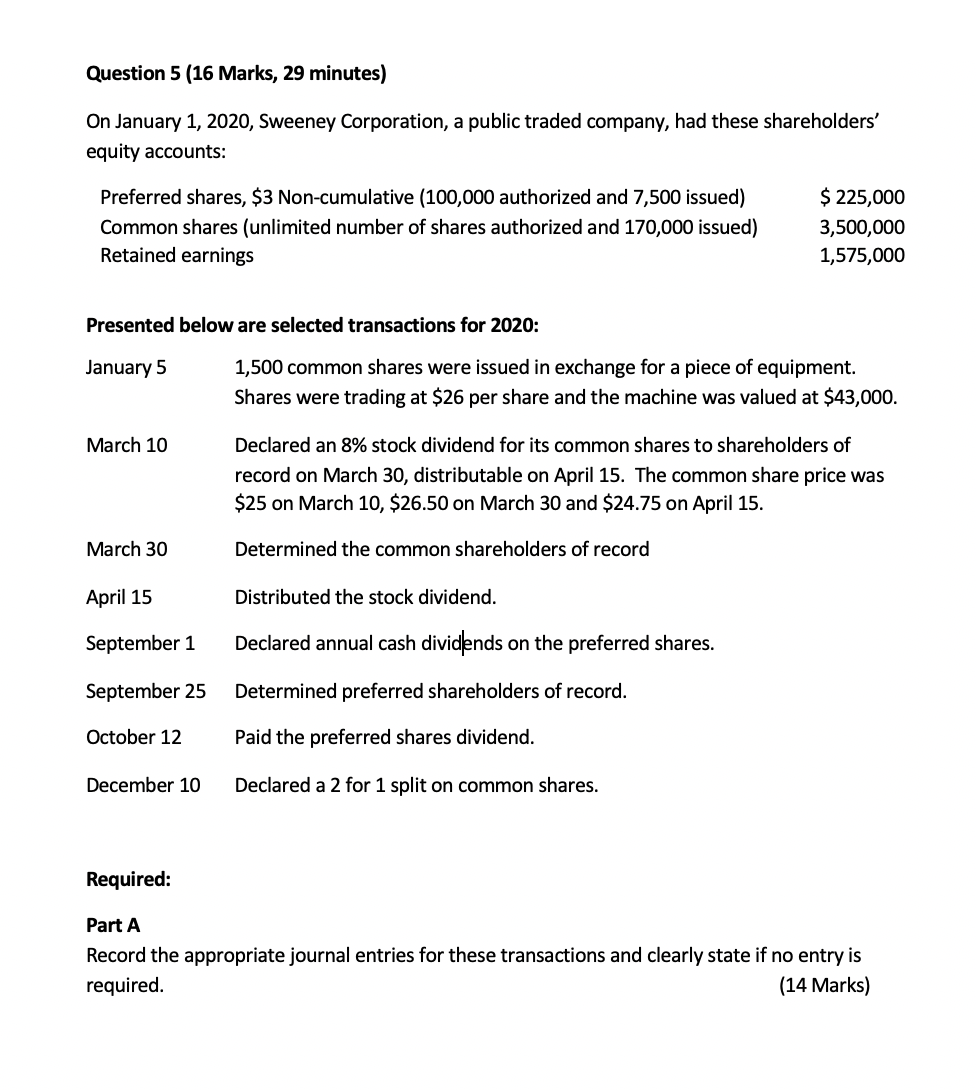

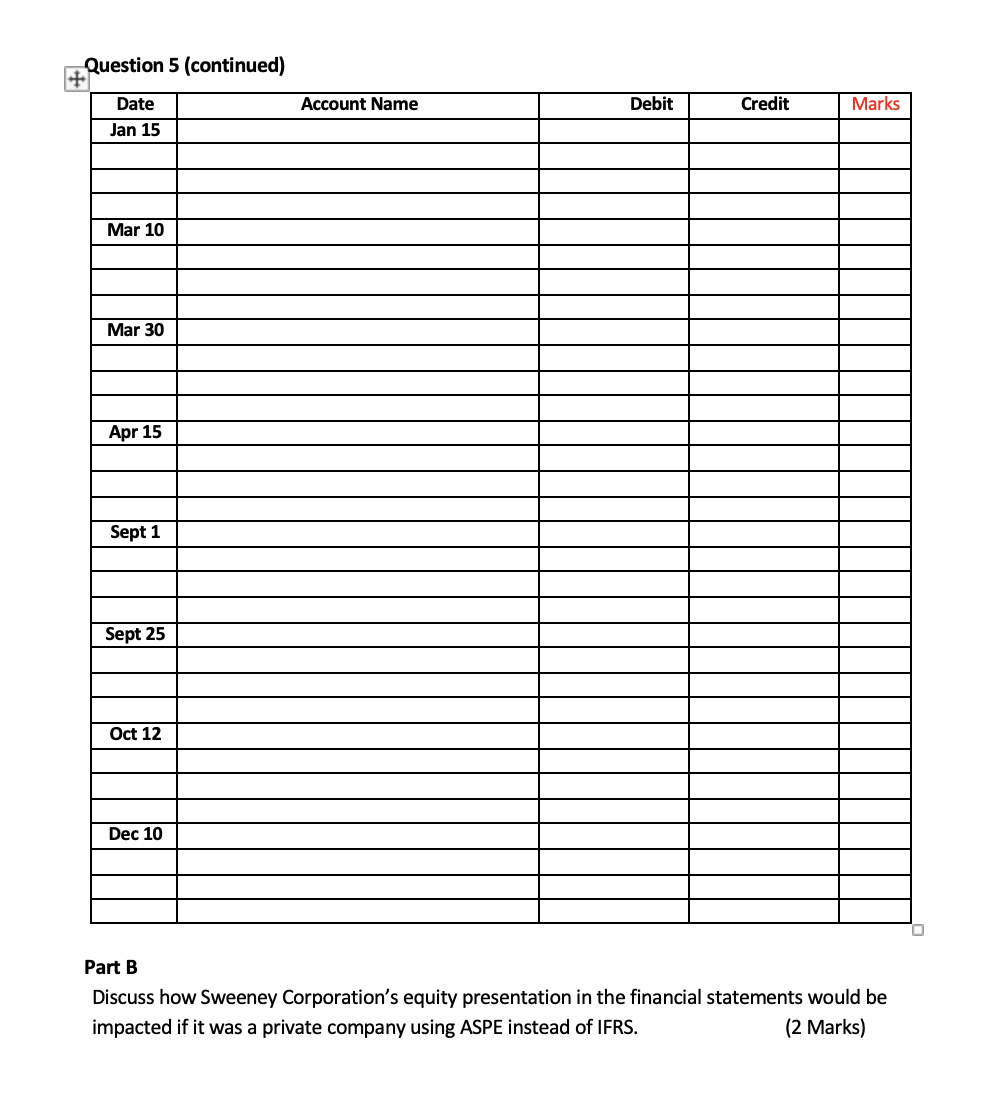

Question 5 (16 Marks, 29 minutes) On January 1, 2020, Sweeney Corporation, a public traded company, had these shareholders' equity accounts: Preferred shares, $3 Non-cumulative (100,000 authorized and 7,500 issued) Common shares (unlimited number of shares authorized and 170,000 issued) Retained earnings $225,000 3,500,000 1,575,000 Presented below are selected transactions for 2020: January 5 1,500 common shares were issued in exchange for a piece of equipment. Shares were trading at $26 per share and the machine was valued at $43,000. March 10 Declared an 8% stock dividend for its common shares to shareholders of record on March 30, distributable on April 15. The common share price was $25 on March 10, $26.50 on March 30 and $24.75 on April 15. March 30 Determined the common shareholders of record April 15 Distributed the stock dividend. September 1 Declared annual cash dividends on the preferred shares. September 25 Determined preferred shareholders of record. October 12 Paid the preferred shares dividend. December 10 Declared a 2 for 1 split on common shares. Required: Part A Record the appropriate journal entries for these transactions and clearly state if no entry is required. (14 Marks) Question 5 (continued) + Account Name Debit Credit Marks Date Jan 15 Mar 10 Mar 30 Apr 15 Sept 1 Sept 25 Oct 12 Dec 10 Part B Discuss how Sweeney Corporation's equity presentation in the financial statements would be impacted if it was a private