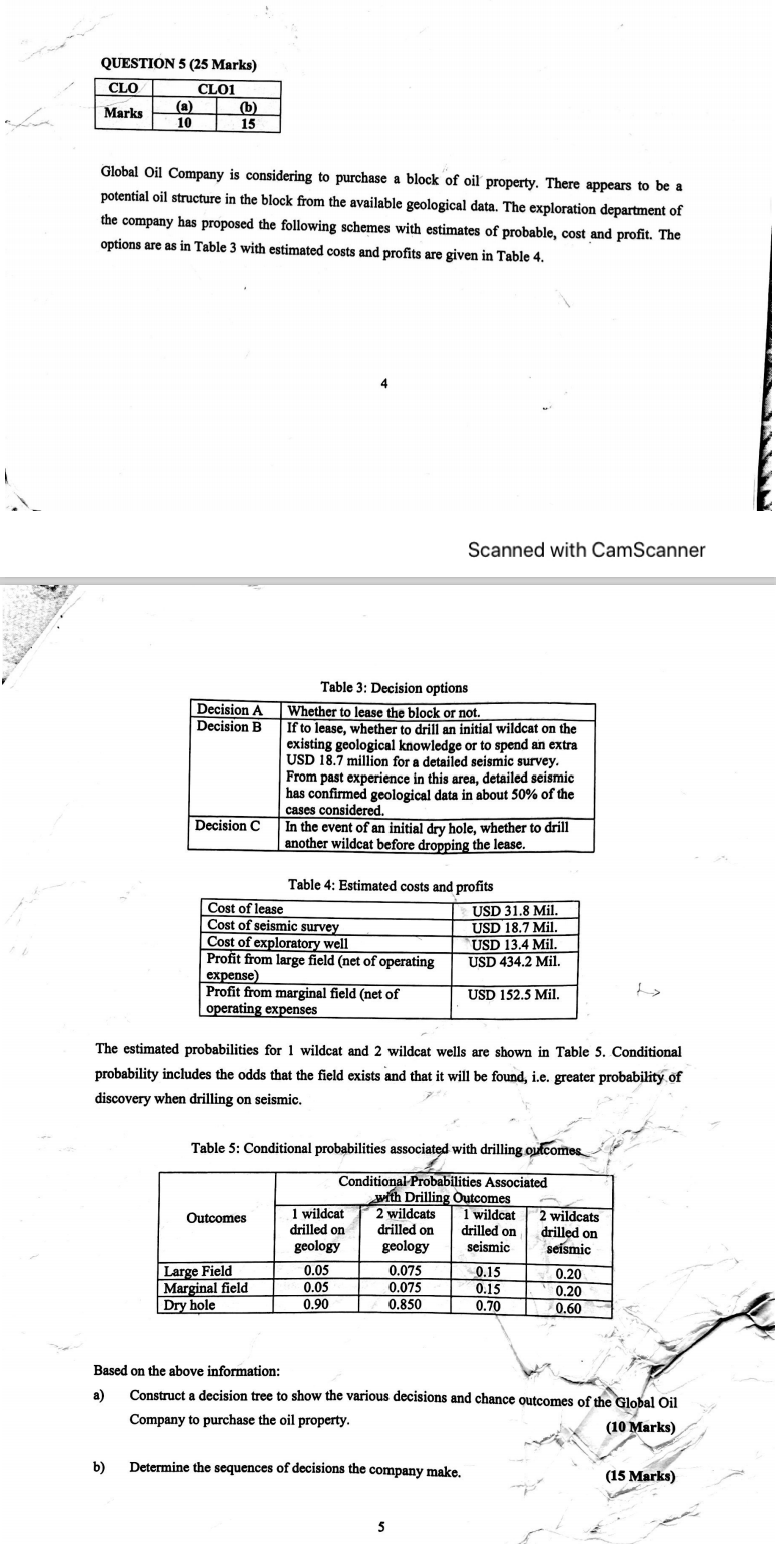

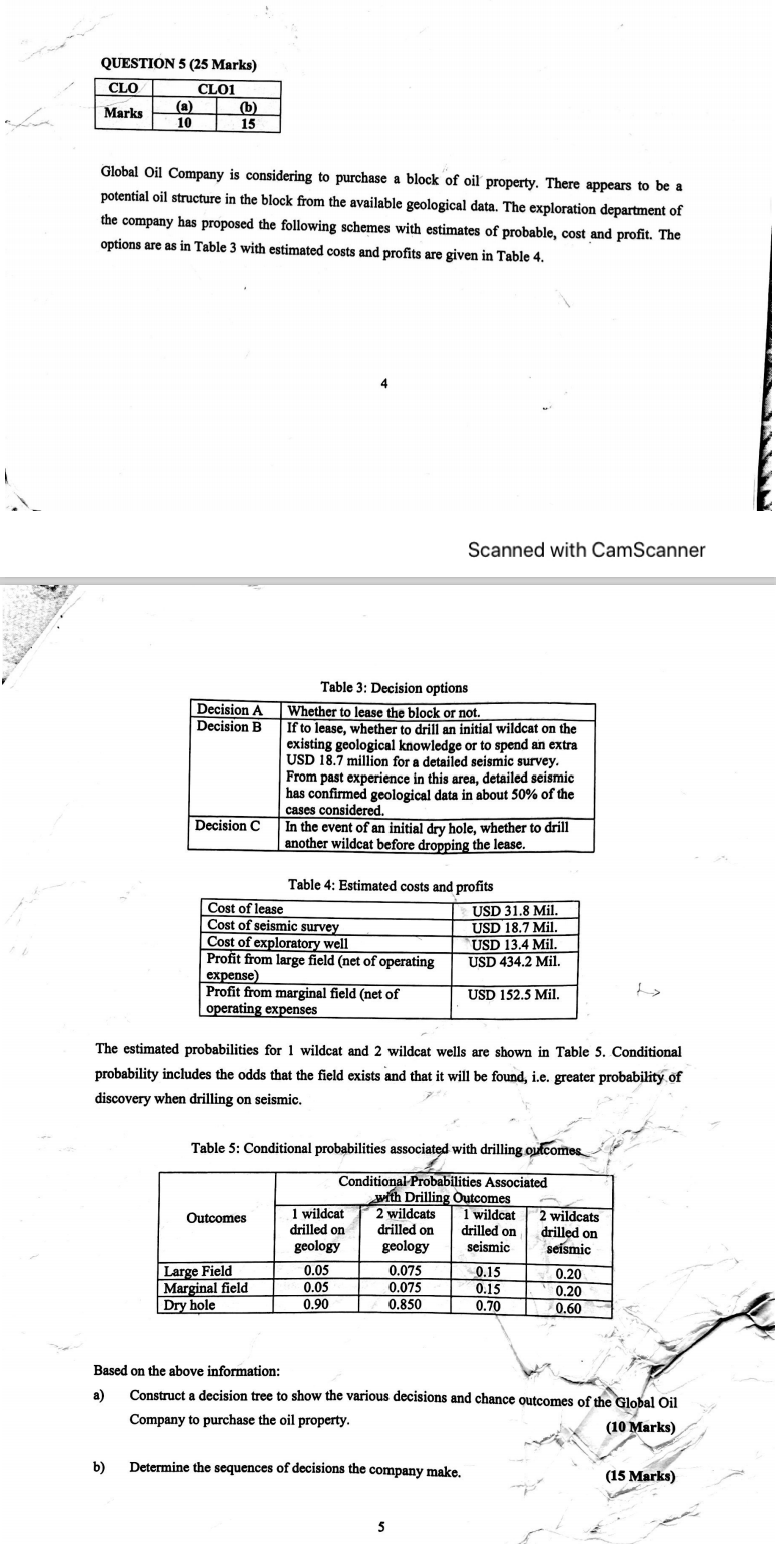

QUESTION 5 (25 Marks) CLO1 Marks (a) 6) 10 15 CLO Global Oil Company is considering to purchase a block of oil property. There appears to be a potential oil structure in the block from the available geological data. The exploration department of the company has proposed the following schemes with estimates of probable, cost and profit. The options are as in Table 3 with estimated costs and profits are given in Table 4. 4 Scanned with CamScanner Decision A Decision B Table 3: Decision options Whether to lease the block or not. If to lease, whether to drill an initial wildcat on the existing geological knowledge or to spend an extra USD 18.7 million for a detailed seismic survey. From past experience in this area, detailed seismic has confirmed geological data in about 50% of the cases considered. In the event of an initial dry hole, whether to drill another wildcat before dropping the lease. Decision C Table 4: Estimated costs and profits Cost of lease USD 31.8 Mil Cost of seismic survey USD 18.7 Mil. Cost of exploratory well USD 13.4 Mil. Profit from large field (net of operating USD 434.2 Mil. expense) Profit from marginal field (net of USD 152.5 Mil. operating expenses The estimated probabilities for 1 wildcat and 2 wildcat wells are shown in Table 5. Conditional probability