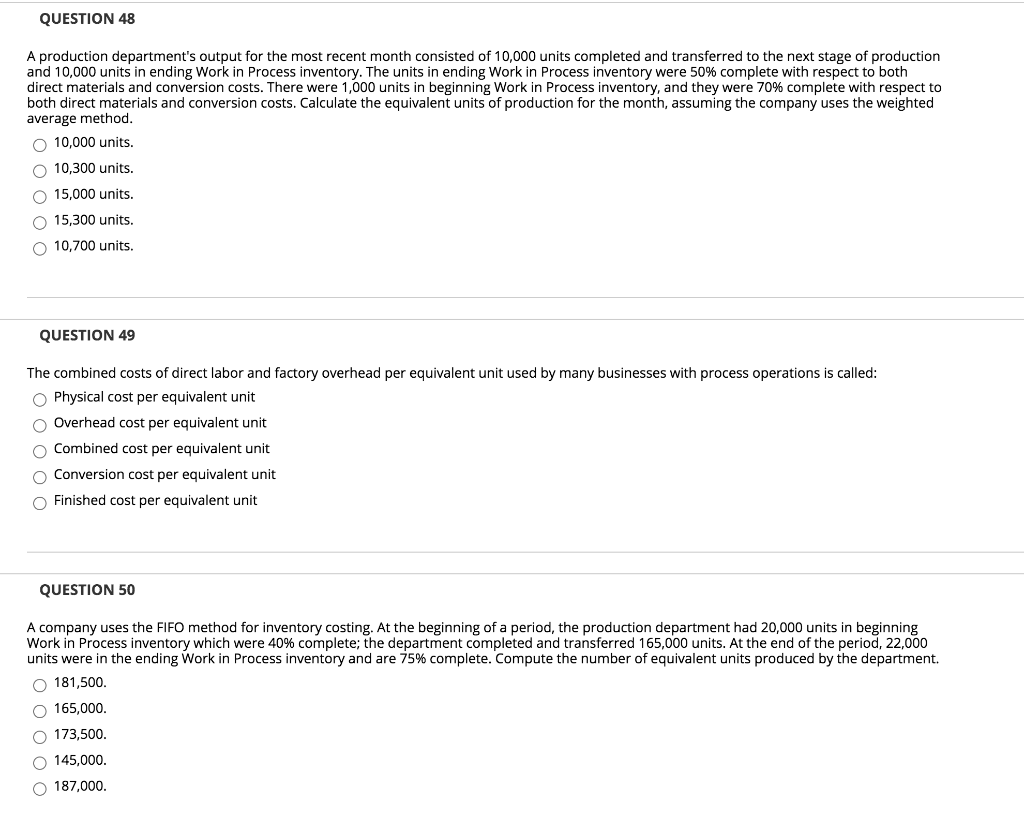

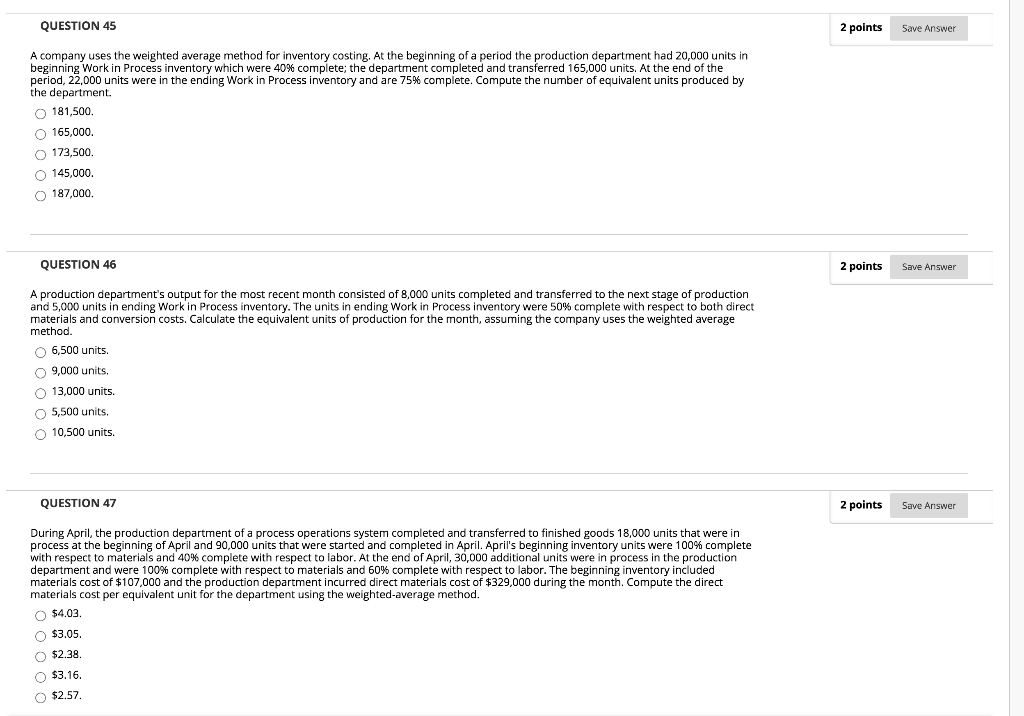

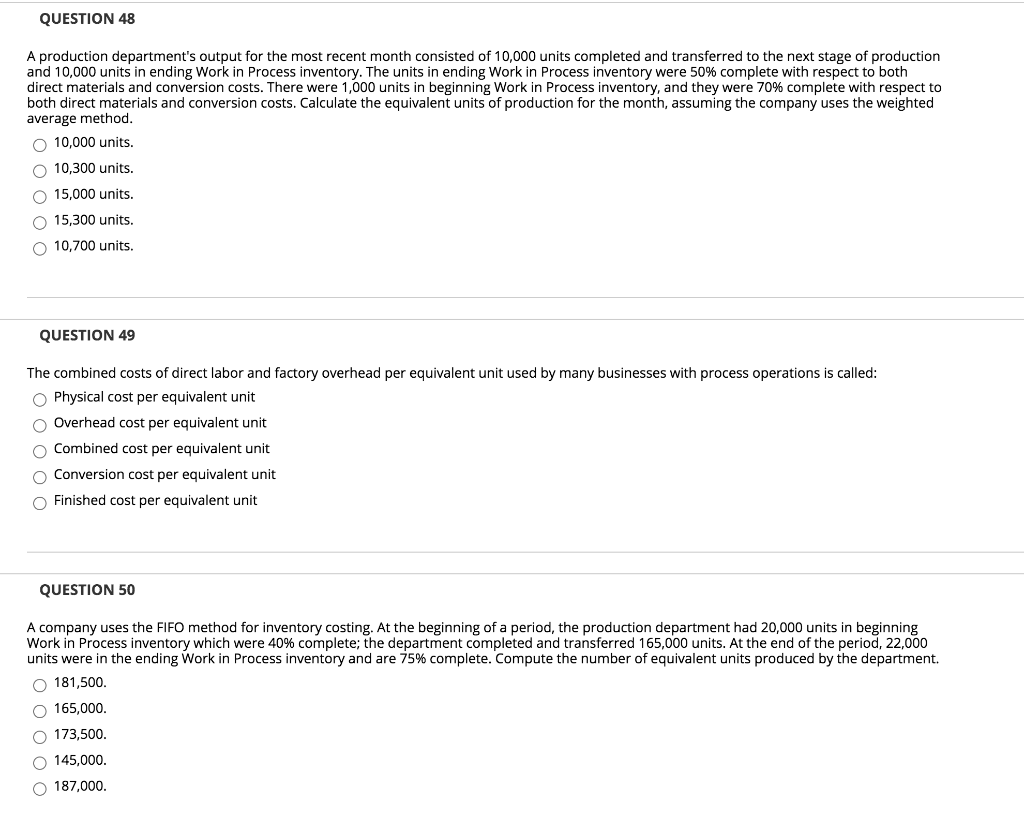

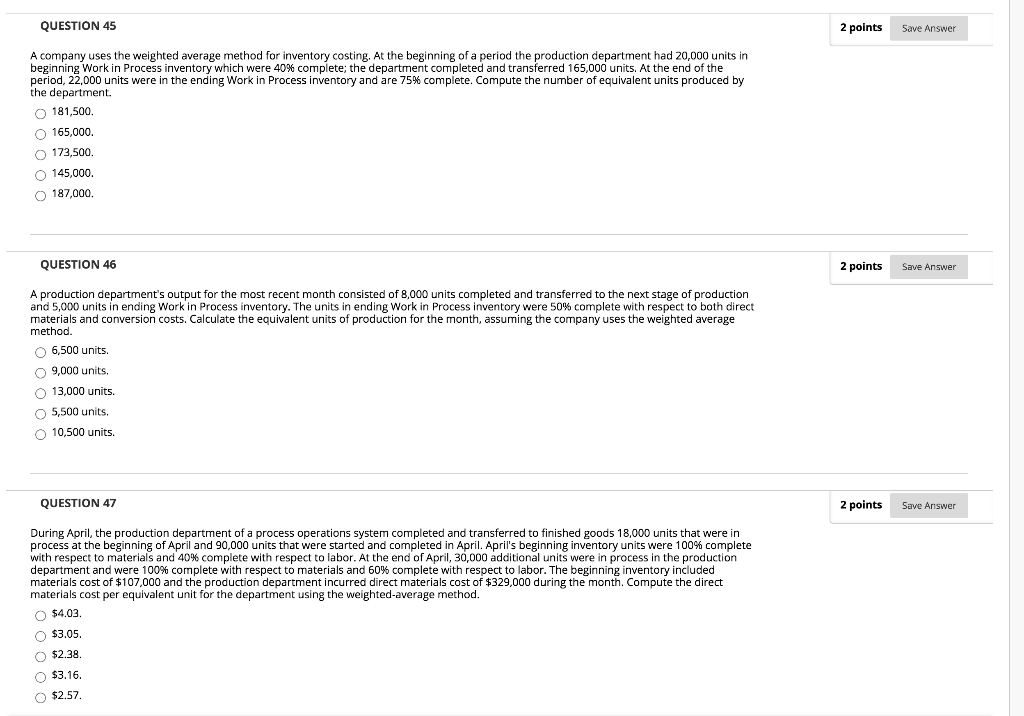

QUESTION 48 A production department's output for the most recent month consisted of 10,000 units completed and transferred to the next stage of production and 10,000 units in ending Work in Process inventory. The units in ending Work in Process inventory were 50% complete with respect to both direct materials and conversion costs. There were 1,000 units in beginning Work in Process inventory, and they were 70% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method. 10,000 units. 10,300 units. 15,000 units. 15,300 units. 10,700 units. QUESTION 49 The combined costs of direct labor and factory overhead per equivalent unit used by many businesses with process operations is called: Physical cost per equivalent unit Overhead cost per equivalent unit Combined cost per equivalent unit Conversion cost per equivalent unit Finished cost per equivalent unit QUESTION 50 A company uses the FIFO