Answered step by step

Verified Expert Solution

Question

1 Approved Answer

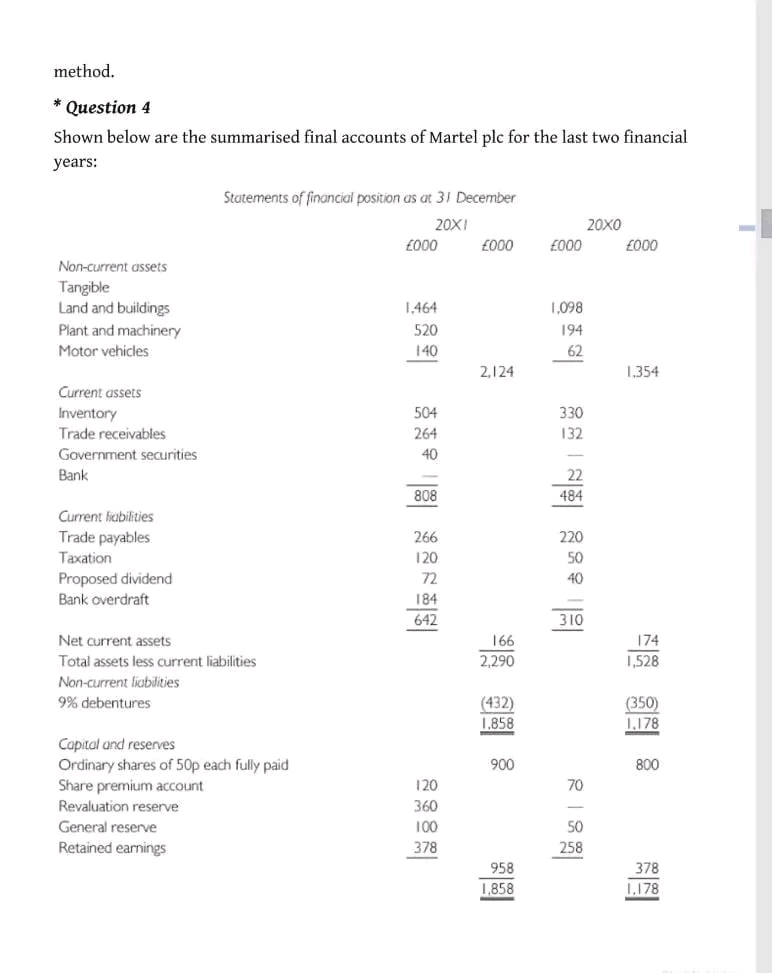

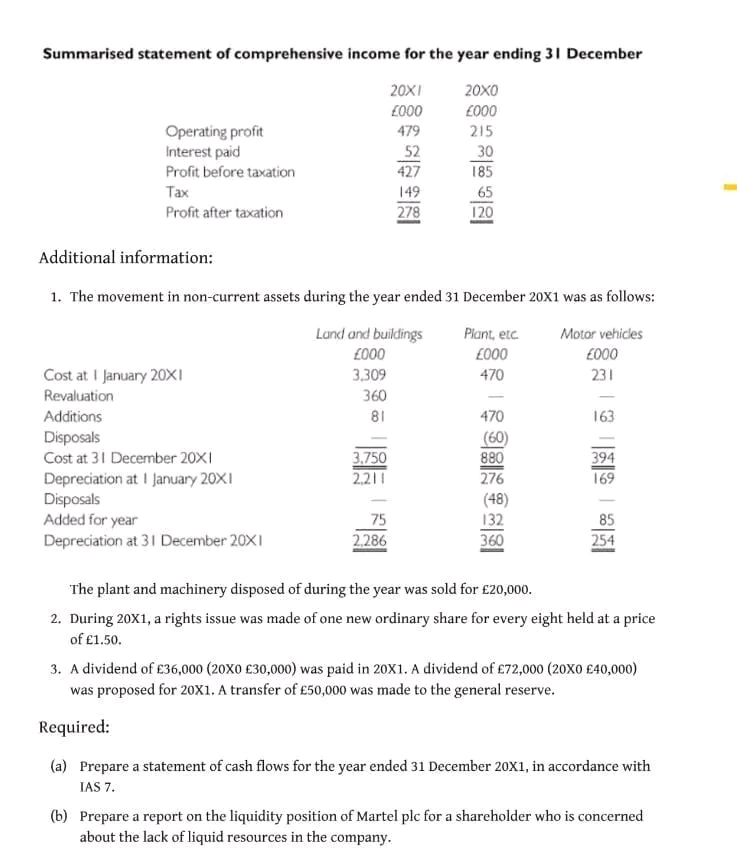

* Question 4 Shown below are the summarised final accounts of Martel plc for the last two financial years: Summarised statement of comprehensive income for

* Question 4 Shown below are the summarised final accounts of Martel plc for the last two financial years: Summarised statement of comprehensive income for the year ending 31 December Additional information: 1. The movement in non-current assets during the year ended 31 December 20X1 was as follows: The plant and machinery disposed of during the year was sold for 20,000. 2. During 20X1, a rights issue was made of one new ordinary share for every eight held at a price of E1.50. 3. A dividend of 36,000 ( 20030,000 ) was paid in 201. A dividend of 72,000 ( 20040,000 ) was proposed for 20X1. A transfer of 50,000 was made to the general reserve. Required: (a) Prepare a statement of cash flows for the year ended 31 December 20X1, in accordance with IAS 7. (b) Prepare a report on the liquidity position of Martel plc for a shareholder who is concerned about the lack of liquid resources in the company. * Question 4 Shown below are the summarised final accounts of Martel plc for the last two financial years: Summarised statement of comprehensive income for the year ending 31 December Additional information: 1. The movement in non-current assets during the year ended 31 December 20X1 was as follows: The plant and machinery disposed of during the year was sold for 20,000. 2. During 20X1, a rights issue was made of one new ordinary share for every eight held at a price of E1.50. 3. A dividend of 36,000 ( 20030,000 ) was paid in 201. A dividend of 72,000 ( 20040,000 ) was proposed for 20X1. A transfer of 50,000 was made to the general reserve. Required: (a) Prepare a statement of cash flows for the year ended 31 December 20X1, in accordance with IAS 7. (b) Prepare a report on the liquidity position of Martel plc for a shareholder who is concerned about the lack of liquid resources in the company

