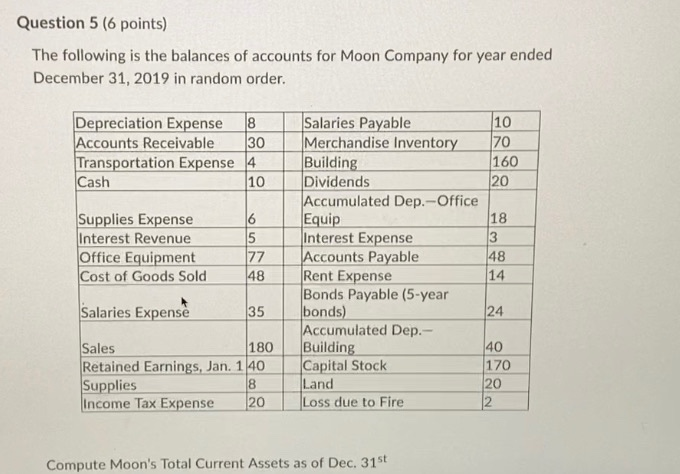

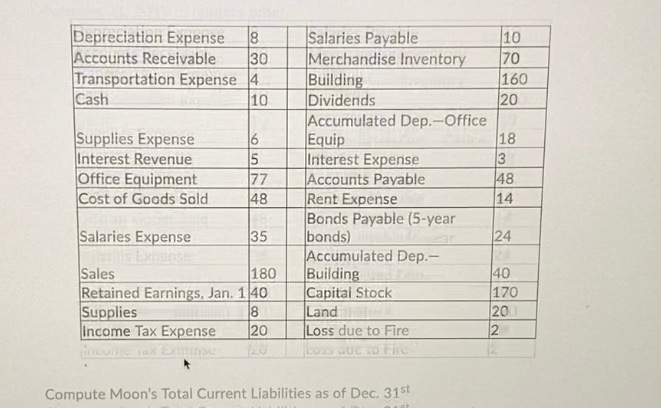

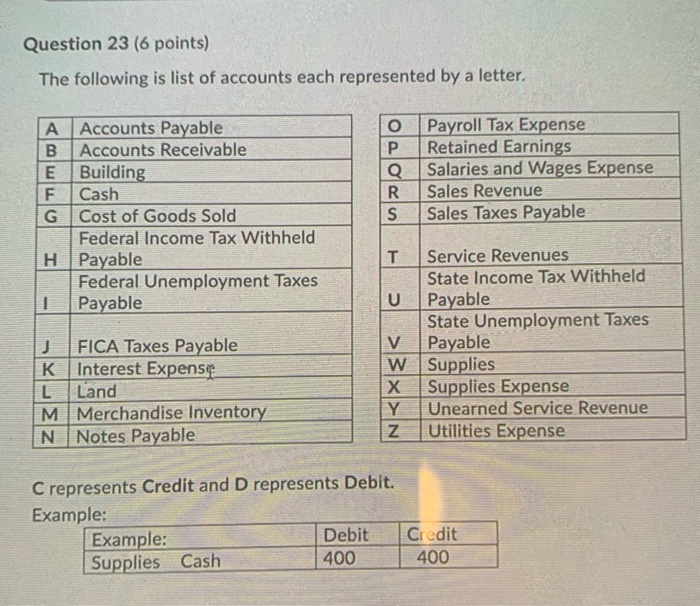

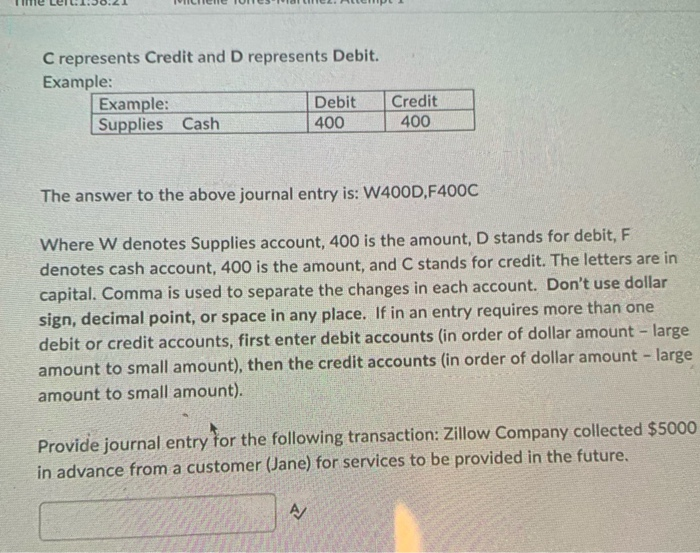

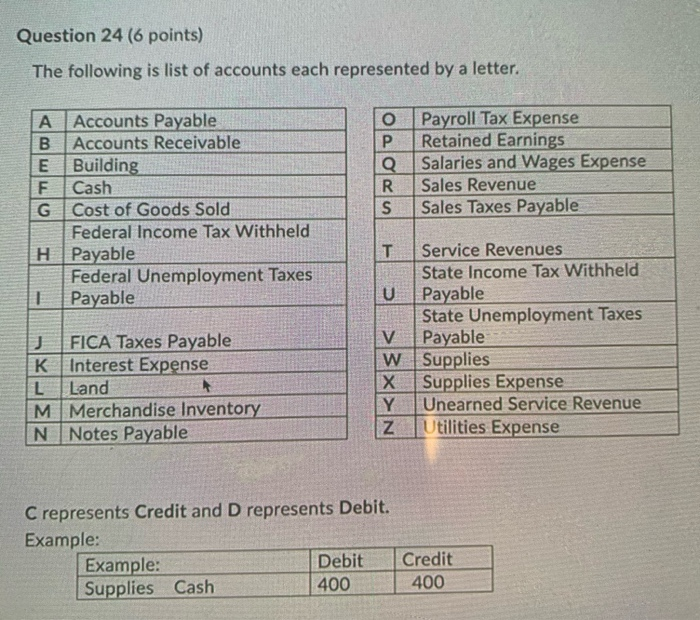

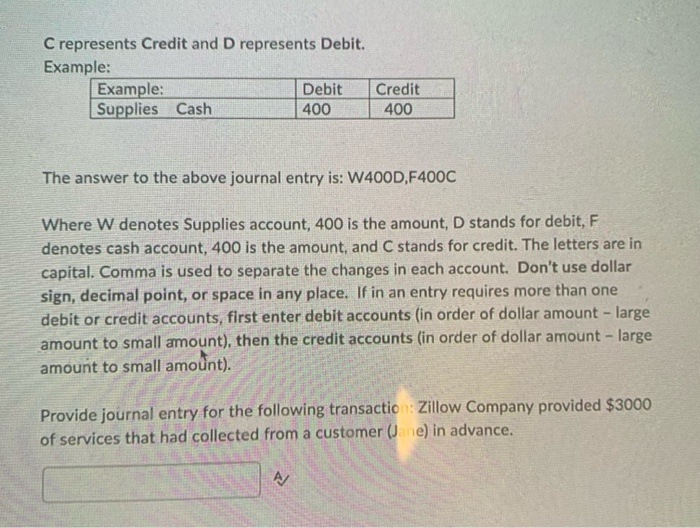

Question 5 (6 points) The following is the balances of accounts for Moon Company for year ended December 31, 2019 in random order. Depreciation Expense 8 Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold 6 5 77 48 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable 48 Rent Expense 14 Bonds Payable (5-year bonds) 24 Accumulated Dep.- Building 40 Capital Stock 170 Land 20 Loss due to Fire 2 Salaries Expense 35 Sales 180 Retained Earnings, Jan. 1 40 Supplies Income Tax Expense 8 20 Compute Moon's Total Current Assets as of Dec. 31st 8 Depreciation Expense Accounts Receivable 30 Transportation Expense 4 Cash 10 Supplies Expense Interest Revenue Office Equipment Cost of Goods Sold 16 5 77 48 Salaries Payable 10 Merchandise Inventory 70 Building 160 Dividends 20 Accumulated Dep.-Office Equip 18 Interest Expense 3 Accounts Payable 48 Rent Expense 14 Bonds Payable (5-year bonds) 24 Accumulated Dep.- Building 40 Capital Stock 170 Land 20 Loss due to Fire 2 Lussullo ao the Salaries Expense 35 Sales 180 Retained Earnings, Jan. 140 Supplies 8 Income Tax Expense 2 20 Compute Moon's Total Current Liabilities as of Dec. 31st Question 23 (6 points) The following is list of accounts each represented by a letter. A Accounts Payable B Accounts Receivable E Building F Cash G Cost of Goods Sold Federal Income Tax Withheld H Payable Federal Unemployment Taxes 1 Payable O Q R S Payroll Tax Expense Retained Earnings Salaries and Wages Expense Sales Revenue Sales Taxes Payable FICA Taxes Payable K Interest Expense L Land M Merchandise Inventory Notes Payable T Service Revenues State Income Tax Withheld U Payable State Unemployment Taxes V Payable W Supplies Supplies Expense Y Unearned Service Revenue Z Utilities Expense C represents Credit and D represents Debit. Example: Example: Debit Credit Supplies Cash 400 400 C represents Credit and D represents Debit. Example: Example: Debit Supplies Cash 400 Credit 400 The answer to the above journal entry