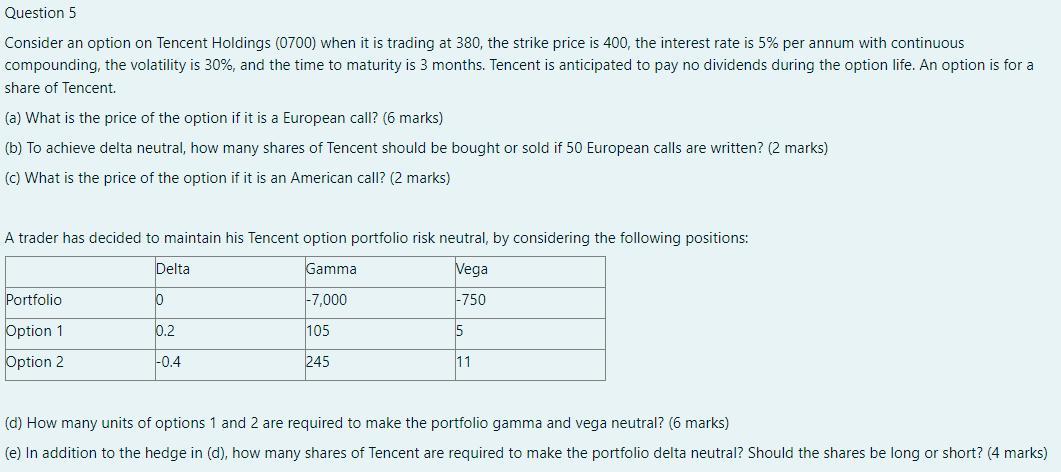

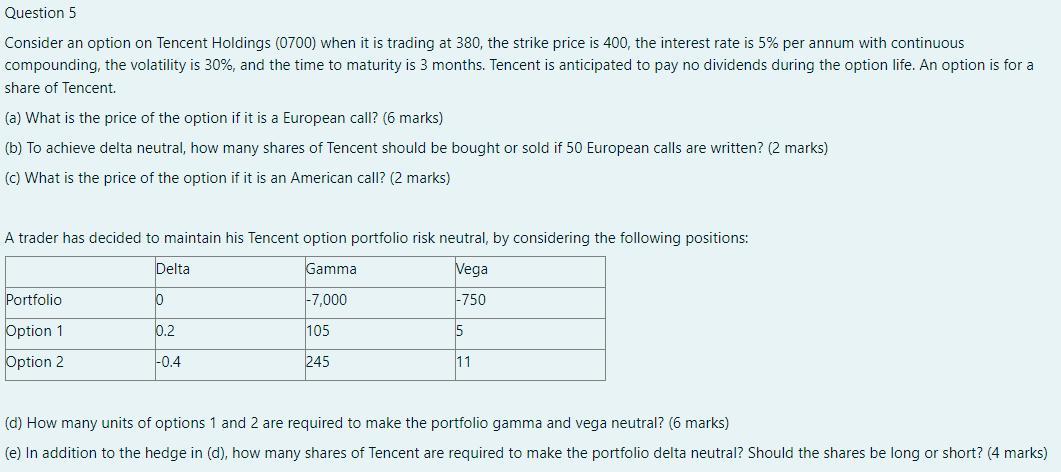

Question 5 Consider an option on Tencent Holdings (0700) when it is trading at 380, the strike price is 400, the interest rate is 5% per annum with continuous compounding, the volatility is 30%, and the time to maturity is 3 months. Tencent is anticipated to pay no dividends during the option life. An option is for a share of Tencent. (a) What is the price of the option if it is a European call? (6 marks) (b) To achieve delta neutral, how many shares of Tencent should be bought or sold if 50 European calls are written? (2 marks) (C) What is the price of the option if it is an American call? (2 marks) A trader has decided to maintain his Tencent option portfolio risk neutral, by considering the following positions: Delta Gamma Vega Portfolio lo -7,000 -750 Option 1 0.2 105 5 Option 2 -0.4 245 11 (d) How many units of options 1 and 2 are required to make the portfolio gamma and vega neutral? (6 marks) (e) In addition to the hedge in (d), how many shares of Tencent are required to make the portfolio delta neutral? Should the shares be long or short? (4 marks) Question 5 Consider an option on Tencent Holdings (0700) when it is trading at 380, the strike price is 400, the interest rate is 5% per annum with continuous compounding, the volatility is 30%, and the time to maturity is 3 months. Tencent is anticipated to pay no dividends during the option life. An option is for a share of Tencent. (a) What is the price of the option if it is a European call? (6 marks) (b) To achieve delta neutral, how many shares of Tencent should be bought or sold if 50 European calls are written? (2 marks) (C) What is the price of the option if it is an American call? (2 marks) A trader has decided to maintain his Tencent option portfolio risk neutral, by considering the following positions: Delta Gamma Vega Portfolio lo -7,000 -750 Option 1 0.2 105 5 Option 2 -0.4 245 11 (d) How many units of options 1 and 2 are required to make the portfolio gamma and vega neutral? (6 marks) (e) In addition to the hedge in (d), how many shares of Tencent are required to make the portfolio delta neutral? Should the shares be long or short? (4 marks)