* Question 4 Shown below are the summarised final accounts of Martel plc for the last two financial years: Summarised statement of comprehensive income for the year ending 31 December Additional information: 1. The movement in non-current assets during the year ended 31 December 20X1 was as follows: The plant and machinery disposed of during the year was sold for 20,000. 2. During 20X1, a rights issue was made of one new ordinary share for every eight held at a price of E1.50. 3. A dividend of 36,000 ( 20030,000 ) was paid in 201. A dividend of 72,000 ( 20040,000 ) was proposed for 20X1. A transfer of 50,000 was made to the general reserve. Required: (a) Prepare a statement of cash flows for the year ended 31 December 20X1, in accordance with IAS 7. (b) Prepare a report on the liquidity position of Martel plc for a shareholder who is concerned about the lack of liquid resources in the company. * Question 4 Shown below are the summarised final accounts of Martel plc for the last two financial years: Summarised statement of comprehensive income for the year ending 31 December Additional information: 1. The movement in non-current assets during the year ended 31 December 20X1 was as follows: The plant and machinery disposed of during the year was sold for 20,000. 2. During 20X1, a rights issue was made of one new ordinary share for every eight held at a price of E1.50. 3. A dividend of 36,000 ( 20030,000 ) was paid in 201. A dividend of 72,000 ( 20040,000 ) was proposed for 20X1. A transfer of 50,000 was made to the general reserve. Required: (a) Prepare a statement of cash flows for the year ended 31 December 20X1, in accordance with IAS 7. (b) Prepare a report on the liquidity position of Martel plc for a shareholder who is concerned about the lack of liquid resources in the company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started