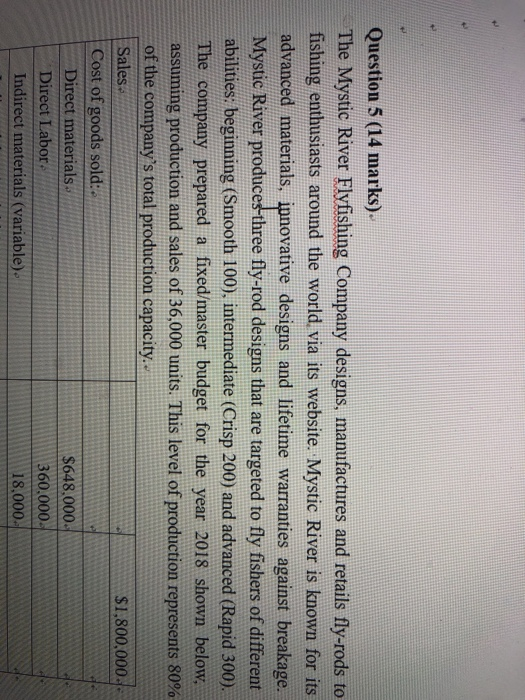

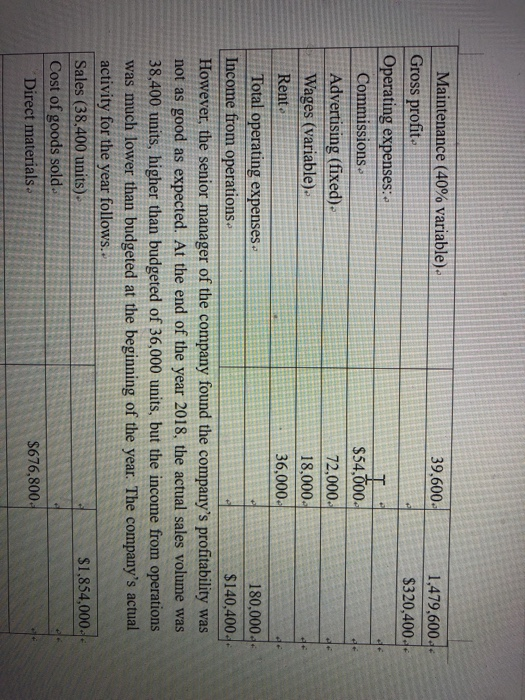

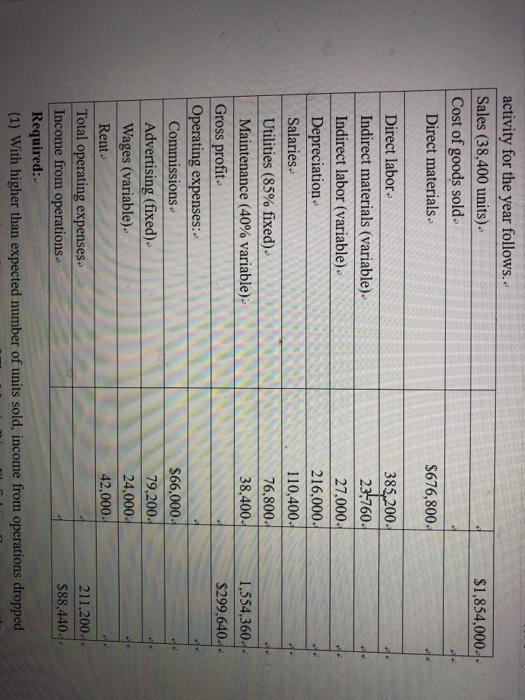

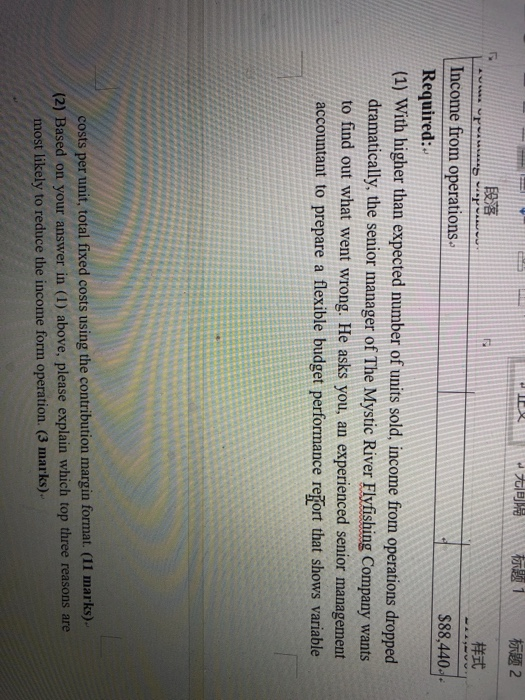

Question 5 (14 marks). The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, ipnovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed/master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity.. Sales $1,800,000 Cost of goods sold:- Direct materials $648,000 Direct Labor 360,000 Indirect materials (variable) 18,000 Question 5 (14 marks). The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, ipnovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed/master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity.. Sales $1,800,000 Cost of goods sold:- Direct materials $648,000 Direct Labor 360,000 Indirect materials (variable) 18,000 activity for the year follows.. Sales (38,400 units) Cost of goods sold Direct materials $1,854,000 $676,800 Direct labor 385,200. Indirect materials (variable). 23,760. Indirect labor (variable) 27,000. Depreciation 216,000. Salaries 110,400. Utilities (85% fixed). 76,800. Maintenance (40% variable) 38,400. 1,554,360- Gross profit. $299,640. Operating expenses: Commissions $66,000 Advertising (fixed). 79,200. Wages (variable) 24,000. Rent 42,000 Total operating expenses 211,200 Income from operations. $88,440 Required:- (1) With higher than expected number of units sold, income from operations dropped Tom Maintenance (40% variable) 39,600. 1,479,600.- Gross profit. $320,400.- Operating expenses:- Commissions $54,000. Advertising (fixed) 72,000. Wages (variable) 18,000 Rent 36,000 Total operating expenses. 180,000.- Income from operations $140,400.- However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows.. Sales (38,400 units) $1,854,000. Cost of goods sold. Direct materials $676,800 Question 5 (14 marks). The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, ipnovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed/master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity.. Sales $1,800,000 Cost of goods sold:- Direct materials $648,000 Direct Labor 360,000 Indirect materials (variable) 18,000 Question 5 (14 marks). The Mystic River Flyfishing Company designs, manufactures and retails fly-rods to fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, ipnovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fishers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) and advanced (Rapid 300). The company prepared a fixed/master budget for the year 2018 shown below, assuming production and sales of 36,000 units. This level of production represents 80% of the company's total production capacity.. Sales $1,800,000 Cost of goods sold:- Direct materials $648,000 Direct Labor 360,000 Indirect materials (variable) 18,000 activity for the year follows.. Sales (38,400 units) Cost of goods sold Direct materials $1,854,000 $676,800 Direct labor 385,200. Indirect materials (variable). 23,760. Indirect labor (variable) 27,000. Depreciation 216,000. Salaries 110,400. Utilities (85% fixed). 76,800. Maintenance (40% variable) 38,400. 1,554,360- Gross profit. $299,640. Operating expenses: Commissions $66,000 Advertising (fixed). 79,200. Wages (variable) 24,000. Rent 42,000 Total operating expenses 211,200 Income from operations. $88,440 Required:- (1) With higher than expected number of units sold, income from operations dropped Tom Maintenance (40% variable) 39,600. 1,479,600.- Gross profit. $320,400.- Operating expenses:- Commissions $54,000. Advertising (fixed) 72,000. Wages (variable) 18,000 Rent 36,000 Total operating expenses. 180,000.- Income from operations $140,400.- However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales volume was 38,400 units, higher than budgeted of 36,000 units, but the income from operations was much lower than budgeted at the beginning of the year. The company's actual activity for the year follows.. Sales (38,400 units) $1,854,000. Cost of goods sold. Direct materials $676,800