Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5. A company operating within the electronic components sector is Peppermint plc; the management are currently considering an exciting potential new project. If undertaken,

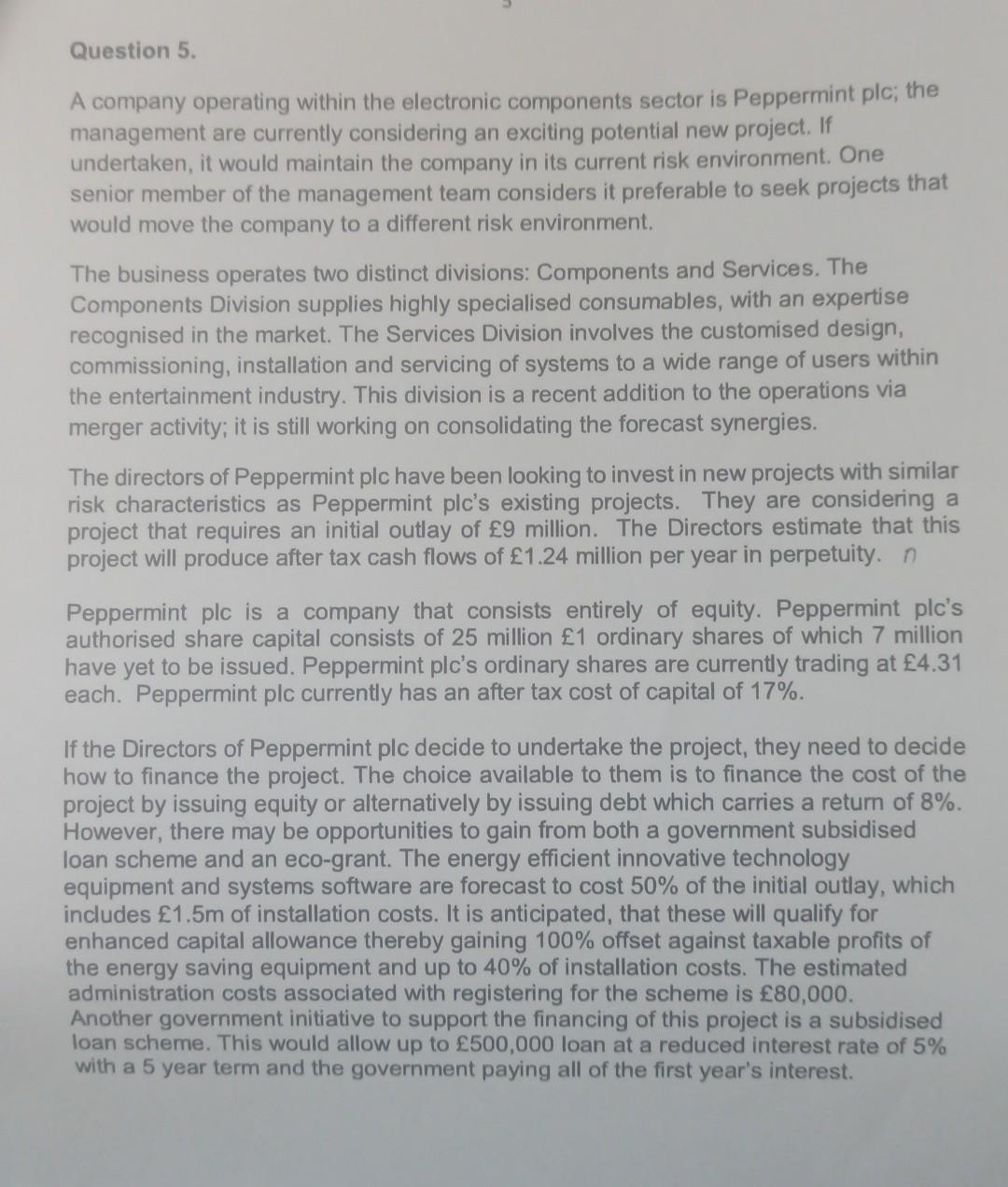

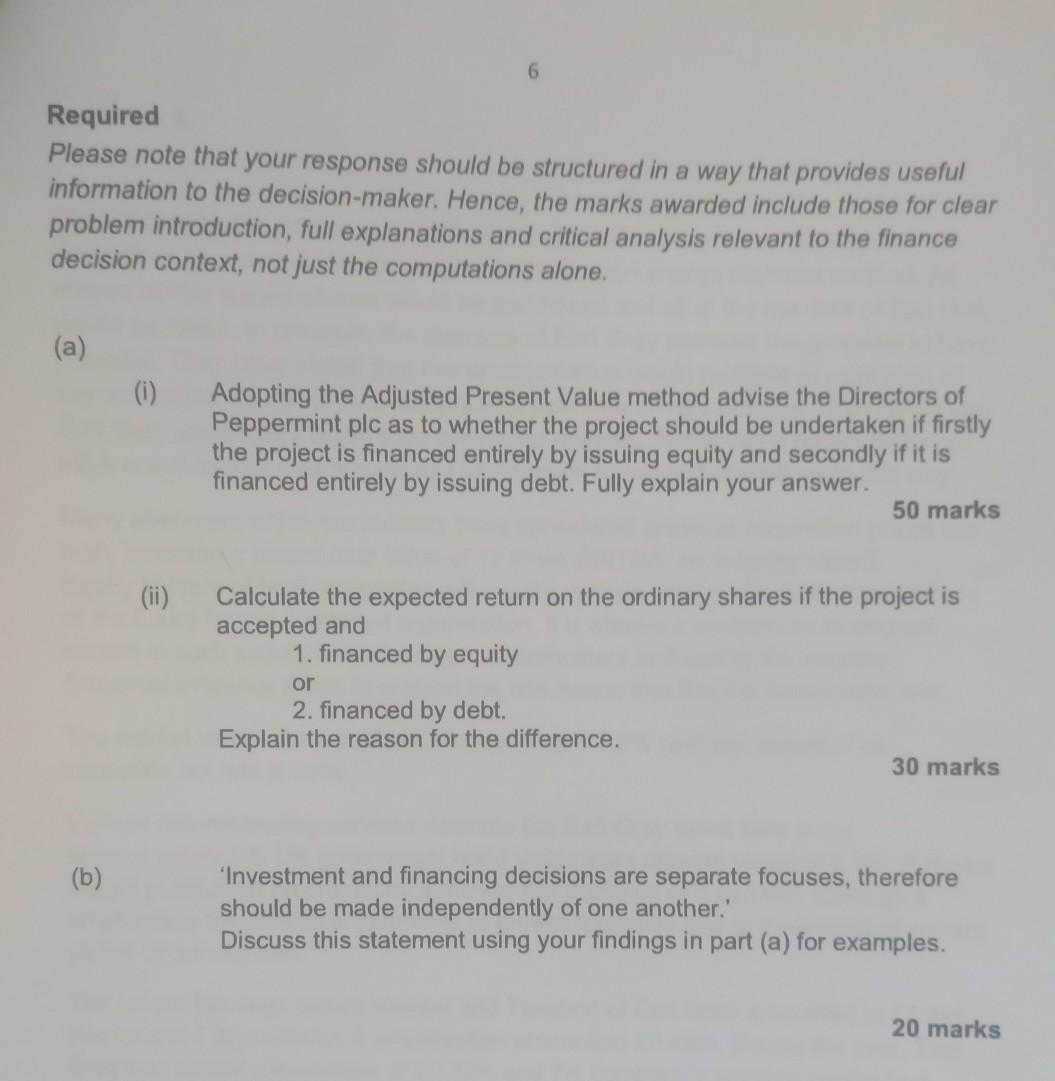

Question 5. A company operating within the electronic components sector is Peppermint plc; the management are currently considering an exciting potential new project. If undertaken, it would maintain the company in its current risk environment. One senior member of the management team considers it preferable to seek projects that would move the company to a different risk environment. The business operates two distinct divisions: Components and Services. The Components Division supplies highly specialised consumables, with an expertise recognised in the market. The Services Division involves the customised design, commissioning, installation and servicing of systems to a wide range of users within the entertainment industry. This division is a recent addition to the operations via merger activity; it is still working on consolidating the forecast synergies. The directors of Peppermint plc have been looking to invest in new projects with similar risk characteristics as Peppermint plc's existing projects. They are considering a project that requires an initial outlay of 9 million. The Directors estimate that this project will produce after tax cash flows of 1.24 million per year in perpetuity. O Peppermint plc is a company that consists entirely of equity. Peppermint plc's authorised share capital consists of 25 million 1 ordinary shares of which 7 million have yet to be issued. Peppermint plc's ordinary shares are currently trading at 4.31 each. Peppermint plc currently has an after tax cost of capital of 17%. If the Directors of Peppermint plc decide to undertake the project, they need to decide how to finance the project. The choice available to them is to finance the cost of the project by issuing equity or alternatively by issuing debt which carries a return of 8%. However, there may be opportunities to gain from both a government subsidised loan scheme and an eco-grant. The energy efficient innovative technology equipment and systems software are forecast to cost 50% of the initial outlay, which includes 1.5m of installation costs. It is anticipated, that these will qualify for enhanced capital allowance thereby gaining 100% offset against taxable profits of