Answered step by step

Verified Expert Solution

Question

1 Approved Answer

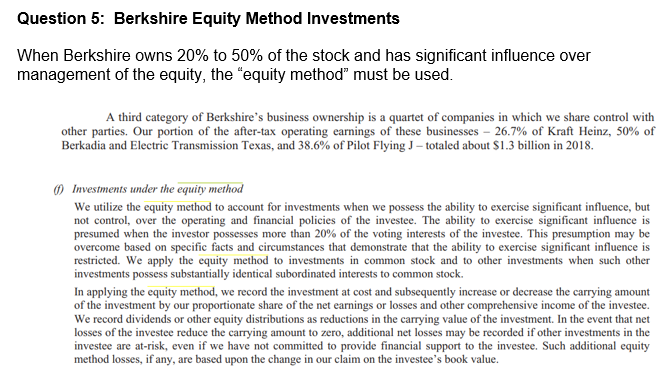

Question 5: Berkshire Equity Method Investments When Berkshire owns 20% to 50% of the stock and has significant influence over management of the equity, the

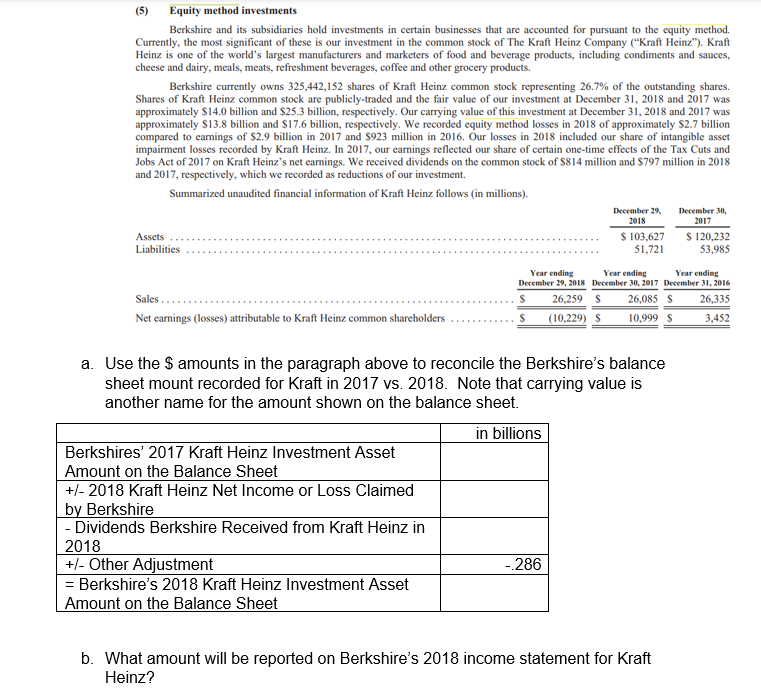

Question 5: Berkshire Equity Method Investments When Berkshire owns 20% to 50% of the stock and has significant influence over management of the equity, the "equity method" must be used. A third category of Berkshire's business ownership is a quartet of companies in which we share control with other parties. Our portion of the after-tax operating earnings of these businesses 26.7% of Kraft Heinz, 50% of Berkadia and Electric Transmission Texas, and 38.6% of Pilot Flying J - totaled about $1.3 billion in 2018. (f) Investments under the equity method We utilize the equity method to account for investments when we possess the ability to exercise significant influence, but not control, over the operating and financial policies of the investee. The ability to exercise significant influence is presumed when the investor possesses more than 20% of the voting interests of the investee. This presumption may be overcome based on specific facts and circumstances that demonstrate that the ability to exercise significant influence is restricted. We apply the equity method to investments in common stock and to other investments when such other investments possess substantially identical subordinated interests to common stock. In applying the equity method, we record the investment at cost and subsequently increase or decrease the carrying amount of the investment by our proportionate share of the net earnings or losses and other comprehensive income of the investee. We record dividends or other equity distributions as reductions in the carrying value of the investment. In the event that net losses of the investee reduce the carrying amount to zero, additional net losses may be recorded if other investments in the investee are at-risk, even if we have not committed to provide financial support to the investee. Such additional equity method losses, if any, are based upon the change in our claim on the investee's book value. (5) Equity method investments Berkshire and its subsidiaries hold investments in certain businesses that are accounted for pursuant to the equity method. Currently, the most significant of these is our investment in the common stock of The Kraft Heinz Company ("Kraft Heinz"). Kraft Heinz is one of the world's largest manufacturers and marketers of food and beverage products, including condiments and sauces, cheese and dairy, meals, meats, refreshment beverages, coffee and other grocery products. Berkshire currently owns 325,442,152 shares of Kraft Heinz common stock representing 26.7% of the outstanding shares. Shares of Kraft Heinz common stock are publicly-traded and the fair value of our investment at December 31, 2018 and 2017 was approximately $14.0 billion and $25.3 billion, respectively. Our carrying value of this investment at December 31,2018 and 2017 was approximately $13.8 billion and $17.6 billion, respectively. We recorded equity method losses in 2018 of approximately $2.7 billion compared to earnings of $2.9 billion in 2017 and $923 million in 2016 . Our losses in 2018 included our share of intangible asset impairment losses recorded by Kraft Heinz. In 2017, our earnings reflected our share of certain one-time effects of the Tax Cuts and Jobs Act of 2017 on Kraft Heinz's net earnings. We received dividends on the common stock of $814 million and \$797 million in 2018 and 2017 , respectively, which we recorded as reductions of our investment. Summarized unaudited financial information of Kraft Heinz follows (in millions). a. Use the $ amounts in the paragraph above to reconcile the Berkshire's balance sheet mount recorded for Kraft in 2017 vs. 2018. Note that carrying value is another name for the amount shown on the balance sheet. b. What amount will be reported on Berkshire's 2018 income statement for Kraft Heinz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started