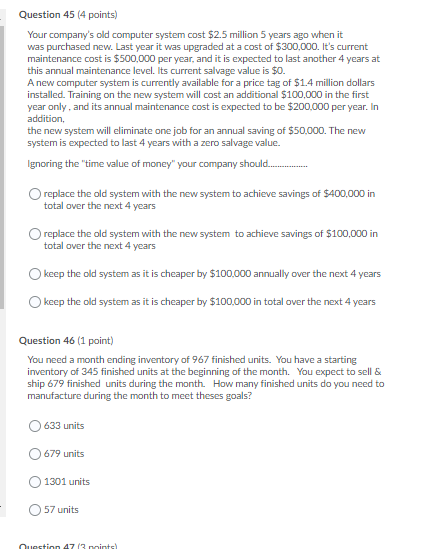

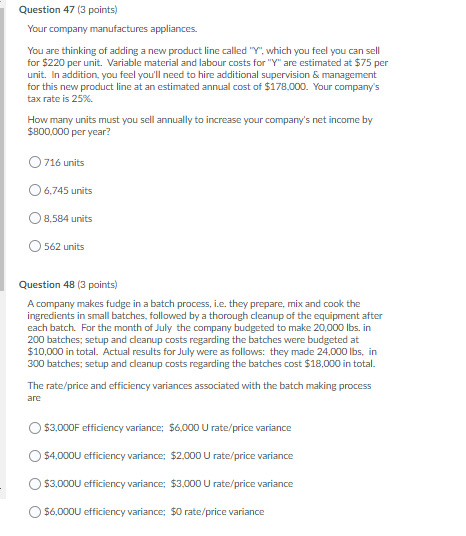

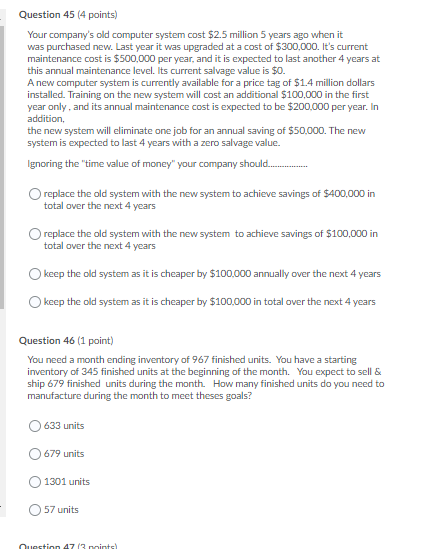

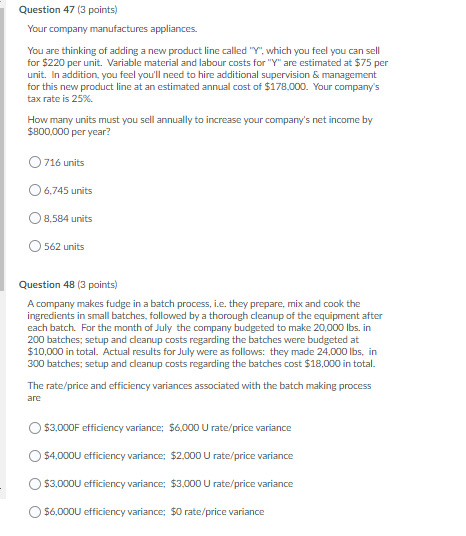

Question 45 (4 points) Your company's old computer system cost $2.5 million 5 years ago when it was purchased new. Last year it was upgraded at a cost of $300,000. It's current maintenance cost is $500,000 per year, and it is expected to last another 4 years at this annual maintenance level. Its current salvage value is $0. A new computer system is currently available for a price tag of $1.4 million dollars installed. Training on the new system will cost an additional $100,000 in the first year only, and its annual maintenance cost is expected to be $200,000 per year. In addition, the new system will eliminate one job for an annual saving of $50,000. The new system is expected to last 4 years with a zero salvage value. Ignoring the "time value of money" your company should... Oreplace the old system with the new system to achieve savings of $400,000 in total over the next 4 years replace the old system with the new system to achieve savings of $100,000 in total over the next 4 years keep the old system as it is cheaper by $100,000 annually over the next 4 years keep the old system as it is cheaper by $100,000 in total over the next 4 years Question 46 (1 point) You need a month ending inventory of 967 finished units. You have a starting inventory of 345 finished units at the beginning of the month. You expect to sell & ship 679 finished units during the month. How many finished units do you need to manufacture during the month to meet theses goals? 633 units 679 units 1301 units 57 units Question 473 points) Question 47 (3 points) Your company manufactures appliances. You are thinking of adding a new product line called "Y", which you feel you can sell for $220 per unit. Variable material and labour costs for "Y" are estimated at $75 per unit. In addition, you feel you'll need to hire additional supervision & management for this new product line at an estimated annual cost of $178,000. Your company's tax rate is 25% How many units must you sell annually to increase your company's net income by $800,000 per year? 716 units 6,745 units 8,584 units 562 units Question 48 (3 points) A company makes fudge in a batch process, i.e. they prepare, mix and cook the ingredients in small batches, followed by a thorough cleanup of the equipment after each batch. For the month of July the company budgeted to make 20,000 lbs. in 200 batches, setup and cleanup costs regarding the batches were budgeted at $10,000 in total. Actual results for July were as follows: they made 24,000 lbs, in 300 batches, setup and cleanup costs regarding the batches cost $18,000 in total. The rate/price and efficiency variances associated with the batch making process are $3,000F efficiency variance; $6,000 U rate/price variance $4,000U efficiency variance; $2,000 U rate/price variance $3,000U efficiency variance: $3,000 U rate/price variance $6,0000 efficiency variance: $0 rate/price variance