is: W400D,F400C Where W denotes Supplies account, 400 is the amount, D stands for debit, F denotes cash account, 400 is the amount, and C stands for credit. The letters are in capital. Comma is used to separate the changes in each account. Don't use dollar sign, decimal point, or space in any place. If in an entry requires more than one debit or credit accounts, first enter debit accounts (in order of dollar amount - large amount to small amount), then the credit accounts (in order of dollar amount - large amount to small amount). Provide journal entry for the following transaction: Zillow Company collected $5000 in advance from a customer (Jane) for services to be provided in the future. A Question 24 (6 points) The following is list of accounts each represented by a letter. A Accounts Payable B Accounts Receivable E Building F Cash G Cost of Goods Sold Federal Income Tax Withheld H Payable Federal Unemployment Taxes 1 Payable o P Q R S Payroll Tax Expense Retained Earnings Salaries and Wages Expense Sales Revenue Sales Taxes Payable FICA Taxes Payable K Interest Expense L Land M Merchandise Inventory N Notes Payable T Service Revenues State Income Tax Withheld U Payable State Unemployment Taxes V Payable W Supplies Supplies Expense Y Unearned Service Revenue Z Utilities Expense C represents Credit and D represents Debit. Example: Example: Debit Supplies Cash 400 Credit 400 C represents Credit and D represents Debit. Example: Example: Debit Supplies Cash 400 Credit 400 The answer to the above journal entry is: W400D,F400C Where W denotes Supplies account, 400 is the amount, D stands for debit, F denotes cash account, 400 is the amount, and C stands for credit. The letters are in capital. Comma is used to separate the changes in each account. Don't use dollar sign, decimal point, or space in any place. If in an entry requires more than one debit or credit accounts, first enter debit accounts (in order of dollar amount - large amount to small amount), then the credit accounts (in order of dollar amount - large amount to small amount). Provide journal entry for the following transaction: Zillow Company provided $3000 of services that had collected from a customer (Jane) in advance. N