Question

Question 5 Ann and Jane have been trading as a partnership for several years, sharing profits and losses in the ratio 3:5. Their profit and

Question 5

Ann and Jane have been trading as a partnership for several years, sharing profits and losses in the ratio 3:5. Their profit and loss account for the year to 31 May 2021 reports a profit of RM126,842 before taking into account the following items:

- Ann is paid a salary of RM22,000 per annum. Janes salary is RM8,000 per annum;

- On 1 September 2020, each of the partners paid RM35,000 into the partnership bank account. Anns payment is to be treated as capital, while Janes is to be treated as a loan, with interest at 4% per annum to be credited to her current account;

- Partners are charged interest on drawings at a rate of 16% per annum. All drawings are assumed to have been made half way through the year. During the year, Anns drawings were RM28,000 and Janes were RM24,000.

At 1 June 2020, the balances on the partners current accounts were: Ann RM17,420 (debit) Jane RM9,547 (credit)

Required:

- Calculate the amount of profit available for appropriation for the year to 31 May 2021. (2 marks)

- Calculate the total amount of profit due to each of the partners for the year to 31 May 2021. (5 marks)

- Show the partners current accounts, including the closing balances for the year ended 31 October 2021. (13 marks)

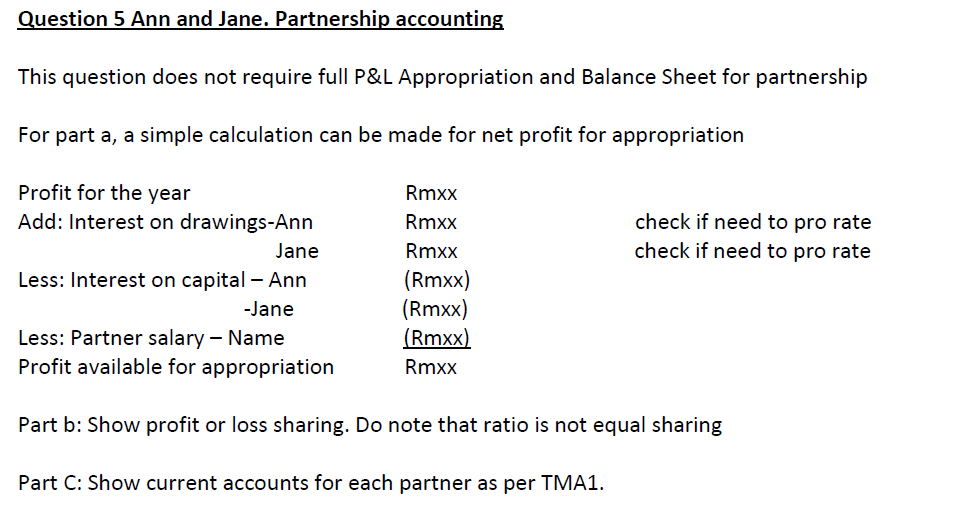

Guidance of answer this question

check if need to pro rate Jane Rmxx check if need to pro rate Less: Interest on capital Ann (Rmxx) -Jane (Rmxx) Less: Partner salary Name (Rmxx) Profit available for appropriation Rmxx Part b: Show profit or loss sharing. Do note that ratio is not equal sharing Part C: Show current accounts for each partner as per TMA1.

check if need to pro rate Jane Rmxx check if need to pro rate Less: Interest on capital Ann (Rmxx) -Jane (Rmxx) Less: Partner salary Name (Rmxx) Profit available for appropriation Rmxx Part b: Show profit or loss sharing. Do note that ratio is not equal sharing Part C: Show current accounts for each partner as per TMA1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started