Question 4&5

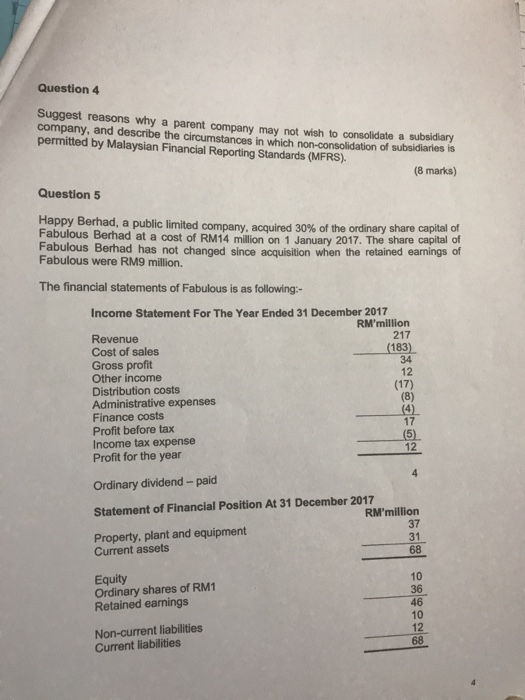

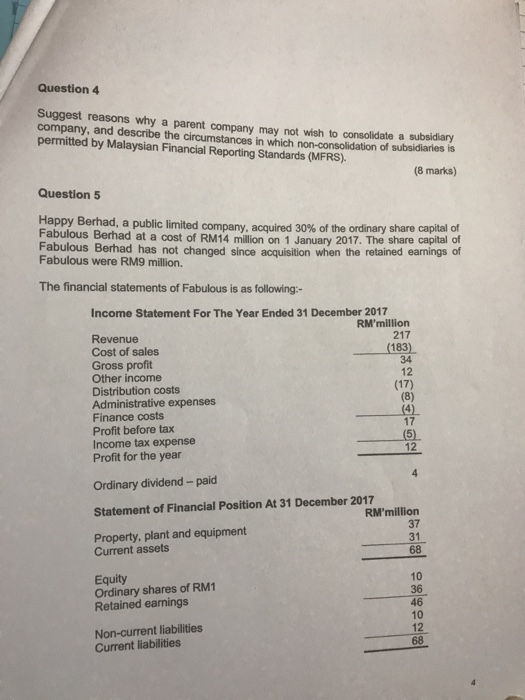

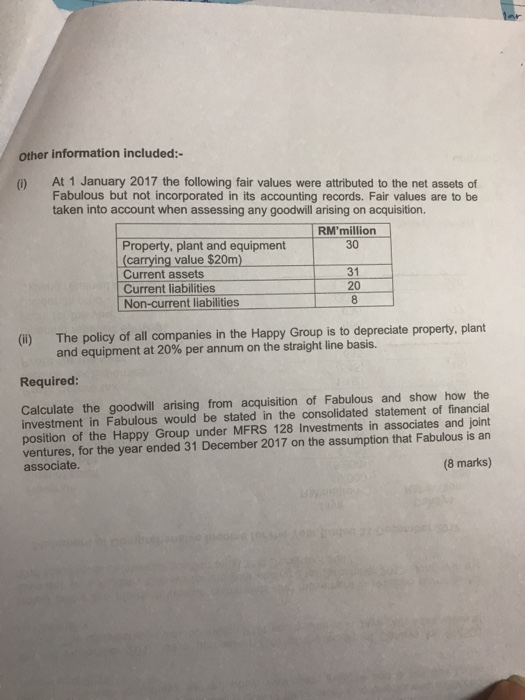

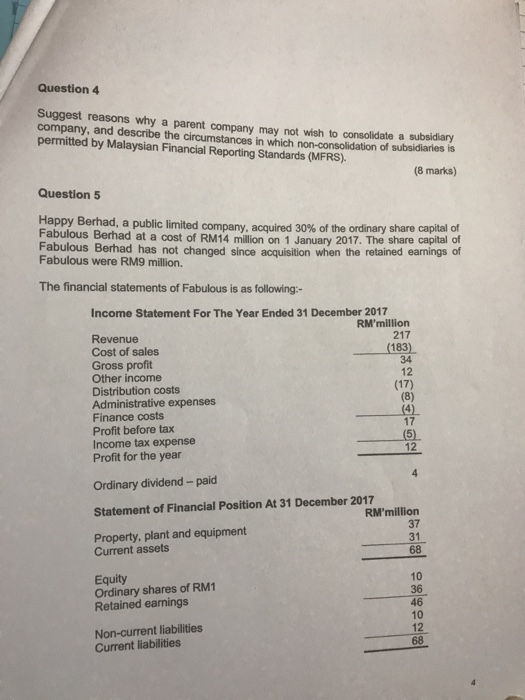

Question 4 Suggest reasons why a parent company may not wish to consolidate company, and describe the circumstances in which non-consolidation of subsidiaries is permitted by Malaysian Financial Reporting Standards (MFRS) a subsidiary (8 marks) Question 5 Happy Berhad, a public li ited company acquired 30% of the ordinary share capital of s Berhad at a cost of RM14 million on 1 January 2017. The share capital of Fabulou Fabulous were RM9 million. The financial statements of Fabulous is as following: Fabulous Berhad has not changed since acquisition when the retained earnings of ncome Statement For The Year Ended 31 December 2017 RM'million 217 Revenue Cost of sales Gross profit Other income Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year 183) 34 12 (17) 17 12 Ordinary dividend- paid Statement of Financial Position At 31 December 2017 Property, plant and equipment Current assets RM'million 37 31 68 Equity Ordinary shares of RM1 Retained earnings 10 36 46 10 12 68 Non-current liabilities Current liabilities other information included:- At 1 January 2017 the following fair values were attributed to the net assets of Fabulous but not incorporated in its accounting records. Fair values are to be taken into account when assessing any goodwill arising on acquisition. RM'million Property, plant and equipment30 (carrying value $20m) Current assets Current liabilities Non-current liabilities 31 20 (i) The policy of all companies in the Happy Group is to depreciate property, plant and equipment at 20% per annum on the straight line basis. Required: Calculate the goodwill arising from acquisition of Fabulous and show how the investment in Fabulous would be stated in the consolidated statement of financial position of the Happy Group under MFRS 128 Investments in associates and joint ventures, for