Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4.7 A. What are the appropriate allocation rates? My solutions: General Admin $1.33 Facilities $1000 Financial Services $0.06 B. Allocate the hospitals overhead cost

Question 4.7

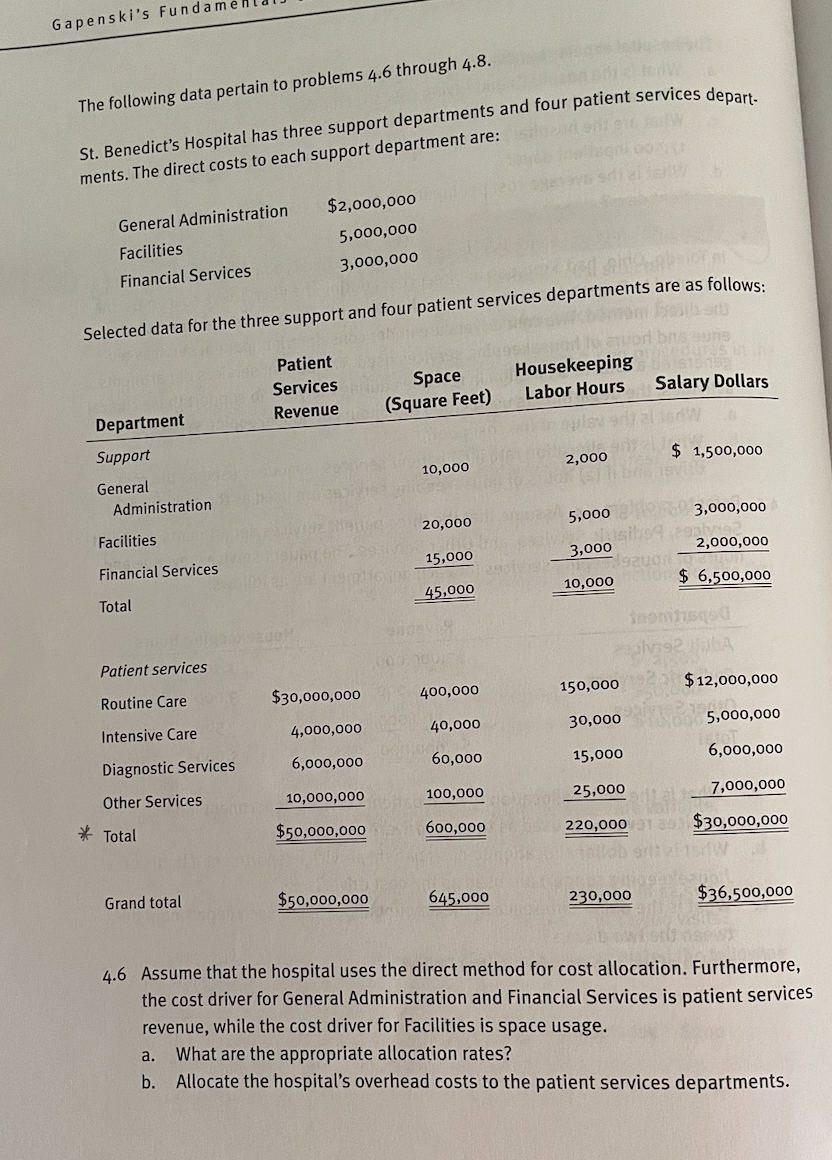

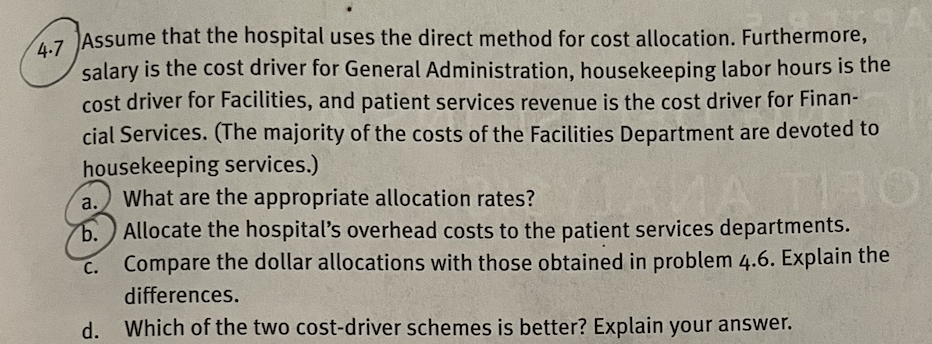

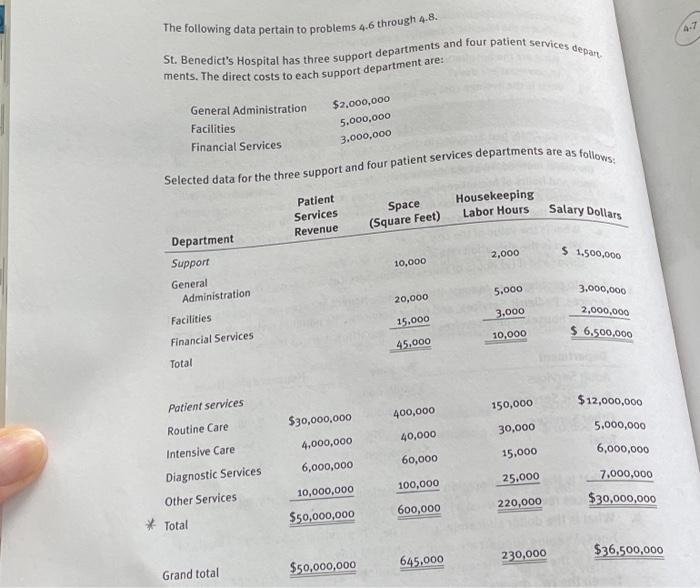

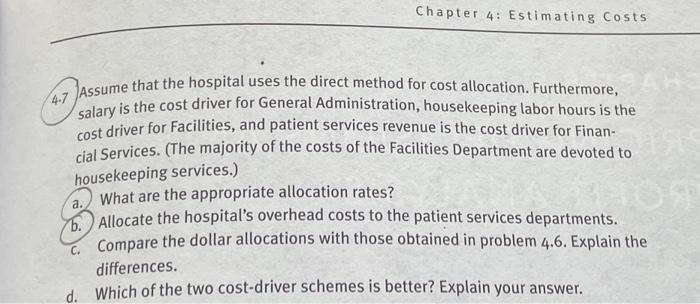

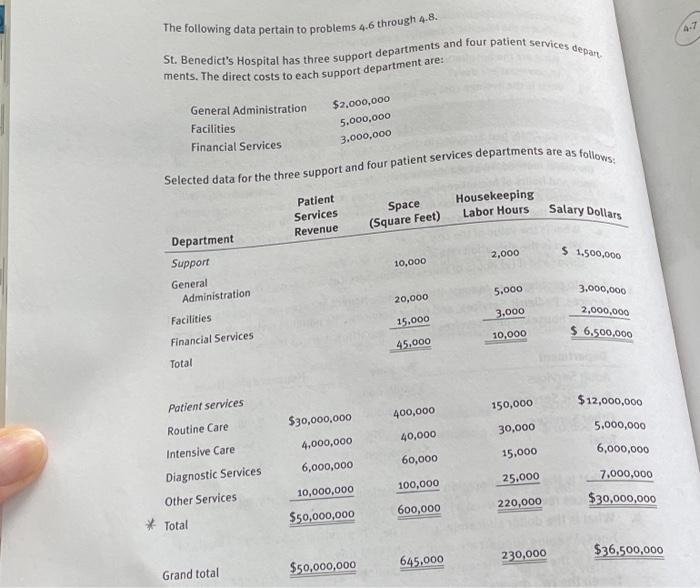

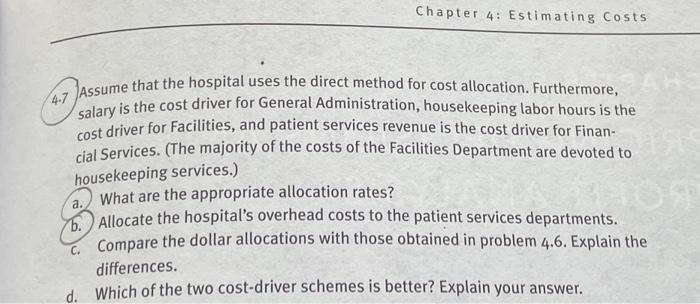

The following data pertain to problems 4.6 through 4.8 . St. Benedict's Hospital has three support departments and four patient services departments. The direct costs to each support department are: colortad data for the three support and four patient services departments are as follows: 4.6 Assume that the hospital uses the direct method for cost allocation. Furthermore, the cost driver for General Administration and Financial Services is patient services revenue, while the cost driver for Facilities is space usage. a. What are the appropriate allocation rates? b. Allocate the hospital's overhead costs to the patient services departments. 4.7 Assume that the hospital uses the direct method for cost allocation. Furthermore, salary is the cost driver for General Administration, housekeeping labor hours is the cost driver for Facilities, and patient services revenue is the cost driver for Financial Services. (The majority of the costs of the Facilities Department are devoted to housekeeping services.) a. What are the appropriate allocation rates? b. Allocate the hospital's overhead costs to the patient services departments. c. Compare the dollar allocations with those obtained in problem 4.6. Explain the differences. d. Which of the two cost-driver schemes is better? Explain your answer. The following data pertain to problem 4.6 tuve ments. The direct costs to each support department are: 4.7 Assume that the hospital uses the direct method for cost allocation. Furthermore, salary is the cost driver for General Administration, housekeeping labor hours is the cost driver for Facilities, and patient services revenue is the cost driver for Financial Services. (The majority of the costs of the Facilities Department are devoted to housekeeping services.) a. What are the appropriate allocation rates? b. Allocate the hospital's overhead costs to the patient services departments. c. Compare the dollar allocations with those obtained in problem 4.6. Explain the differences. d. Which of the two cost-driver schemes is better? Explain your A. What are the appropriate allocation rates?

My solutions:

General Admin $1.33

Facilities $1000

Financial Services $0.06

B. Allocate the hospitals overhead cost to the patient service departments.

I'm uncertain of what to multiply the allocation rates with. Is the entire cost pool? The first page has the info for question 4.7.

Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started