Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 (10 points) 4) Listen Saved What is the present value of $800 per year, at a discount rate of 1.5 percent, if the

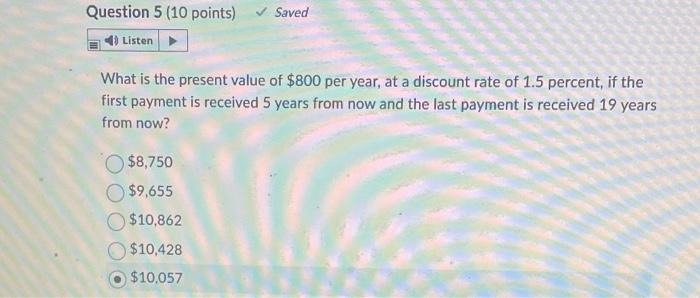

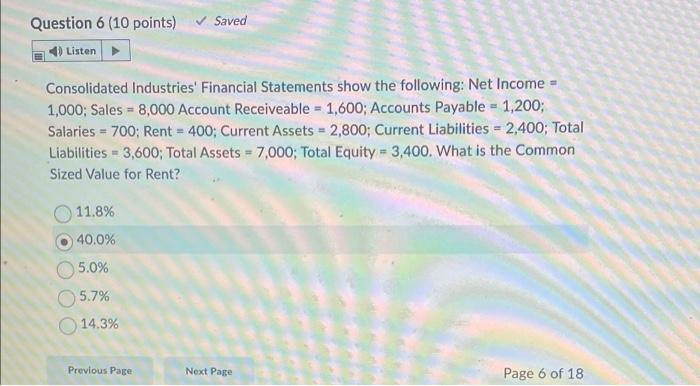

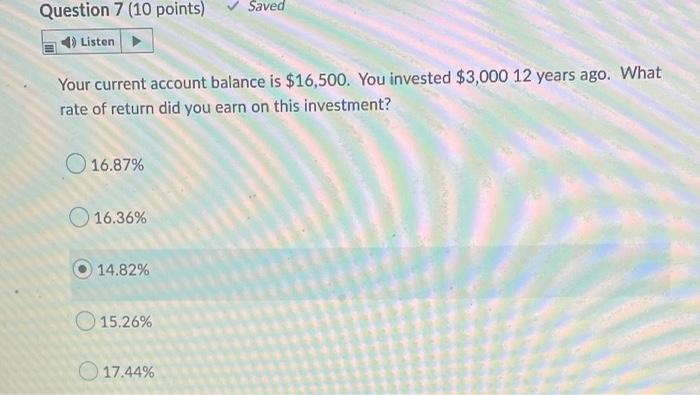

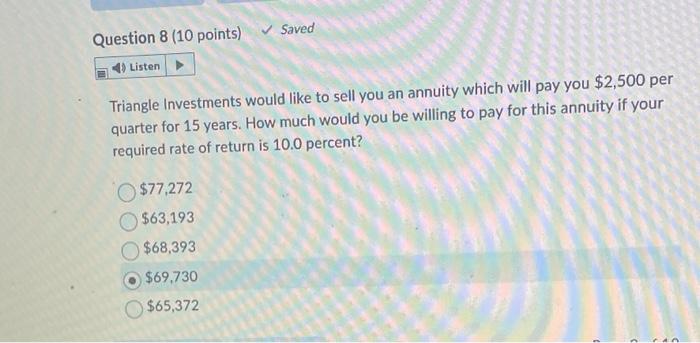

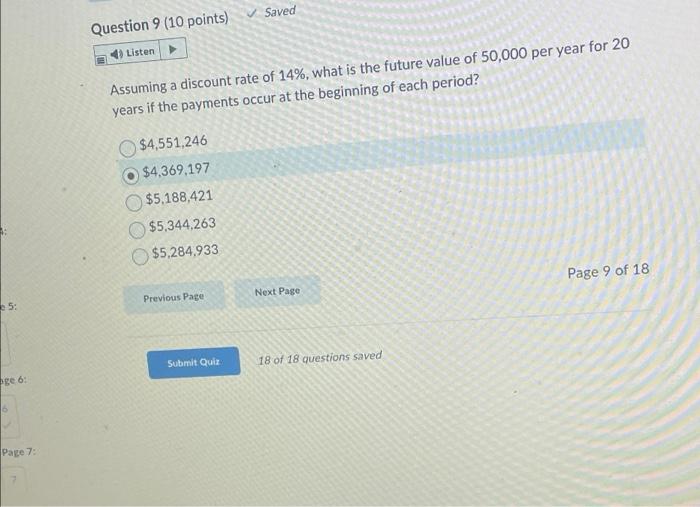

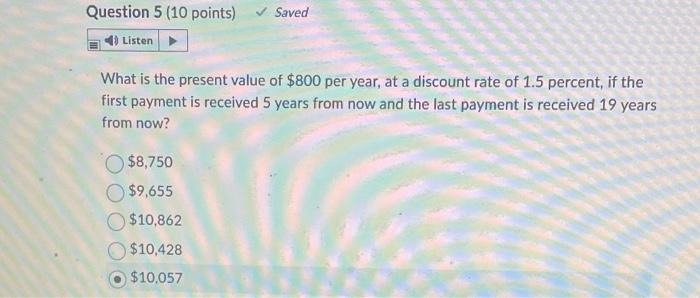

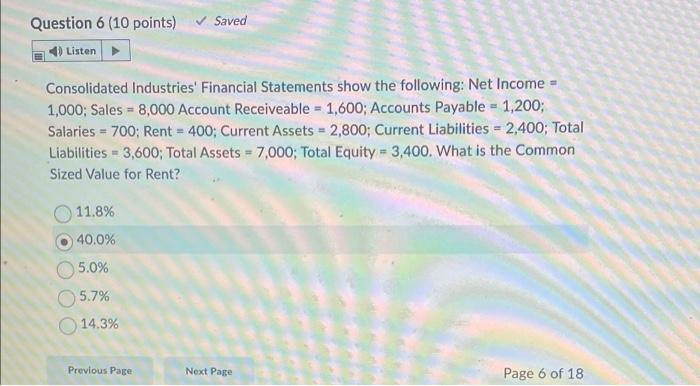

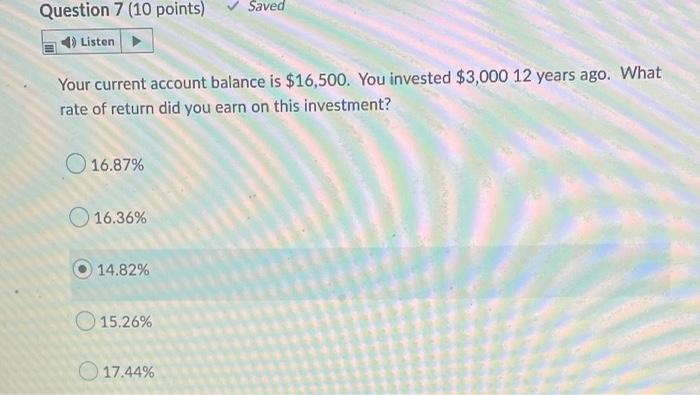

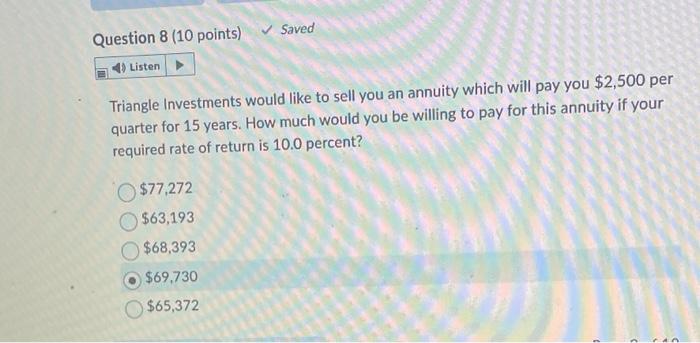

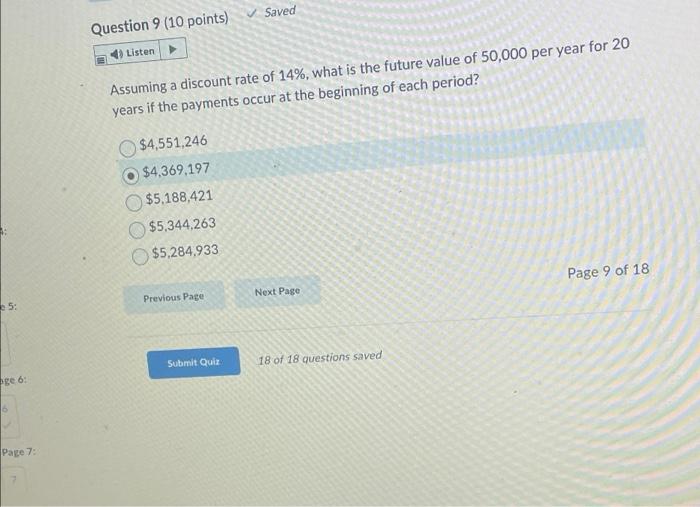

Question 5 (10 points) 4) Listen Saved What is the present value of $800 per year, at a discount rate of 1.5 percent, if the first payment is received 5 years from now and the last payment is received 19 years from now? $8,750 $9,655 $10,862 $10,428 $10.057 Question 6 (10 points) Listen Consolidated Industries' Financial Statements show the following: Net Income 1,000; Sales = 8,000 Account Receiveable = 1,600; Accounts Payable = 1,200; Salaries 700; Rent = 400; Current Assets = 2,800; Current Liabilities = 2,400; Total Liabilities 3,600; Total Assets = 7,000; Total Equity = 3,400. What is the Common Sized Value for Rent? = = 11.8% 40.0% 