Answered step by step

Verified Expert Solution

Question

1 Approved Answer

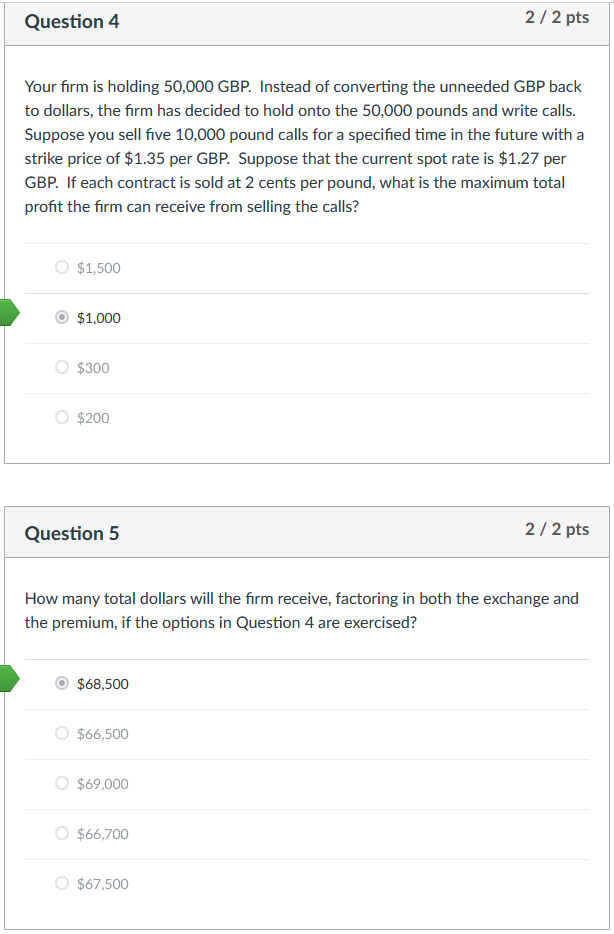

Question 4 Your firm is holding 5 0 , 0 0 0 GBP . Instead of converting the unneeded GBP back to dollars, the firm

Question

Your firm is holding GBP Instead of converting the unneeded GBP back

to dollars, the firm has decided to hold onto the pounds and write calls.

Suppose you sell five pound calls for a specified time in the future with a

strike price of $ per GBP Suppose that the current spot rate is $ per

GBP If each contract is sold at cents per pound, what is the maximum total

profit the firm can receive from selling the calls?

$

$

$

$

Question

How many total dollars will the firm receive, factoring in both the exchange and

the premium, if the options in Question are exercised?

$

$

$

$

$

I ONLY NEED HELP WITH QUESTION I ALREADY KNOW HOW TO DO IT IS JUST PROVIDED FOR INFORMATION. THANKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started