Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Wizzjet Ltd Wizzjet Ltd is a small company operating a single airplane for short journeys between UK city airports. Wizzjet Ltd purchased

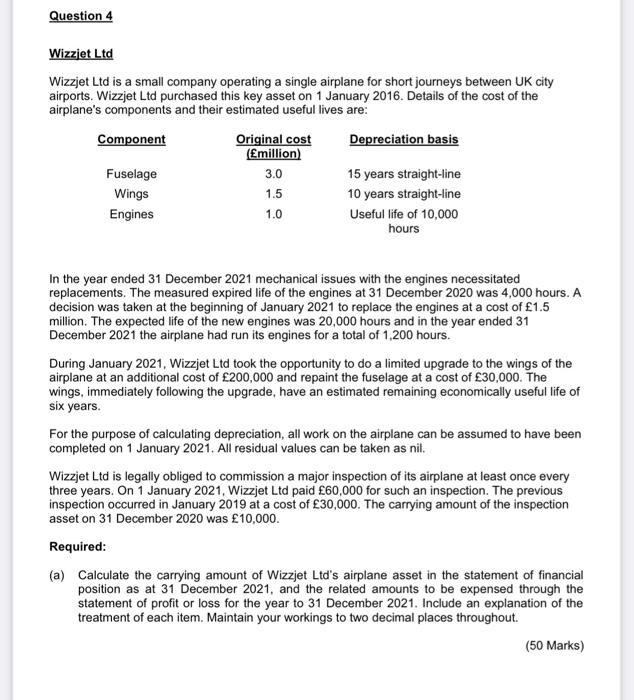

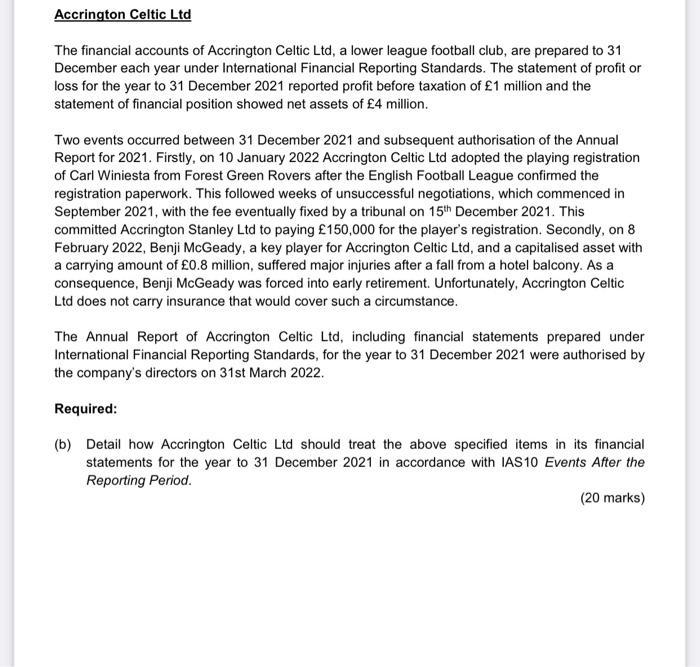

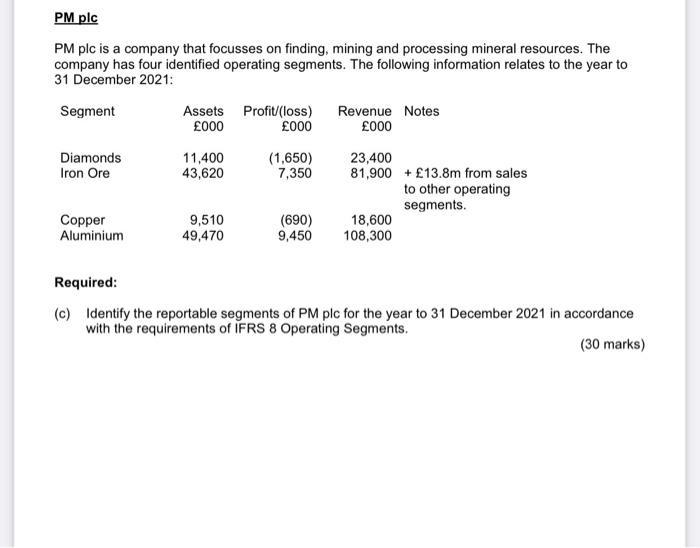

Question 4 Wizzjet Ltd Wizzjet Ltd is a small company operating a single airplane for short journeys between UK city airports. Wizzjet Ltd purchased this key asset on 1 January 2016. Details of the cost of the airplane's components and their estimated useful lives are: Component Fuselage Wings Engines Original cost (million) 3.0 1.5 1.0 Depreciation basis 15 years straight-line 10 years straight-line Useful life of 10,000 hours In the year ended 31 December 2021 mechanical issues with the engines necessitated replacements. The measured expired life of the engines at 31 December 2020 was 4,000 hours. A decision was taken at the beginning of January 2021 to replace the engines at a cost of 1.5 million. The expected life of the new engines was 20,000 hours and in the year ended 31 December 2021 the airplane had run its engines for a total of 1,200 hours. During January 2021, Wizzjet Ltd took the opportunity to do a limited upgrade to the wings of the airplane at an additional cost of 200,000 and repaint the fuselage at a cost of 30,000. The wings, immediately following the upgrade, have an estimated remaining economically useful life of six years. For the purpose of calculating depreciation, all work on the airplane can be assumed to have been completed on 1 January 2021. All residual values can be taken as nil. Wizzjet Ltd is legally obliged to commission a major inspection of its airplane at least once every three years. On 1 January 2021, Wizzjet Ltd paid 60,000 for such an inspection. The previous inspection occurred in January 2019 at a cost of 30,000. The carrying amount of the inspection asset on 31 December 2020 was 10,000. Required: (a) Calculate the carrying amount of Wizzjet Ltd's airplane asset in the statement of financial position as at 31 December 2021, and the related amounts to be expensed through the statement of profit or loss for the year to 31 December 2021. Include an explanation of the treatment of each item. Maintain your workings to two decimal places throughout. (50 Marks) Accrington Celtic Ltd The financial accounts of Accrington Celtic Ltd, a lower league football