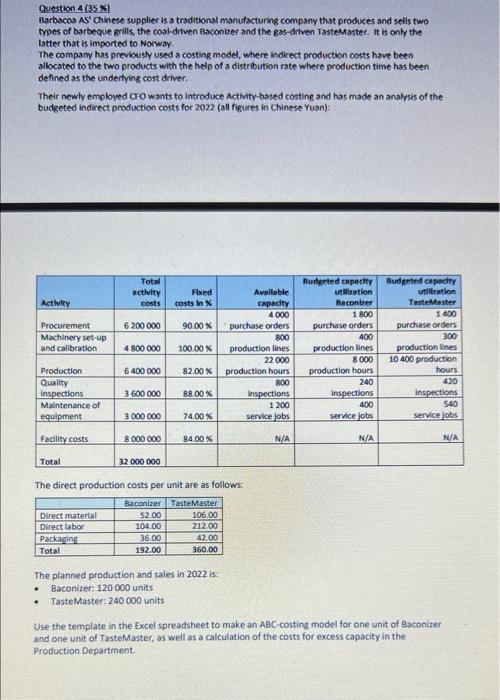

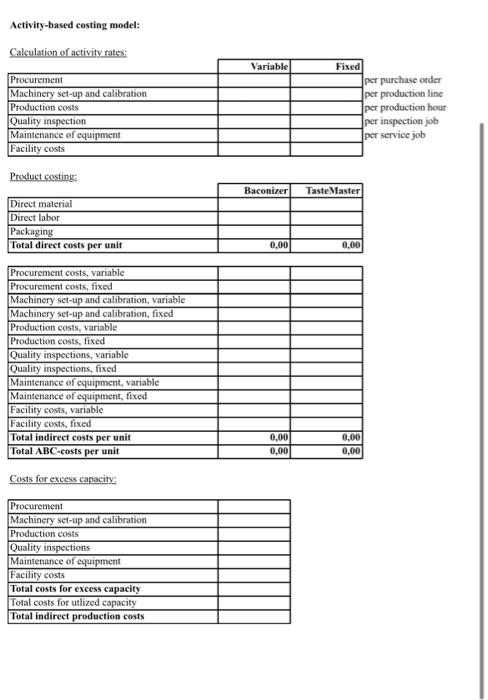

Question 4(25 XI Barbacoa As' Chinese supplier is a traditional manufacturing company that produces and sells two types of barbeque grills, the coal-driven raconter and the Ras-driven Tastemaster. It is only the latter that is imported to Norway The company has previously used a costing model, where indirect production costs have been allocated to the two products with the help of a distribution rate where production time has been defined as the underlying cost driver. Their newly employed Co wants to introduce Activity-based costing and has made an analysis of the budgeted Indirect production costs for 2022 (all figures in Chinese Yuan): Total activity costs Fixed costs in Activity 6 200 000 90.00% Procurement Machinery set-up and calibration 4 800 000 100,00 % Available capacity 4000 purchase orders 800 production lines 22 000 production hours 800 Inspections 1 200 service Jobs Budgeted capacity utilization Racontrer 1 800 purchase orders 400 production lines 8 000 production hours 240 Inspections 400 service jobs Rudgeted capacity ration Taste Master 1400 purchase orders 300 production lines 10 400 production hours 420 Inspections 540 servicejobs 6 400 000 82.00% Production Quality Inspections Maintenance of equipment 3 600 000 88.00% 3 000 000 74.00 % Facility costs B 000 000 84.00 % N/A N/A N/A Total 32 000 000 The direct production costs per unit are as follows: Direct material Direct labor Packaging Total Baconizer Taste Master 5200 106.00 104.00 212.00 36.00 42.00 192.00 360.00 The planned production and sales in 2022 is: Baconizer: 120 000 units Taste Master: 240 000 units Use the template in the Excel spreadsheet to make an ABC costing model for one unit of Baconiser and one unit of Taste Master, as well as a calculation of the costs for excess capacity in the Production Department. Activity-based costing model: Calculation of activity rates: Variable Procurement Machinery set-up and calibration Production costs Quality inspection Maintenance of equipment Facility costs Fixed per purchase order per production line per production hour per inspection job per service job Product costing: Baconizer Taste Master Direct material Direct labor Packaging Total direct costs per unit 0,00 0.00 Procurement costs, variable Procurement costs, fixed Machinery set-up and calibration, variable Machinery set-up and calibration, fixed Production costs, variable Production costs, fixed Quality inspections, variable Quality inspections, fixed Maintenance of equipment, variable Maintenance of equipment, fixed Facility costs, variable Facility costs, fixed Total indirect costs per unit Total ABC costs per unit 0,00 0,00 0,00 0.00 Costs for excess capacity Procurement Machinery set-up and calibration Production costs Quality inspections Maintenance of equipment Facility costs Total costs for excess capacity Total costs for utlized capacity Total indirect production costs