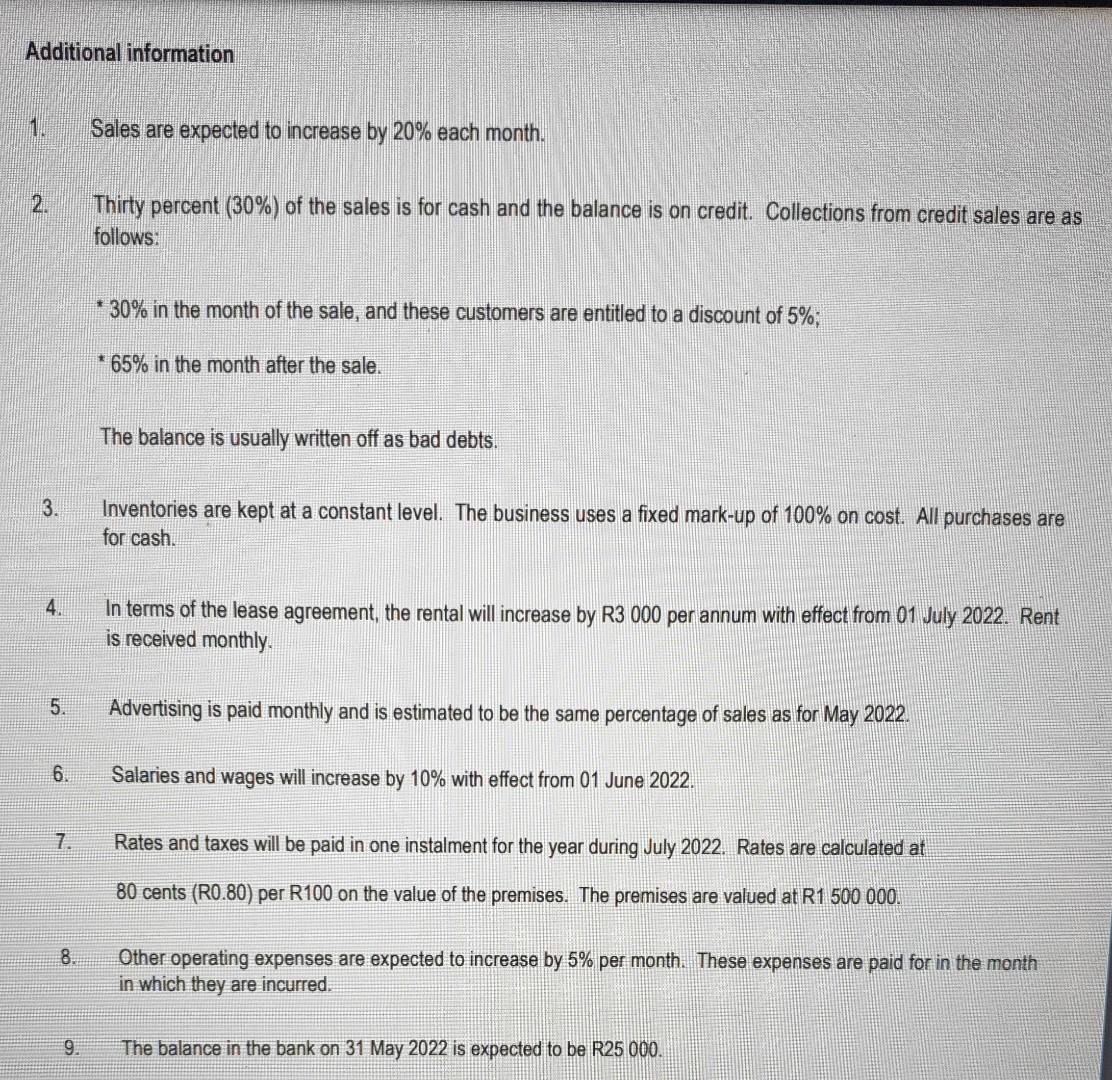

Question 4 please assist me 4.1) Debtors collection schedule 4.2) Cash Budget INFORMATION Extract of the Statement of Comprehensive Income for the month ended 31

Question 4 please assist me

4.1) Debtors collection schedule 4.2) Cash Budget

INFORMATION Extract of the Statement of Comprehensive Income for the month ended 31 May 2022 Sales Cost of sales Rent income Advertising Salaries and wages Rates and taxes Other operating expenses R 100 000 50 000 2 500 5 000 15 000 900 20 000 Additional information 110 2 4. 5. 6 7. 9 Sales are expected to increase by 20% each month. Thirty percent (30%) of the sales is for cash and the balance is on credit. Collections from credit sales are as follows: *30% in the month of the sale, and these customers are entitled to a discount of 5%; 65% in the month after the sale. The balance is usually written off as bad debts. Inventories are kept at a constant level. The business uses a fixed mark-up of 100% on cost. All purchases are for cash. In terms of the lease agreement, the rental will increase by R3 000 per annum with effect from 01 July 2022. Rent is received monthly. Advertising is paid monthly and is estimated to be the same percentage of sales as for May 2022. Salaries and wages will increase by 10% with effect from 01 June 2022. Rates and taxes will be paid in one instalment for the year during July 2022. Rates are calculated at 80 cents (R0.80) per R100 on the value of the premises. The premises are valued at R1 500 000. Other operating expenses are expected to increase by 5% per month. These expenses are paid for in the month in which they are incurred. The balance in the bank on 31 May 2022 is expected to be R25 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started