Question # 4.5

You decide that you are not indifferent to either unit -- you love Unit 10Z. Because you had an amazing Real Estate Finance & Development class in graduate school, you realize that with some financial engineering, you can tweak the terms offered by the developers so that your monthly payment is the same or less than the monthly payment on Unit 3Q. Explain three different ways you could manipulate the loan terms to reach the lower monthly payment without changing the actual asking price of $361,000.

the questions are displayed on the image attached to this question. question 4.5 is at the bottom of the image.

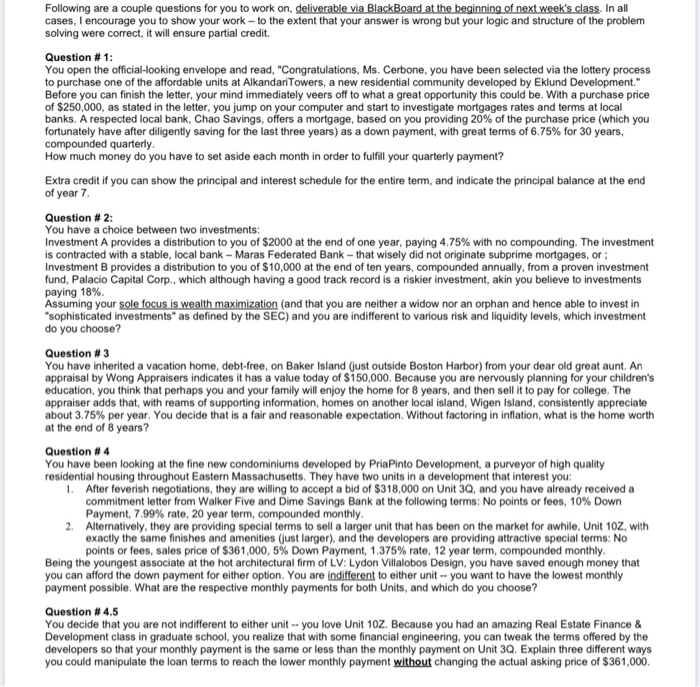

Following are a couple questions for you to work on, deliverable via BlackBoard at the beginning of next week's class. In all cases, I encourage you to show your work to the extent that your answer is wrong but your logic and structure of the problem solving were correct, it will ensure partial credit. Question #1: You open the official-looking envelope and read, "Congratulations, Ms. Cerbone, you have been selected via the lottery process to purchase one of the affordable units at Alkandari Towers, a new residential community developed by Eklund Development." Before you can finish the letter, your mind immediately veers off to what a great opportunity this could be. With a purchase price of $250,000, as stated in the letter, you jump on your computer and start to investigate mortgages rates and terms at local banks. A respected local bank, Chao Savings, offers a mortgage, based on you providing 20% of the purchase price (which you fortunately have after diligently saving for the last three years) as a down payment, with great terms of 6.75% for 30 years, compounded quarterly. How much money do you have to set aside each month in order to fulfill your quarterly payment? Extra credit if you can show the principal and interest schedule for the entire term, and indicate the principal balance at the end of year 7. Question # 2: You have a choice between two investments: Investment A provides a distribution to you of $2000 at the end of one year, paying 4.75% with no compounding. The investment is contracted with a stable, local bank - Maras Federated Bank - that wisely did not originate subprime mortgages, or Investment B provides a distribution to you of $10,000 at the end of ten years, compounded annually, from a proven investment fund, Palacio Capital Corp., which although having a good track record is a riskier investment, akin you believe to investments paying 18%. Assuming your sole focus is wealth maximization (and that you are neither a widow nor an orphan and hence able to invest in "sophisticated investments" as defined by the SEC) and you are indifferent to various risk and liquidity levels, which investment do you choose? Question #3 You have inherited a vacation home, debt-free, on Baker Island (just outside Boston Harbor) from your dear old great aunt. An appraisal by Wong Appraisers indicates it has a value today of $150,000. Because you are nervously planning for your children's education, you think that perhaps you and your family will enjoy the home for 8 years, and then sell it to pay for college. The appraiser adds that, with reams of supporting information, homes on another local island, Wigen Island, consistently appreciate about 3.75% per year. You decide that is a fair and reasonable expectation. Without factoring in inflation, what is the home worth at the end of 8 years? Question #4 You have been looking at the fine new condominiums developed by Pria Pinto Development, a purveyor of high quality residential housing throughout Eastern Massachusetts. They have two units in a development that interest you: 1. After feverish negotiations, they are willing to accept a bid of $318,000 on Unit 30, and you have already received a commitment letter from Walker Five and Dime Savings Bank at the following terms: No points or fees, 10% Down Payment, 7.99% rate, 20 year term, compounded monthly 2. Alternatively, they are providing special terms to sell a larger unit that has been on the market for awhile. Unit 102, with exactly the same finishes and amenities (just larger), and the developers are providing attractive special terms: No points or fees, sales price of $361,000, 5% Down Payment, 1.375% rate, 12 year term, compounded monthly Being the youngest associate at the hot architectural firm of LV: Lydon Villalobos Design, you have saved enough money that you can afford the down payment for either option. You are indifferent to either unit - you want to have the lowest monthly payment possible. What are the respective monthly payments for both Units, and which do you choose? Question # 4.5 You decide that you are not indifferent to either unit - you love Unit 10Z. Because you had an amazing Real Estate Finance & Development class in graduate school, you realize that with some financial engineering, you can tweak the terms offered by the developers so that your monthly payment is the same or less than the monthly payment on Unit 30. Explain three different ways you could manipulate the loan terms to reach the lower monthly payment without changing the actual asking price of $361,000