includes the odds that the field exists and that it will be found, i.e. greater probability of discovery when drilling on seismic. Table 5: Conditional probabilities associated with drilling outcomes Outcomes drilled on Conditional Probabilities Associated with Drilling Outcomes 1 wildcat 2 wildcats 1 wildcat 2 wildcats drilled on drilled on drilled on geology geology seismic seismic 0.05 0.075 0.15 0.20 0.05 0.075 0.15 0.20 0.90 0.850 0.70 0.60 Large Field Marginal field Dry hole Based on the above information: Construct a decision tree to show the various decisions and chance outcomes of the Global Oil Company to purchase the oil property. (10 Marks) b) Determine the sequences of decisions the company make. (15 Marks) 5 QUESTION 5 (25 Marks) CLO1 Marks (a) 6) 10 15 CLO Global Oil Company is considering to purchase a block of oil property. There appears to be a potential oil structure in the block from the available geological data. The exploration department of the company has proposed the following schemes with estimates of probable, cost and profit. The options are as in Table 3 with estimated costs and profits are given in Table 4. 4 Scanned with CamScanner Decision A Decision B Table 3: Decision options Whether to lease the block or not. If to lease, whether to drill an initial wildcat on the existing geological knowledge or to spend an extra USD 18.7 million for a detailed seismic survey. From past experience in this area, detailed seismic has confirmed geological data in about 50% of the cases considered. In the event of an initial dry hole, whether to drill another wildcat before dropping the lease. Decision C Table 4: Estimated costs and profits Cost of lease USD 31.8 Mil Cost of seismic survey USD 18.7 Mil. Cost of exploratory well USD 13.4 Mil. Profit from large field (net of operating USD 434.2 Mil. expense) Profit from marginal field (net of USD 152.5 Mil. operating expenses The estimated probabilities for 1 wildcat and 2 wildcat wells are shown in Table 5. Conditional probability includes the odds that the field exists and that it will be found, i.e. greater probability of discovery when drilling on seismic. Table 5: Conditional probabilities associated with drilling outcomes Outcomes drilled on Conditional Probabilities Associated with Drilling Outcomes 1 wildcat 2 wildcats 1 wildcat 2 wildcats drilled on drilled on drilled on geology geology seismic seismic 0.05 0.075 0.15 0.20 0.05 0.075 0.15 0.20 0.90 0.850 0.70 0.60 Large Field Marginal field Dry hole Based on the above information: Construct a decision tree to show the various decisions and chance outcomes of the Global Oil Company to purchase the oil property. (10 Marks) b) Determine the sequences of decisions the company make. (15 Marks) 5