Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Clara, a Malaysian resident, is a widow, with a one-year-old child. She is employed as a research scientist in a local university. Details

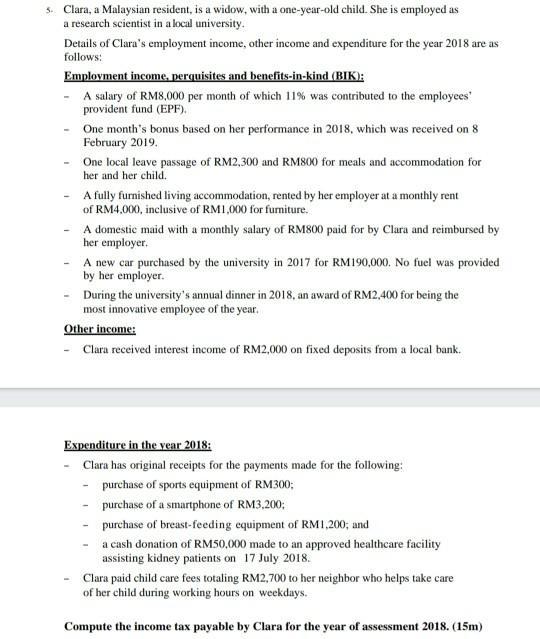

5. Clara, a Malaysian resident, is a widow, with a one-year-old child. She is employed as a research scientist in a local university. Details of Clara's employment income, other income and expenditure for the year 2018 are as follows: Emplovment income. perquisites and benefits-in-kind (BIK): A salary of RM8,000 per month of which 11% was contributed to the employees' provident fund (EPF). - One month's bonus based on her performance in 2018, which was received on 8 February 2019. - One local leave passage of RM2,300 and RM800 for meals and accommodation for her and her child. A fully furnished living accommodation, rented by her employer at a monthly rent of RM4,000, inclusive of RMI,000 for fumiture. A domestie maid with a monthly salary of RM800 paid for by Clara and reimbursed by her employer. A new car purchased by the university in 2017 for RM190,000. No fuel was provided by her employer. During the university's annual dinner in 2018, an award of RM2,400 for being the most innovative employee of the year. Other income: - Clara received interest income of RM2,000 on fixed deposits from a local bank. Expenditure in the year 2018: Clara has original receipts for the payments made for the following: purchase of sports equipment of RM300; purchase of a smartphone of RM3,200; purchase of breast-feeding equipment of RM1,200; and a cash donation of RM50,000 made to an approved healthcare facility assisting kidney patients on 17 July 2018. Clara paid child care fees totaling RM2,700 to her neighbor who helps take care of her child during working hours on weekdays. Compute the income tax payable by Clara for the year of assessment 2018. (15m)

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started