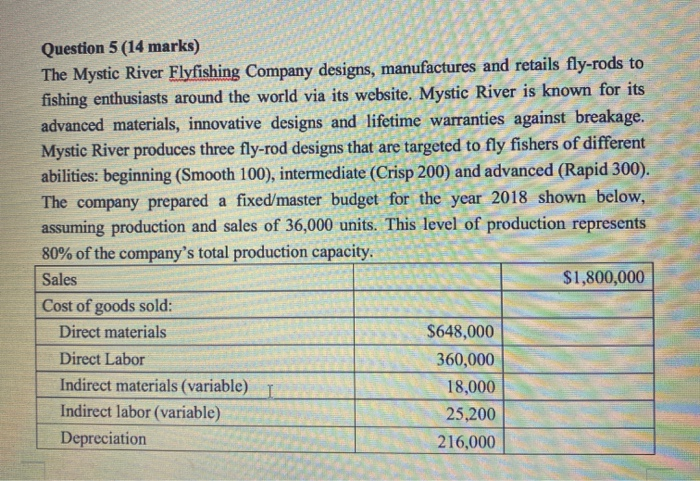

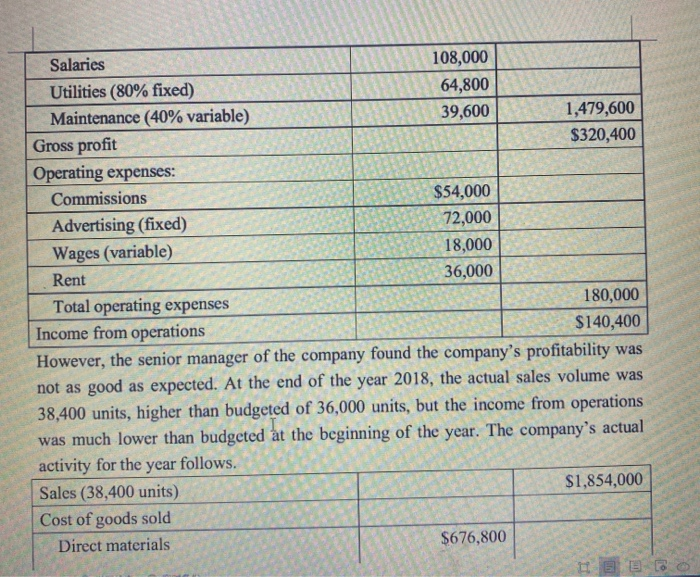

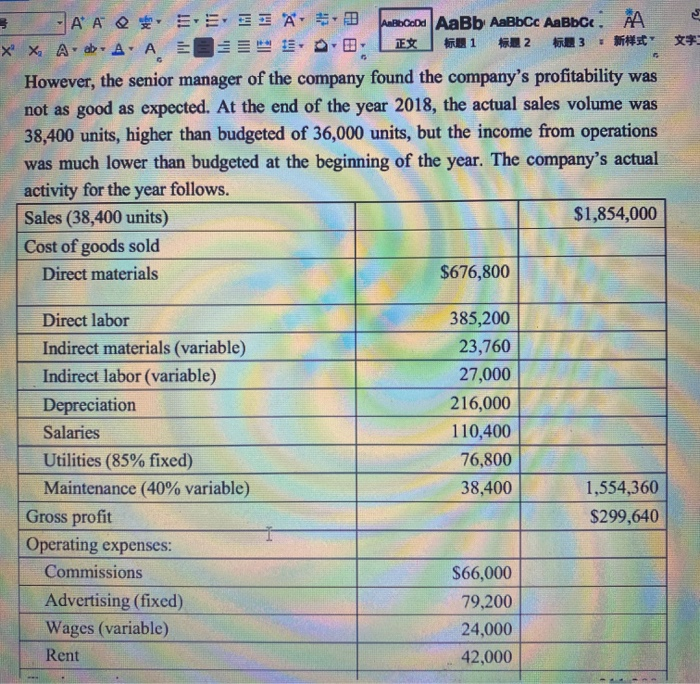

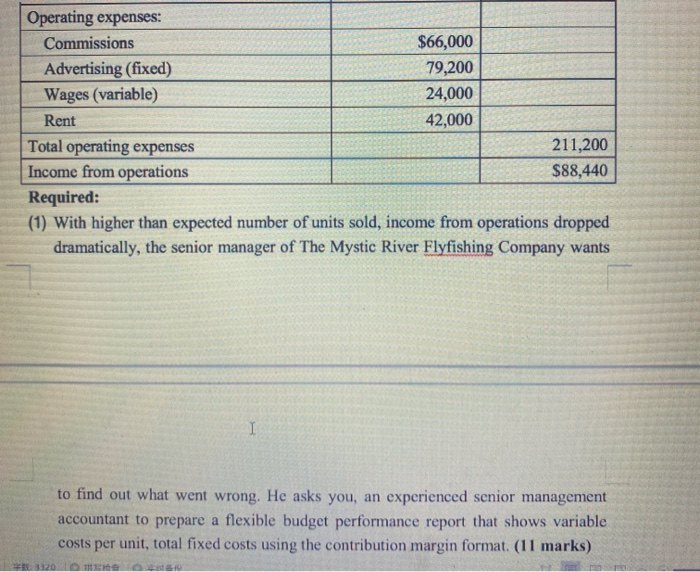

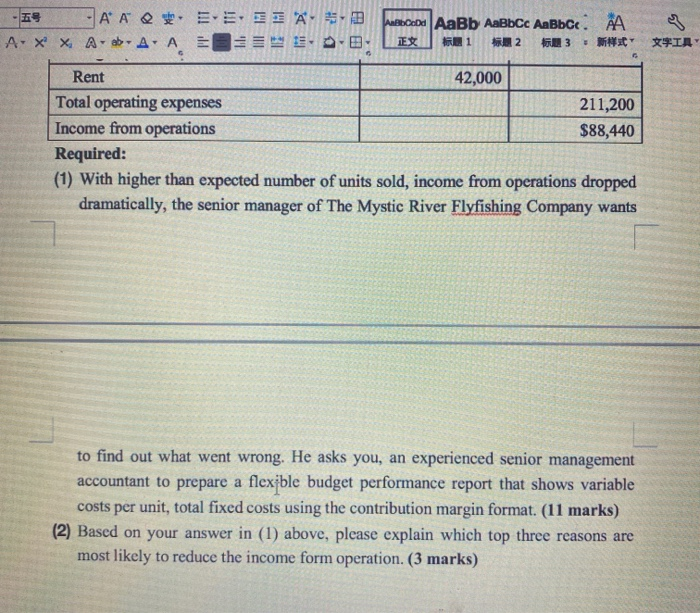

Question 5 (14 marks) The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, innovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity. Sales $1,800,000 Cost of goods sold: Direct materials $648,000 Direct Labor 360,000 Indirect materials (variable) 18,000 Indirect labor (variable) 25,200 Depreciation 216,000 Salaries 108,000 Utilities (80% fixed) 64,800 Maintenance (40% variable) 39,600 1,479,600 Gross profit $320,400 Operating expenses: Commissions $54,000 Advertising (fixed) 72,000 Wages (variable) 18,000 Rent 36,000 Total operating expenses 180,000 Income from operations $140,400 However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows. Sales (38,400 units) $1,854,000 Cost of goods sold Direct materials $676,800 ** A ASIA AMED CODAaBb AaBbcc AaBbce: AA XX. AAA ISO: EX 1 2 3 However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows. Sales (38,400 units) $1,854,000 Cost of goods sold Direct materials $676,800 Direct labor Indirect materials (variable) Indirect labor (variable) Depreciation Salaries Utilities (85% fixed) Maintenance (40% variable) Gross profit Operating expenses: Commissions Advertising (fixed) Wages (variable) Rent 385,200 23,760 27,000 216,000 110,400 76,800 38,400 1,554,360 $299,640 $66,000 79,200 24,000 42,000 Operating expenses: Commissions $66,000 Advertising (fixed) 79,200 Wages (variable) 24,000 Rent 42,000 Total operating expenses 211,200 Income from operations $88,440 Required: (1) With higher than expected number of units sold, income from operations dropped dramatically, the senior manager of The Mystic River Flyfishing Company wants I to find out what went wrong. He asks you, an experienced senior management accountant to prepare a flexible budget performance report that shows variable costs per unit, total fixed costs using the contribution margin format. (11 marks) 3320 - AAEEEA A: * X. AA. AISEE. OB WebCode AaBb AaBbcc AaBbce: AA ES L 1 HR2 5. 3 Nyt Rent 42,000 Total operating expenses 211,200 Income from operations $88,440 Required: (1) With higher than expected number of units sold, income from operations dropped dramatically, the senior manager of The Mystic River Flyfishing Company wants to find out what went wrong. He asks you, an experienced senior management accountant to prepare a flexible budget performance report that shows variable costs per unit, total fixed costs using the contribution margin format. (11 marks) (2) Based on your answer in (1) above, please explain which top three reasons are most likely to reduce the income form operation