company using ASPE instead of IFRS. (2 Marks) Question 5 (16 Marks, 29 minutes) On January 1, 2020, Sweeney Corporation, a public traded company, had these shareholders' equity accounts: Preferred shares, $3 Non-cumulative (100,000 authorized and 7,500 issued) Common shares (unlimited number of shares authorized and 170,000 issued) Retained earnings $225,000 3,500,000 1,575,000 Presented below are selected transactions for 2020: January 5 1,500 common shares were issued in exchange for a piece of equipment. Shares were trading at $26 per share and the machine was valued at $43,000. March 10 Declared an 8% stock dividend for its common shares to shareholders of record on March 30, distributable on April 15. The common share price was $25 on March 10, $26.50 on March 30 and $24.75 on April 15. March 30 Determined the common shareholders of record April 15 Distributed the stock dividend. September 1 Declared annual cash dividends on the preferred shares. September 25 Determined preferred shareholders of record. October 12 Paid the preferred shares dividend. December 10 Declared a 2 for 1 split on common shares. Required: Part A Record the appropriate journal entries for these transactions and clearly state if no entry is required. (14 Marks) Question 5 (continued) + Account Name Debit Credit Marks Date Jan 15 Mar 10 Mar 30 Apr 15 Sept 1 Sept 25 Oct 12 Dec 10 Part B Discuss how Sweeney Corporation's equity presentation in the financial statements would be impacted if it was a private company using ASPE instead of IFRS. (2 Marks)