Answered step by step

Verified Expert Solution

Question

1 Approved Answer

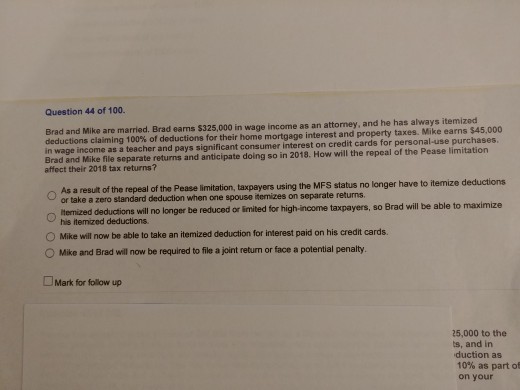

Question 44 of 100. e are married. Brad eams $325,000 in wage income as an attorney, and he has always itemized property taxes. Mike earns

Question 44 of 100. e are married. Brad eams $325,000 in wage income as an attorney, and he has always itemized property taxes. Mike earns $45,000 deductions claiming 100% of deductions for their home mortgage interest and ge income as a teacher and pays significant consumer interest on credit cards for personal-use purchases. Brad and Mike file affect their 2018 tax returns? separate returns and anticipate doing so in 2018. How will the repeal of the Pease limitation As a result of the repeal of the Pease limitation, taxpayers using the MFS status no longer have to itemize deductions or take a zero standard deduction when one spouse itemizes on separate returns. Itenized deductions will no longer be reduced or tmited for high-income taxpayers, so Brad will be able to maximize his itemized deductions O Mike will now be able to take an itemized deduction for interest paid on his credit cards O Mike and Brad will now be required to file a joint return or face a potential penalty. ?Mark for follow up 25,000 to the ts, and in duction as 10% as part of on your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started