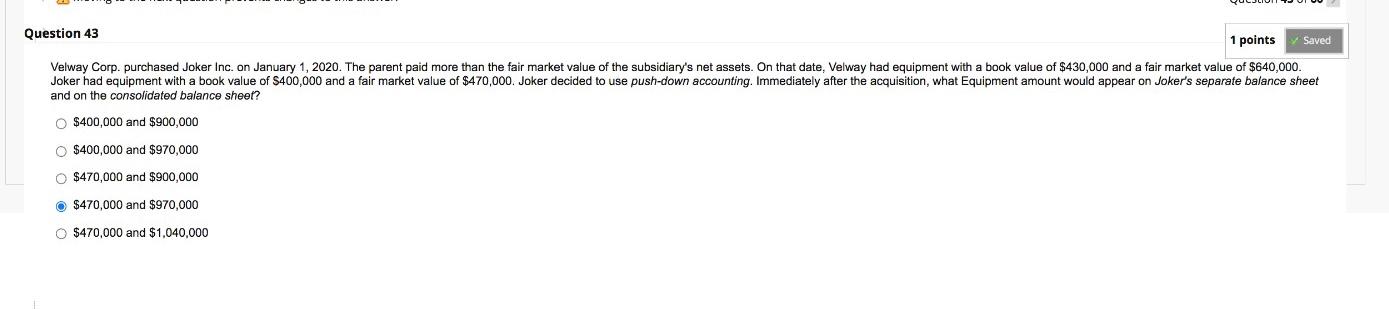

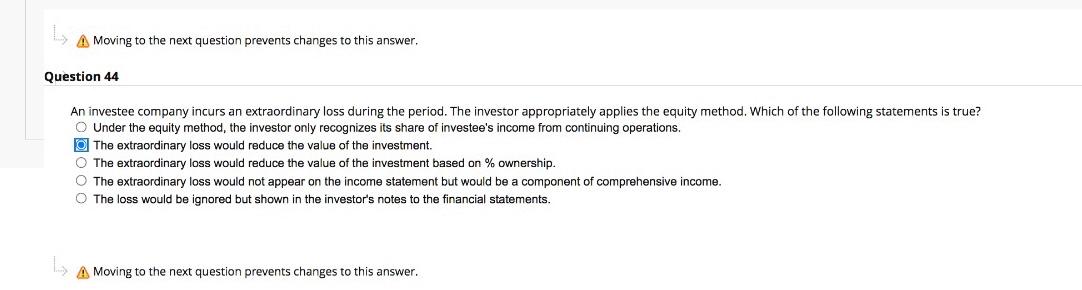

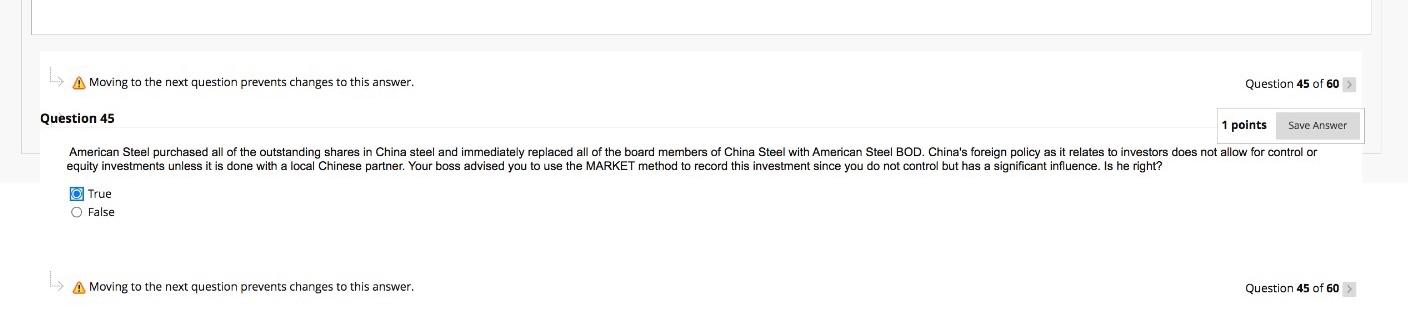

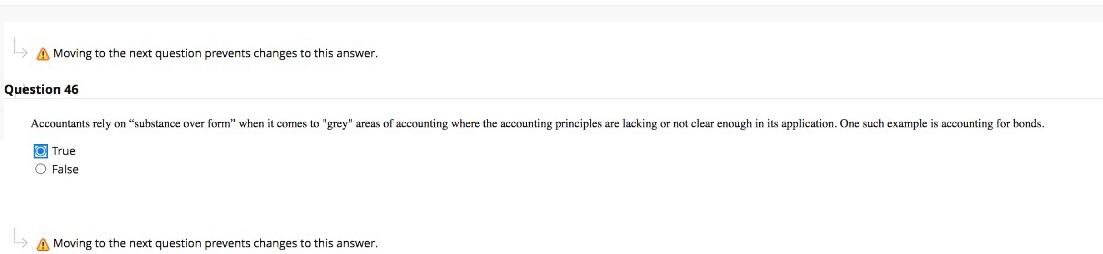

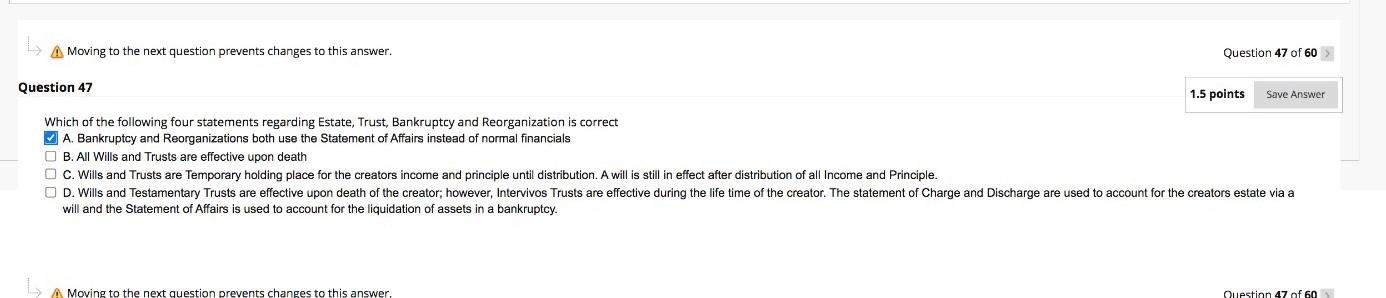

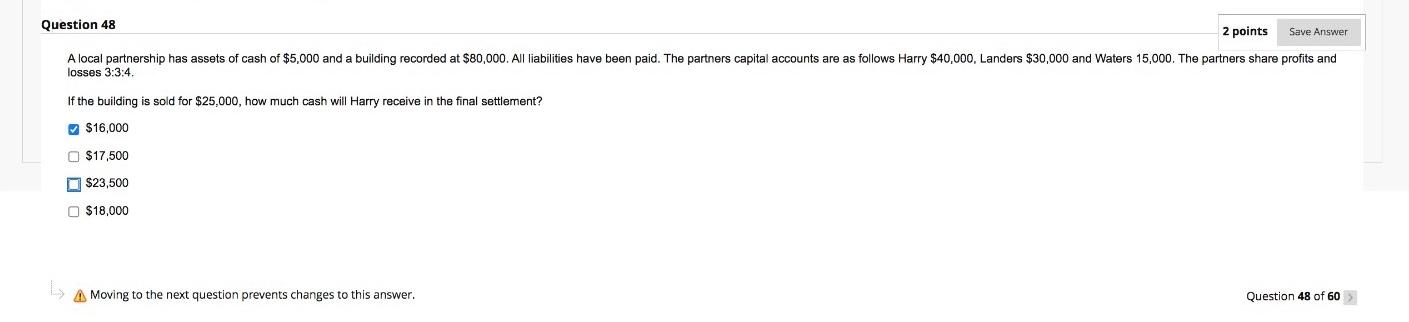

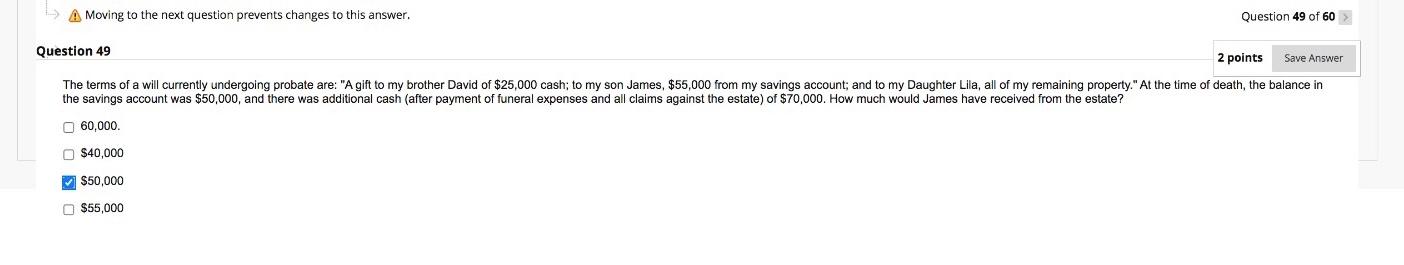

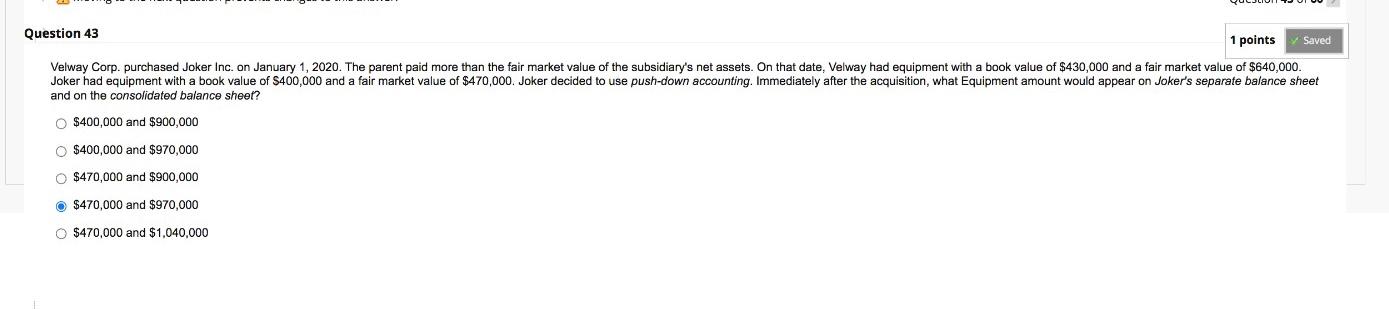

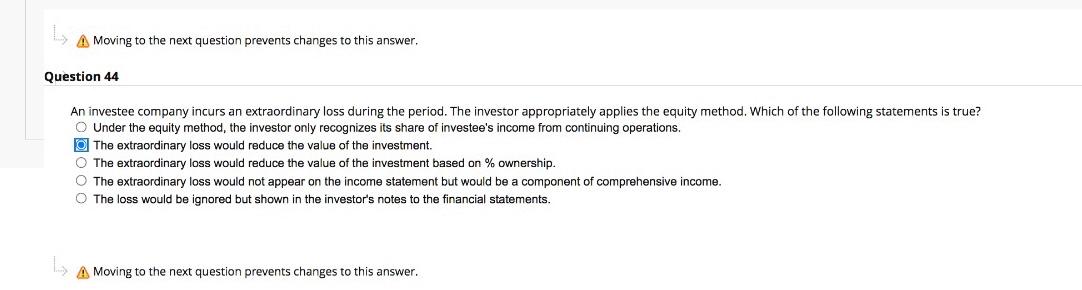

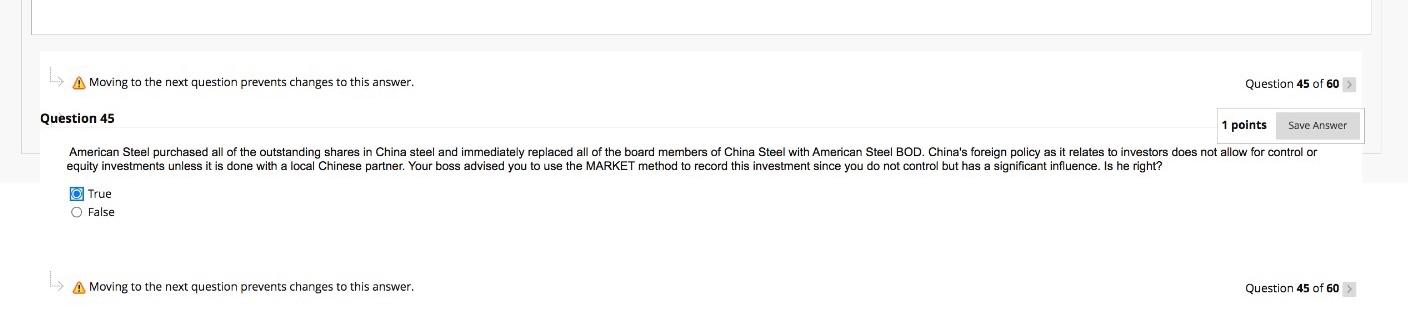

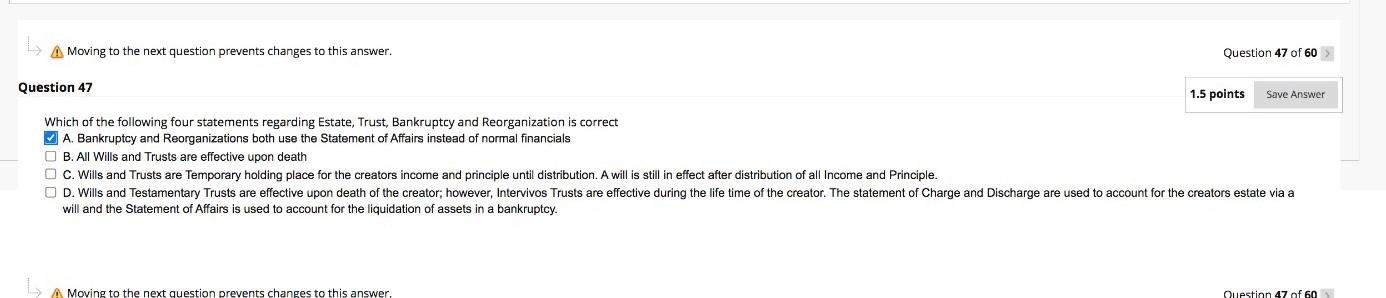

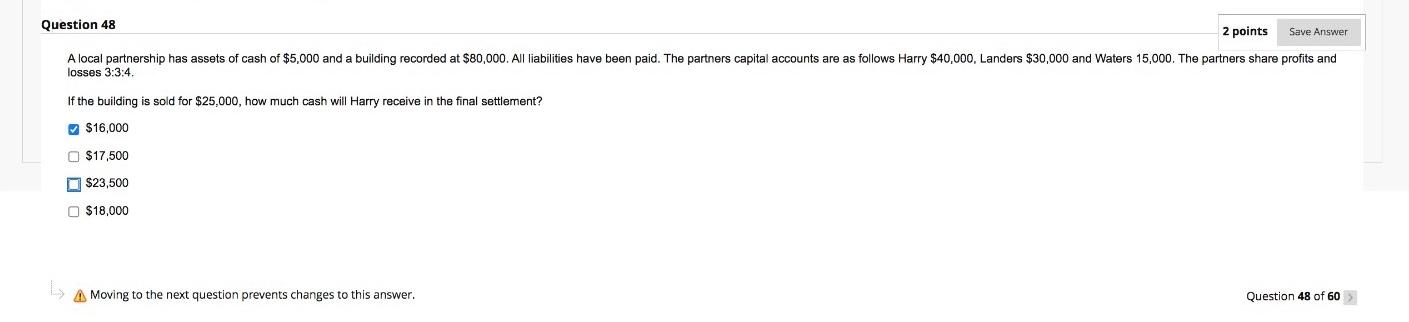

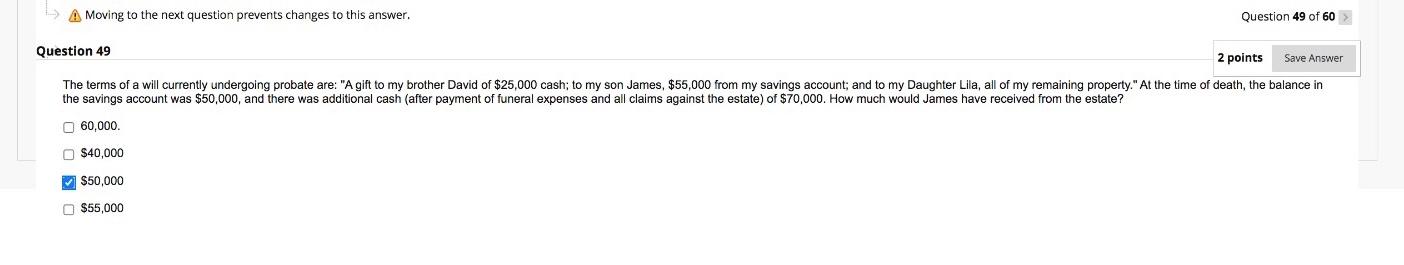

Question 43 1 points Saved Velway Corp. purchased Joker Inc. on January 1, 2020. The parent paid more than the fair market value of the subsidiary's net assets. On that date, Velway had equipment with a book value of $430,000 and a fair market value of $640,000. Joker had equipment with a book value of $400,000 and a fair market value of $470,000. Joker decided to use push-down accounting. Immediately after the acquisition, what Equipment amount would appear