Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Which of the following statements is/are FALSE? A. Under IAS17, companies would often structure their leases as operating leases instead of finance leases

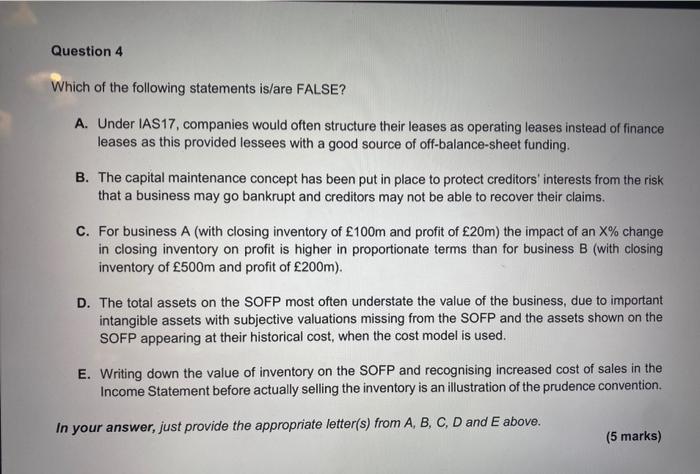

Question 4 Which of the following statements is/are FALSE? A. Under IAS17, companies would often structure their leases as operating leases instead of finance leases as this provided lessees with a good source of off-balance-sheet funding. B. The capital maintenance concept has been put in place to protect creditors' interests from the risk that a business may go bankrupt and creditors may not be able to recover their claims. C. For business A (with closing inventory of 100m and profit of 20m) the impact of an X% change in closing inventory on profit is higher in proportionate terms than for business B (with closing inventory of 500m and profit of 200m). D. The total assets on the SOFP most often understate the value of the business, due to important intangible assets with subjective valuations missing from the SOFP and the assets shown on the SOFP appearing at their historical cost, when the cost model is used. E. Writing down the value of inventory on the SOFP and recognising increased cost of sales in the Income Statement before actually selling the inventory is an illustration of the prudence convention. In your answer, just provide the appropriate letter(s) from A, B, C, D and E above

Question 4 Which of the following statements is/are FALSE? A. Under IAS17, companies would often structure their leases as operating leases instead of finance leases as this provided lessees with a good source of off-balance-sheet funding. B. The capital maintenance concept has been put in place to protect creditors' interests from the risk that a business may go bankrupt and creditors may not be able to recover their claims. C. For business A (with closing inventory of 100m and profit of 20m) the impact of an X% change in closing inventory on profit is higher in proportionate terms than for business B (with closing inventory of 500m and profit of 200m). D. The total assets on the SOFP most often understate the value of the business, due to important intangible assets with subjective valuations missing from the SOFP and the assets shown on the SOFP appearing at their historical cost, when the cost model is used. E. Writing down the value of inventory on the SOFP and recognising increased cost of sales in the Income Statement before actually selling the inventory is an illustration of the prudence convention. In your answer, just provide the appropriate letter(s) from A, B, C, D and E above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started