Question

Question 5 a) Assuming you are a Malaysian investor. Consider the following exchange rates: EUR/MY = 0.2105 MY/USD = 4.3350 EUR/USD = 1.0960 How could

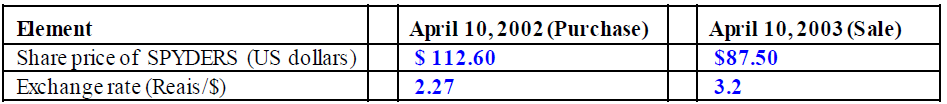

Question 5 a) Assuming you are a Malaysian investor. Consider the following exchange rates: EUR/MY = 0.2105 MY/USD = 4.3350 EUR/USD = 1.0960 How could you use this information to make money in the currency markets? b) The Brazilian economy had gone up and down in 2001 and 2002. The Brazilian reais (R$) had also been declining since 1999 (when it was floated). Investors wished to diversify internationally into U.S. dollars for the most part to protect themselves against the domestic economy and currency. A large private investor had, in April 2002, invested R$500,000 in Standard & Poors 500 Indexes, which are traded on the American Stock Exchange (AMSE: SPY). The beginning and ending index prices and exchange rates between the reais and the dollar were as follows:

i. What was the return on the index fund for the year to a U.S.-based investor? ii. What was the return to the Brazilian investor for the one year holding period? iii. If the Brazilian investor could have invested locally in Brazil in an interest-bearing account guaranteeing 12%, would that have been better than the American diversification strategy? iv. The currency risk associated with international diversification is a serious concern for portfolio managers. Is it possible for currency risk ever to benefit the portfolios return?

Element Share price of SPYDERS (US dollars) Exchange rate (Reais/$) April 10, 2002 (Purchase) April 10,2003 (Sale) S 112.60 $87.50 2.27 3.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started