Question 5

help solve question number 4

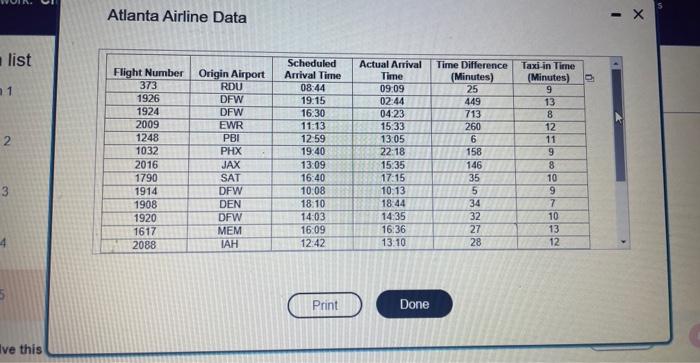

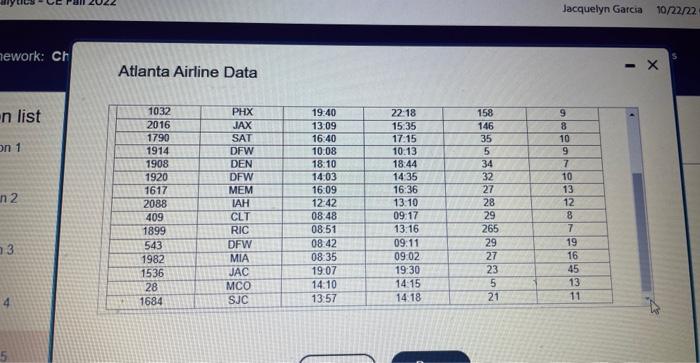

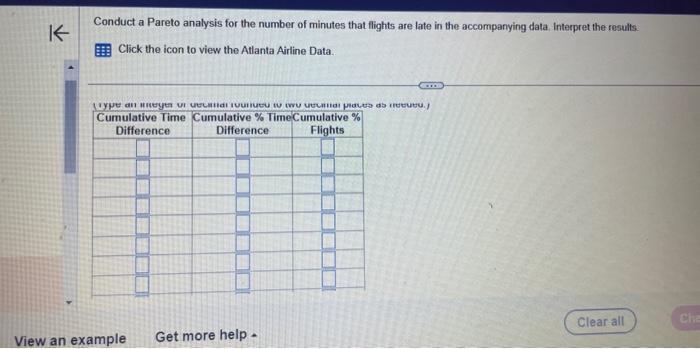

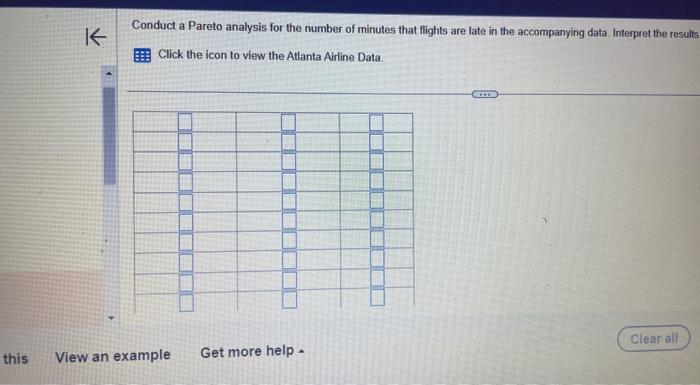

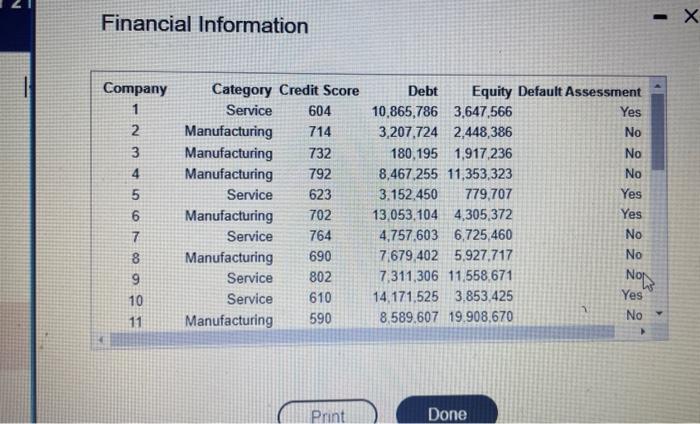

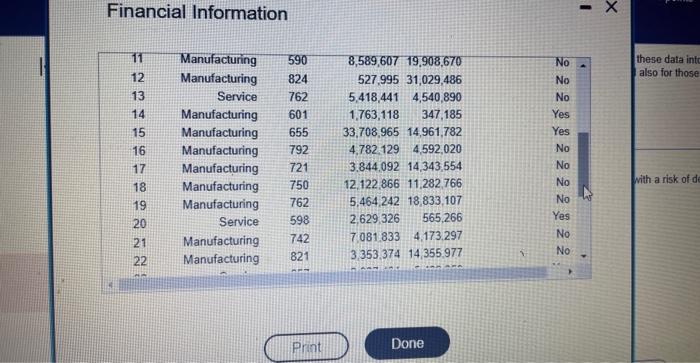

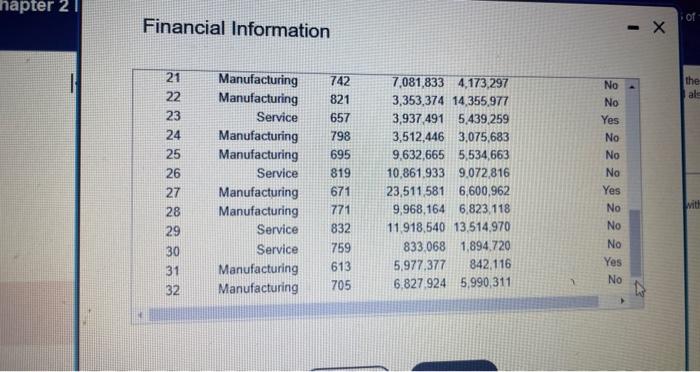

Atlanta Airline Data Atlanta Airline Data Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the results E:7 Click the icon to view the Atlanta Airline Data. Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the result Click the icon to view the Atlanta Airline Data. Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the resulls :E: Click the icon to view the Atlanta Airline Data. The database summarizes financial information for 32 companios and their percelved risk of dofault. Corvert these dati into an Excel table. Use table-based calculations to find the average debt and average equity for companies with a risk of default, and also for thone without a risk of default Does there appear to be a difference between companies with and without a risk of default? Click the icon to view the financial information for the 32 companies. Convert these data into an Excel table. Use table-based calculations to find the gverage debt for companies with a riak of default The average debt for companies with a risk of default is 5 (Round to the nearost whole number as needed) Financial Information Financial Information Financial Information Atlanta Airline Data Atlanta Airline Data Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the results E:7 Click the icon to view the Atlanta Airline Data. Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the result Click the icon to view the Atlanta Airline Data. Conduct a Pareto analysis for the number of minutes that flights are late in the accompanying data. Interpret the resulls :E: Click the icon to view the Atlanta Airline Data. The database summarizes financial information for 32 companios and their percelved risk of dofault. Corvert these dati into an Excel table. Use table-based calculations to find the average debt and average equity for companies with a risk of default, and also for thone without a risk of default Does there appear to be a difference between companies with and without a risk of default? Click the icon to view the financial information for the 32 companies. Convert these data into an Excel table. Use table-based calculations to find the gverage debt for companies with a riak of default The average debt for companies with a risk of default is 5 (Round to the nearost whole number as needed) Financial Information Financial Information Financial Information