Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 Edmund Hillary, Chief Financial Officer of TitiwangsaBerhadisinvolvedin a meeting with the firm's external auditors KPNH. TitiwangsaBerhad is a major client of KPNH. KPNH

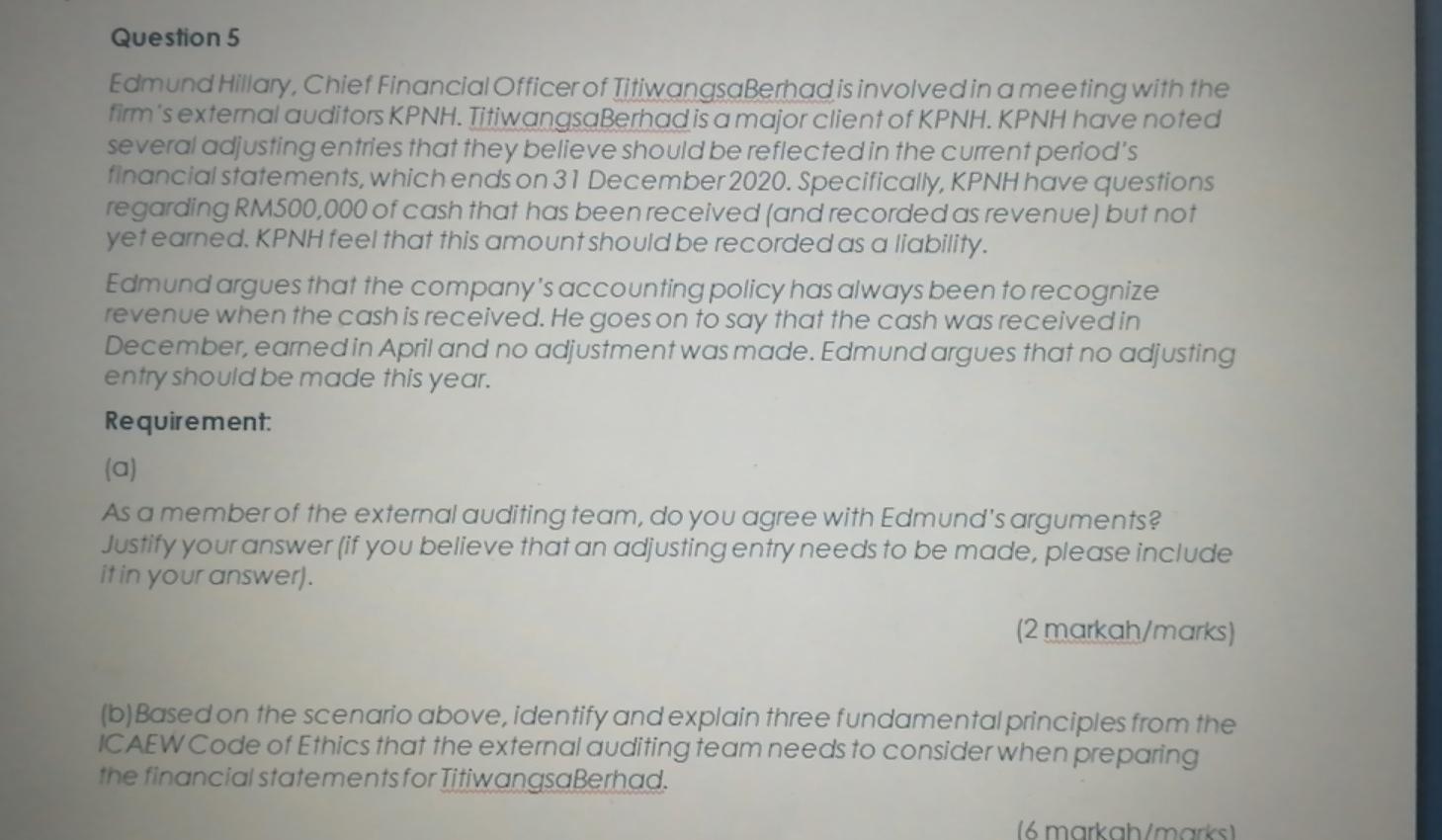

Question 5 Edmund Hillary, Chief Financial Officer of TitiwangsaBerhadisinvolvedin a meeting with the firm's external auditors KPNH. TitiwangsaBerhad is a major client of KPNH. KPNH have noted several adjusting entries that they believe should be reflectedin the current period's financial statements, which ends on 31 December 2020. Specifically, KPNH have questions regarding RM500,000 of cash that has been received and recorded as revenue) but not yetearned. KPNH feel that this amount should be recorded as a liability. Edmund argues that the company's accounting policy has always been to recognize revenue when the cash is received. He goes on to say that the cash was received in December, earnedin April and no adjustment was made. Edmund argues that no adjusting entry should be made this year. Requirement (a) As a member of the external auditing team, do you agree with Edmund's arguments? Justify your answer (if you believe that an adjusting entry needs to be made, please include it in your answer). (2 markah/marks) (b) Based on the scenario above, identify and explain three fundamental principles from the ICAEW Code of Ethics that the external auditing team needs to considerwhen preparing the financial statements for TitiwangsaBerhad. 16 markah/marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started