the energy saving equipment and up to 40% of installation costs. The estimated administration costs associated with registering for the scheme is 80,000. Another government initiative to support the financing of this project is a subsidised loan scheme. This would allow up to 500,000 loan at a reduced interest rate of 5% with a 5 year term and the government paying all of the first year's interest. 6 Required Please note that your response should be structured in a way that provides useful information to the decision-maker. Hence, the marks awarded include those for clear problem introduction, full explanations and critical analysis relevant to the finance decision context, not just the computations alone. (a) (i) Adopting the Adjusted Present Value method advise the Directors of Peppermint plc as to whether the project should be undertaken if firstly the project is financed entirely by issuing equity and secondly if it is financed entirely by issuing debt. Fully explain your answer. 50 marks (ii) Calculate the expected return on the ordinary shares if the project is accepted and 1. financed by equity or 2. financed by debt. Explain the reason for the difference. 30 marks (b) 'Investment and financing decisions are separate focuses, therefore should be made independently of one another.' Discuss this statement using your findings in part (a) for examples. 20 marks Question 5. A company operating within the electronic components sector is Peppermint plc; the management are currently considering an exciting potential new project. If undertaken, it would maintain the company in its current risk environment. One senior member of the management team considers it preferable to seek projects that would move the company to a different risk environment. The business operates two distinct divisions: Components and Services. The Components Division supplies highly specialised consumables, with an expertise recognised in the market. The Services Division involves the customised design, commissioning, installation and servicing of systems to a wide range of users within the entertainment industry. This division is a recent addition to the operations via merger activity; it is still working on consolidating the forecast synergies. The directors of Peppermint plc have been looking to invest in new projects with similar risk characteristics as Peppermint plc's existing projects. They are considering a project that requires an initial outlay of 9 million. The Directors estimate that this