Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 14 Suppose John has a utility function (1) = inz, where 1 > 0 is the total wealth Moreover, he has a total

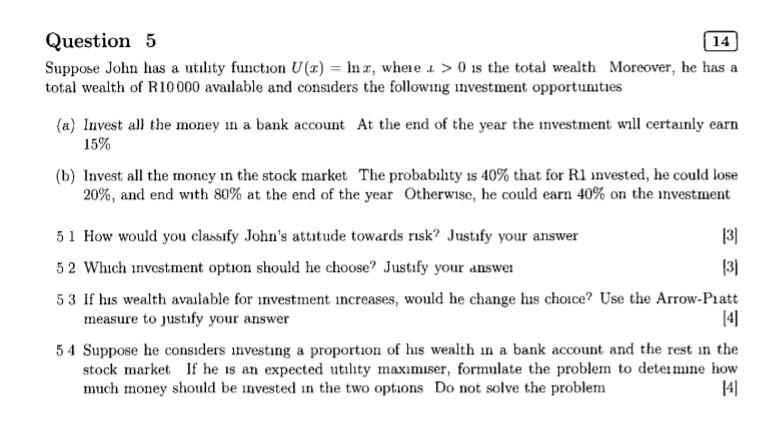

Question 5 14 Suppose John has a utility function (1) = inz, where 1 > 0 is the total wealth Moreover, he has a total wealth of R10000 available and considers the following investment opportunities (a) Invest all the money in a bank account At the end of the year the investment will certainly earn 15% (b) Invest all the moncy in the stock market The probability is 40% that for Rl invested, he could lose 20%, and end with 80% at the end of the year Otherwise, he could earn 40% on the investment 51 How would you classify John's attitude towards risk? Justify your answer 131 52 Which investment option should he choose? Justify your answer 131 53 If his wealth available for investment increases, would he change his choice? Use the Arrow-Piatt measure to justify your answer 54 Suppose he considers investing a proportion of his wealth in a bank account and the rest in the stock market If he is an expected utility maximiser, formulate the problem to determine how much money should be invested in the two options Do not solve the problem 14] 141 Question 5 14 Suppose John has a utility function (1) = inz, where 1 > 0 is the total wealth Moreover, he has a total wealth of R10000 available and considers the following investment opportunities (a) Invest all the money in a bank account At the end of the year the investment will certainly earn 15% (b) Invest all the moncy in the stock market The probability is 40% that for Rl invested, he could lose 20%, and end with 80% at the end of the year Otherwise, he could earn 40% on the investment 51 How would you classify John's attitude towards risk? Justify your answer 131 52 Which investment option should he choose? Justify your answer 131 53 If his wealth available for investment increases, would he change his choice? Use the Arrow-Piatt measure to justify your answer 54 Suppose he considers investing a proportion of his wealth in a bank account and the rest in the stock market If he is an expected utility maximiser, formulate the problem to determine how much money should be invested in the two options Do not solve the problem 14] 141

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started