on Joker's separate balance sheet and on the consolidated balance sheet? $400,000 and $900,000 $400,000 and $970,000 $470,000 and $900,000 $470,000 and $970,000 $470,000 and $1,040,000 A Moving to the next question prevents changes to this answer, Question 44 An investee company incurs an extraordinary loss during the period. The investor appropriately applies the equity method. Which of the following statements is true? O Under the equity method, the investor only recognizes its share of investee's income from continuing operations. The extraordinary loss would reduce the value of the investment. The extraordinary loss would reduce the value of the investment based on % ownership. The extraordinary loss would not appear on the income statement but would be a component of comprehensive income. The loss would be ignored but shown in the investor's notes to the financial statements. A Moving to the next question prevents changes to this answer. A Moving to the next question prevents changes to this answer. Question 45 of 60 Question 45 1 points Save Answer American Steel purchased all of the outstanding shares in China steel and immediately replaced all of the board members of China Steel with American Steel BOD. China's foreign policy as it relates to investors does not allow for control or equity investments unless it is done with a local Chinese partner. Your boss advised you to use the MARKET method to record this investment since you do not control but has a significant influence. Is he right? True O False A Moving to the next question prevents changes to this answer. Question 45 of 60 L A Moving to the next question prevents changes to this answer. Question 46 Accountants rely on substance over form" when it comes to "grey" areas of accounting where the accounting principles are lacking or not clear enough in its application. One such example is accounting for bonds. gTrue O False A Moving to the next question prevents changes to this answer. A Moving to the next question