Answered step by step

Verified Expert Solution

Question

1 Approved Answer

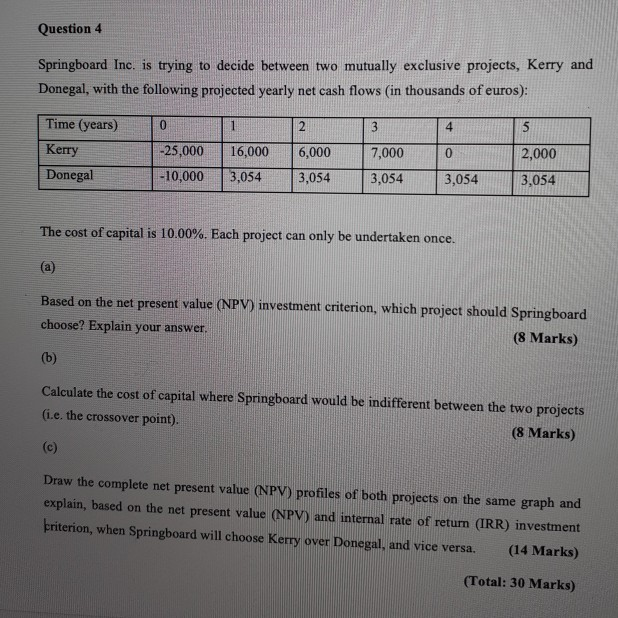

Question 4 Springboard Inc. is trying to decide between two mutually exclusive projects, Kerry and Donegal, with the following projected yearly net cash flows (in

Question 4 Springboard Inc. is trying to decide between two mutually exclusive projects, Kerry and Donegal, with the following projected yearly net cash flows (in thousands of euros): 0 1 2 3 4 5 Time (years) Kerry Donegal 16,000 6,000 7,000 0 2,000 -25,000 -10,000 3,054 3,054 3,054 3,054 3,054 The cost of capital is 10.00%. Each project can only be undertaken once. (a) Based on the net present value (NPV) investment criterion, which project should Springboard choose? Explain your answer. (8 Marks) (b) Calculate the cost of capital where Springboard would be indifferent between the two projects (i.e. the crossover point). (8 Marks) (c) Draw the complete net present value (NPV) profiles of both projects on the same graph and explain, based on the net present value (NPV) and internal rate of return (IRR) investment priterion, when Springboard will choose Kerry over Donegal, and vice versa. (14 Marks) (Total: 30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started