method for inventory costing. At the beginning of a period, the production department had 20,000 units in beginning Work in Process inventory which were 40% complete; the department completed and transferred 165,000 units. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 75% complete. Compute the number of equivalent units produced by the department. 181,500. O 165,000. 173,500. 145,000. 187,000. QUESTION 45 2 points Save Answer A company uses the weighted average method for inventory costing. At the beginning of a period the production department had 20,000 units in beginning Work in Process inventory which were 40% complete; the department completed and transferred 165,000 units. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 75% complete. Compute the number of equivalent units produced by the department 181,500. 165,000. 173,500 145,000. 187,000. QUESTION 46 2 points Save Answer A production department's output for the most recent month consisted of 8,000 units completed and transferred to the next stage of production and 5,000 units in ending Work in Process inventory. The units in ending Work in Process inventory were 50% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method. 6,500 units. 9,000 units. 13,000 units. 5,500 units. 10,500 units. QUESTION 47 2 points Save Answer During April, the production department of a process operations system completed and transferred to finished goods 18,000 units that were in process at the beginning of April and 90,000 units that were started and completed in April. April's beginning inventory units were 100% complete with respect to materials and 40% complete with respect to labor. At the end of April, 30,000 additional units were in process in the production department and were 100% complete with respect to materials and 60% complete with respect to labor. The beginning inventory included materials cost of $107,000 and the production department incurred direct materials cost of $329,000 during the month. Compute the direct materials cost per equivalent unit for the department using the weighted-average method. $4.03, $3.05. $2.38. $3.16. $2.57