Answered step by step

Verified Expert Solution

Question

1 Approved Answer

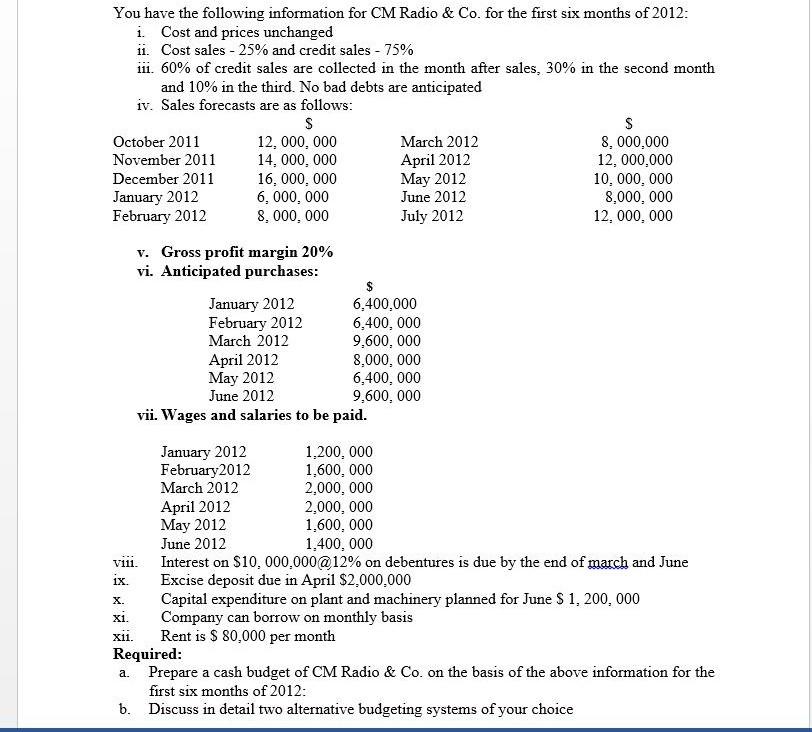

You have the following information for CM Radio & Co. for the first six months of 2012: i. Cost and prices unchanged i1. Cost

You have the following information for CM Radio & Co. for the first six months of 2012: i. Cost and prices unchanged i1. Cost sales - 25% and credit sales - 75% iii. 60% of credit sales are collected in the month after sales, 30% in the second month and 10% in the third. No bad debts are anticipated iv. Sales forecasts are as follows: October 2011 12, 000, 000 14, 000, 000 16, 000, 000 6, 000, 000 8, 000, 000 March 2012 April 2012 May 2012 8, 000,000 12, 000,000 10, 000, 000 8,000, 000 12, 000, 000 November 2011 December 2011 January 2012 February 2012 June 2012 July 2012 v. Gross profit margin 20% vi. Anticipated purchases: January 2012 February 2012 March 2012 6,400,000 6,400, 000 9,600, 000 8,000, 000 6,400, 000 9,600, 000 April 2012 May 2012 June 2012 vii. Wages and salaries to be paid. January 2012 February2012 March 2012 1,200, 000 1,600, 000 2,000, 000 2,000, 000 1,600, 000 1,400, 000 April 2012 May 2012 June 2012 Interest on $10, 000,000@12% on debentures is due by the end of march and June Excise deposit due in April $2,000,000 Capital expenditure on plant and machinery planned for June S 1, 200, 000 Company can borrow on monthly basis Rent is $ 80,000 per month viii. ix. . xi. xii. Required: Prepare a cash budget of CM Radio & Co. on the basis of the above information for the first six months of 2012: b. Discuss in detail two alternative budgeting systems of your choice .

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Cash Budget Cash Budget CM Radio Co six Months Jan 2012june 2012 Jan Feb Mar Apr May Jun Cash Open...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started