Answered step by step

Verified Expert Solution

Question

1 Approved Answer

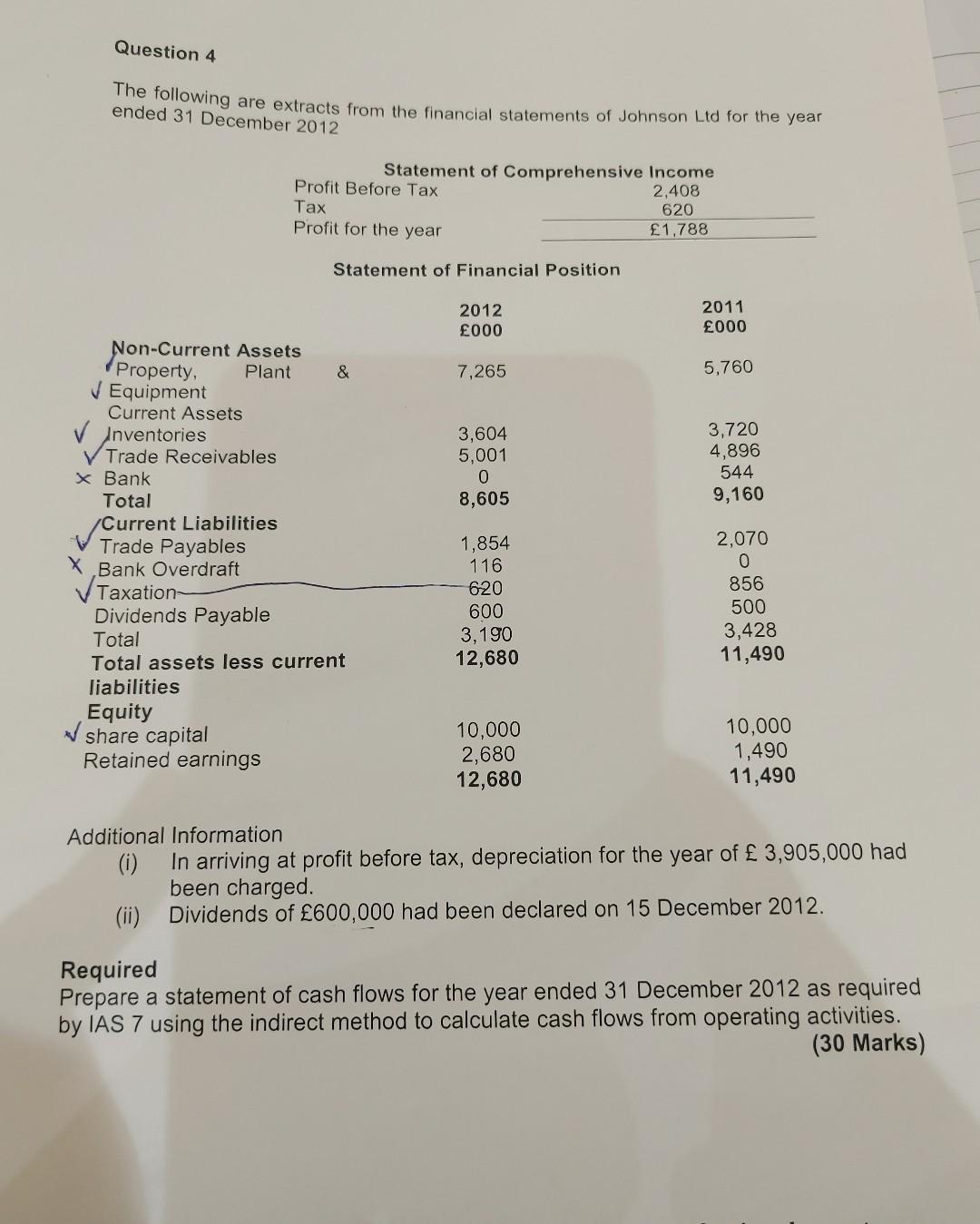

Question 4 The following are extracts from the financial statements of Johnson Ltd for the year ended 31 December 2012 Statement of Comprehensive Income Profit

Question 4 The following are extracts from the financial statements of Johnson Ltd for the year ended 31 December 2012 Statement of Comprehensive Income Profit Before Tax 2,408 Tax 620 Profit for the year 1.788 Statement of Financial Position 2012 000 2011 000 7,265 5,760 3,604 5,001 0 8,605 3,720 4,896 544 9,160 Non-Current Assets Property, Plant & Equipment Current Assets Inventories Trade Receivables X Bank Total Current Liabilities Trade Payables X Bank Overdraft Taxation Dividends Payable Total Total assets less current liabilities Equity share capital Retained earnings 1,854 116 620 600 3,190 12,680 2,070 0 856 500 3,428 11,490 10,000 2,680 12,680 10,000 1,490 11,490 Additional Information (i) In arriving at profit before tax, depreciation for the year of 3,905,000 had been charged (ii) Dividends of 600,000 had been declared on 15 December 2012. Required Prepare a statement of cash flows for the year ended 31 December 2012 as required by IAS 7 using the indirect method to calculate cash flows from operating activities. (30 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started