club, are prepared to 31 December each year under International Financial Reporting Standards. The statement of profit or loss for the year to 31 December 2021 reported profit before taxation of 1 million and the statement of financial position showed net assets of 4 million. Two events occurred between 31 December 2021 and subsequent authorisation of the Annual Report for 2021. Firstly, on 10 January 2022 Accrington Celtic Ltd adopted the playing registration of Carl Winiesta from Forest Green Rovers after the English Football League confirmed the registration paperwork. This followed weeks of unsuccessful negotiations, which commenced in September 2021, with the fee eventually fixed by a tribunal on 15th December 2021. This committed Accrington Stanley Ltd to paying 150,000 for the player's registration. Secondly, on 8 February 2022, Benji McGeady, a key player for Accrington Celtic Ltd, and a capitalised asset with a carrying amount of 0.8 million, suffered major injuries after a fall from a hotel balcony. As a consequence, Benji McGeady was forced into early retirement. Unfortunately, Accrington Celtic Ltd does not carry insurance that would cover such a circumstance. The Annual Report of Accrington Celtic Ltd, including financial statements prepared under International Financial Reporting Standards, for the year to 31 December 2021 were authorised by the company's directors on 31st March 2022. Required: (b) Detail how Accrington Celtic Ltd should treat the above specified items in its financial statements for the year to 31 December 2021 in accordance with IAS10 Events After the Reporting Period. (20 marks) PM plc PM plc is a company that focusses on finding, mining and processing mineral resources. The company has four identified operating segments. The following information relates to the year to 31 December 2021: Segment Diamonds Iron Ore Copper Aluminium Assets Profit/(loss) 000 000 11,400 43,620 9,510 49,470 (1,650) 7,350 (690) 9,450 Revenue Notes 000 23,400 81,900 13.8m from sales to other operating segments. 18,600 108,300 Required: (c) Identify the reportable segments of PM plc for the year to 31 December 2021 in accordance with the requirements of IFRS 8 Operating Segments. (30 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Carrying amount of airplane asset as at 31 December 2021 30000001400010000 15000001400010000 10000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started