5.0% 5.7% 14.3% Saved Previous Page Next Page Page 6 of 18 Question 7 (10 points) 4) Listen Your current account balance is $16,500. You invested $3,000 12 years ago. What rate of return did you earn on this investment? 16.87% 16.36% 14.82% 15.26% Saved 17.44% Question 8 (10 points) 4) Listen Saved Triangle Investments would like to sell you an annuity which will pay you $2,500 per quarter for 15 years. How much would you be willing to pay for this annuity if your required rate of return is 10.0 percent? $77,272 $63,193 $68,393 $69,730 $65,372 5: ge 6: 6 Page 7: Question 9 (10 points) 4) Listen Assuming a discount rate of 14%, what is the future value of 50,000 per year for 20 years if the payments occur at the beginning of each period? $4,551,246 $4,369,197 $5,188,421 $5,344,263 $5,284,933 Previous Page Saved Submit Quiz Next Page 18 of 18 questions saved Page 9 of 18

Question 5 (10 points) 4) Listen Saved What is the present value of $800 per year, at a discount rate of 1.5 percent, if the first payment is received 5 years from now and the last payment is received 19 years from now? $8,750 $9,655 $10,862 $10,428 $10.057 Question 6 (10 points) Listen Consolidated Industries' Financial Statements show the following: Net Income 1,000; Sales = 8,000 Account Receiveable = 1,600; Accounts Payable = 1,200; Salaries 700; Rent = 400; Current Assets = 2,800; Current Liabilities = 2,400; Total Liabilities 3,600; Total Assets = 7,000; Total Equity = 3,400. What is the Common Sized Value for Rent? = = 11.8% 40.0% 5.0% 5.7% 14.3% Saved Previous Page Next Page Page 6 of 18 Question 7 (10 points) 4) Listen Your current account balance is $16,500. You invested $3,000 12 years ago. What rate of return did you earn on this investment? 16.87% 16.36% 14.82% 15.26% Saved 17.44% Question 8 (10 points) 4) Listen Saved Triangle Investments would like to sell you an annuity which will pay you $2,500 per quarter for 15 years. How much would you be willing to pay for this annuity if your required rate of return is 10.0 percent? $77,272 $63,193 $68,393 $69,730 $65,372 5: ge 6: 6 Page 7: Question 9 (10 points) 4) Listen Assuming a discount rate of 14%, what is the future value of 50,000 per year for 20 years if the payments occur at the beginning of each period? $4,551,246 $4,369,197 $5,188,421 $5,344,263 $5,284,933 Previous Page Saved Submit Quiz Next Page 18 of 18 questions saved Page 9 of 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started