prevents changes to this answer. Question 47 of 60 Question 47 1.5 points Save Answer Which of the following four statements regarding Estate, Trust, Bankruptcy and Reorganization is correct A. Bankruptcy and Reorganizations both use the Statement of Affairs instead of normal financials B. All Wills and Trusts are effective upon death C. Wills and Trusts are Temporary holding place for the creators income and principle until distribution. A will is still in effect after distribution of all Income and Principle. D. Wills and Testamentary Trusts are effective upon death of the creator; however, Intervivos Trusts are effective during the life time of the creator. The statement of Charge and Discharge are used to account for the creators estate via a will and the Statement of Affairs is used to account for the liquidation of assets in a bankruptcy. A Moving to the next question prevents changes to this answer Question 47 of 60 Question 48 2 points Save Answer A local partnership has assets of cash of $5,000 and a building recorded at $80,000. All liabilities have been paid. The partners capital accounts are as follows Harry $40,000, Landers $30,000 and Waters 15,000. The partners share profits and losses 3:34. If the building sold for $25,000, how much cash will Harry receive in the final settlement? $16,000 O $17,500 $23,500 $18,000 A Moving to the next question prevents changes to this answer. Question 48 of 60 A Moving to the next question prevents changes to this answer. Question 49 of 60 > Question 49 2 points Save Answer The terms of a will currently undergoing probate are: "A gift to my brother David of $25,000 cash; to my son James, $55,000 from my savings account; and to my Daughter Lila, all of my remaining property." At the time of death, the balance in the savings account was $50,000, and there was additional cash (after payment of funeral expenses and all claims against the estate) of $70,000. How much would James have received from the estate? 60,000 $40,000 $50,000 $55,000