project will produce after tax cash flows of 1.24 million per year in perpetuity. O Peppermint plc is a company that consists entirely of equity. Peppermint plc's authorised share capital consists of 25 million 1 ordinary shares of which 7 million have yet to be issued. Peppermint plc's ordinary shares are currently trading at 4.31 each. Peppermint plc currently has an after tax cost of capital of 17%. If the Directors of Peppermint plc decide to undertake the project, they need to decide how to finance the project. The choice available to them is to finance the cost of the project by issuing equity or alternatively by issuing debt which carries a return of 8%. However, there may be opportunities to gain from both a government subsidised loan scheme and an eco-grant. The energy efficient innovative technology equipment and systems software are forecast to cost 50% of the initial outlay, which includes 1.5m of installation costs. It is anticipated, that these will qualify for enhanced capital allowance thereby gaining 100% offset against taxable profits of the energy saving equipment and up to 40% of installation costs. The estimated administration costs associated with registering for the scheme is 80,000. Another government initiative to support the financing of this project is a subsidised loan scheme. This would allow up to 500,000 loan at a reduced interest rate of 5% with a 5 year term and the government paying all of the first year's interest. 6 Required Please note that your response should be structured in a way that provides useful information to the decision-maker. Hence, the marks awarded include those for clear problem introduction, full explanations and critical analysis relevant to the finance decision context, not just the computations alone. (a) (i) Adopting the Adjusted Present Value method advise the Directors of Peppermint plc as to whether the project should be undertaken if firstly the project is financed entirely by issuing equity and secondly if it is financed entirely by issuing debt. Fully explain your answer. 50 marks (ii) Calculate the expected return on the ordinary shares if the project is accepted and 1. financed by equity or 2. financed by debt. Explain the reason for the difference. 30 marks (b) 'Investment and financing decisions are separate focuses, therefore should be made independently of one another.' Discuss this statement using your findings in part (a) for examples. 20 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started