the year ended 31 December 2017 on the assumption that Fabulous is an associate (8 marks) Question 4 Suggest reasons why a parent company may not wish to consolidate company, and describe the circumstances in which non-consolidation of subsidiaries is permitted by Malaysian Financial Reporting Standards (MFRS) a subsidiary (8 marks) Question 5 Happy Berhad, a public li ited company acquired 30% of the ordinary share capital of s Berhad at a cost of RM14 million on 1 January 2017. The share capital of Fabulou Fabulous were RM9 million. The financial statements of Fabulous is as following: Fabulous Berhad has not changed since acquisition when the retained earnings of ncome Statement For The Year Ended 31 December 2017 RM'million 217 Revenue Cost of sales Gross profit Other income Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year 183) 34 12 (17) 17 12 Ordinary dividend- paid Statement of Financial Position At 31 December 2017 Property, plant and equipment Current assets RM'million 37 31 68 Equity Ordinary shares of RM1 Retained earnings 10 36 46 10 12 68 Non-current liabilities Current liabilities other information included:- At 1 January 2017 the following fair values were attributed to the net assets of Fabulous but not incorporated in its accounting records. Fair values are to be taken into account when assessing any goodwill arising on acquisition. RM'million Property, plant and equipment30 (carrying value $20m) Current assets Current liabilities Non-current liabilities 31 20 (i) The policy of all companies in the Happy Group is to depreciate property, plant and equipment at 20% per annum on the straight line basis. Required: Calculate the goodwill arising from acquisition of Fabulous and show how the investment in Fabulous would be stated in the consolidated statement of financial position of the Happy Group under MFRS 128 Investments in associates and joint ventures, for the year ended 31 December 2017 on the assumption that Fabulous is an associate (8 marks)