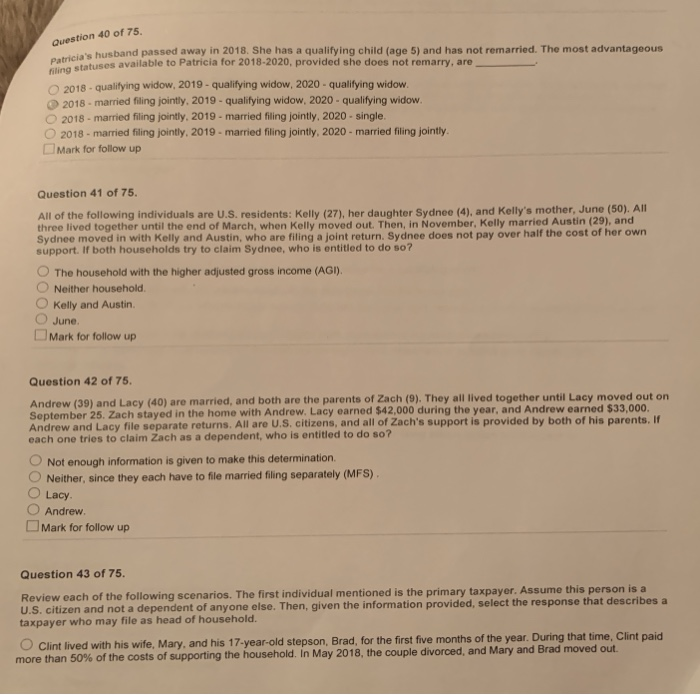

Question 40 of 75 tricia's husband passed away in 2018. She has a qualifying child (age 5) and has not remarried. The most advantageous statuses available to Patricia for 2018-2020, provided she does not remarry, are filing 2018-qualifying widow, 2019-qualifying widow, 2020-qualifying widow. 2018-married filing jointly, 2019-qualifying widow. 2020-qualifying widow O 2018-married filing jointly, 2019 -married filing jointly, 2020- single. 2018-married filing jointly, 2019 . married filing jointly, 2020-married filing jointly Mark for follow up Question 41 of 75 All of the following individuals are U.S. residents: Kelly (27), her daughter Sydnee (4), and Kelly's mother, June (50). All three lived together until the end of March, when Kelly moved out. Then, in November, Kelly married Austin (29), and Sydnee moved in with Kelly and Austin, who are filing a joint return. Sydnee does not pay over half the cost of her own support. If both households try to claim Sydnee, who is entitled to do so? O The household with the higher adjusted gross income (AGI) O Neither household O Kelly and Austin. O June Mark for follow up Question 42 of 75 Andrew (39) and Lacy (40) are married, and both are the parents of Zach (9). They all lived together until Lacy moved out on September 25. Zach stayed in the home with Andrew. Lacy earned $42,000 during the year, and Andrew earned $33,000. Andrew and Lacy file separate returns. All are U.S. citizens, and all of Zach's support is provided by both of his parents. If each one tries to claim Zach as a dependent, who is entitled to do so? ONot enough information is given to make this determination Neither, since they each have to file married filing separately (MFS) O Lacy O Andrew Mark for follow up Question 43 of 75. Review each of the following scenarios. The first individual mentioned is the primary taxpayer. Assume this person is a u.s. citizen and not a dependent of anyone else. Then, given the information provided, select the response that describes a taxpayer who may file as head of household. Clint lived with his wife, Mary, and his 17-year-old stepson, Brad, for the first five months of the year more than 50% of the costs of supporting the household. In May 2018, the couple divorced, and Mary and Brad moved out