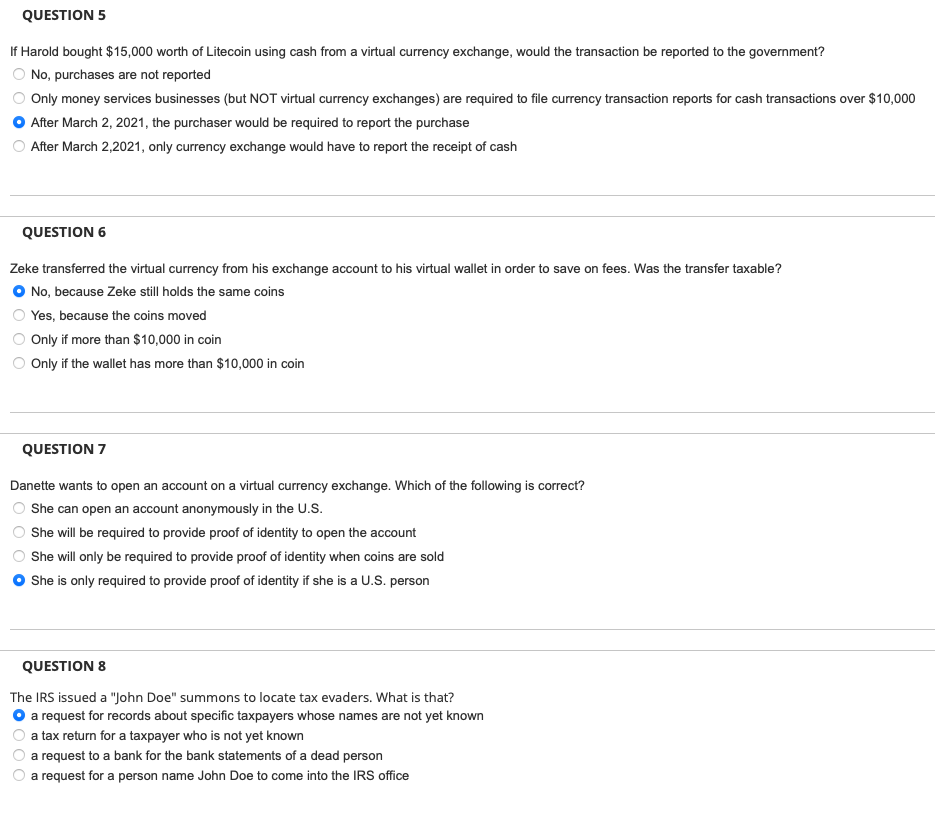

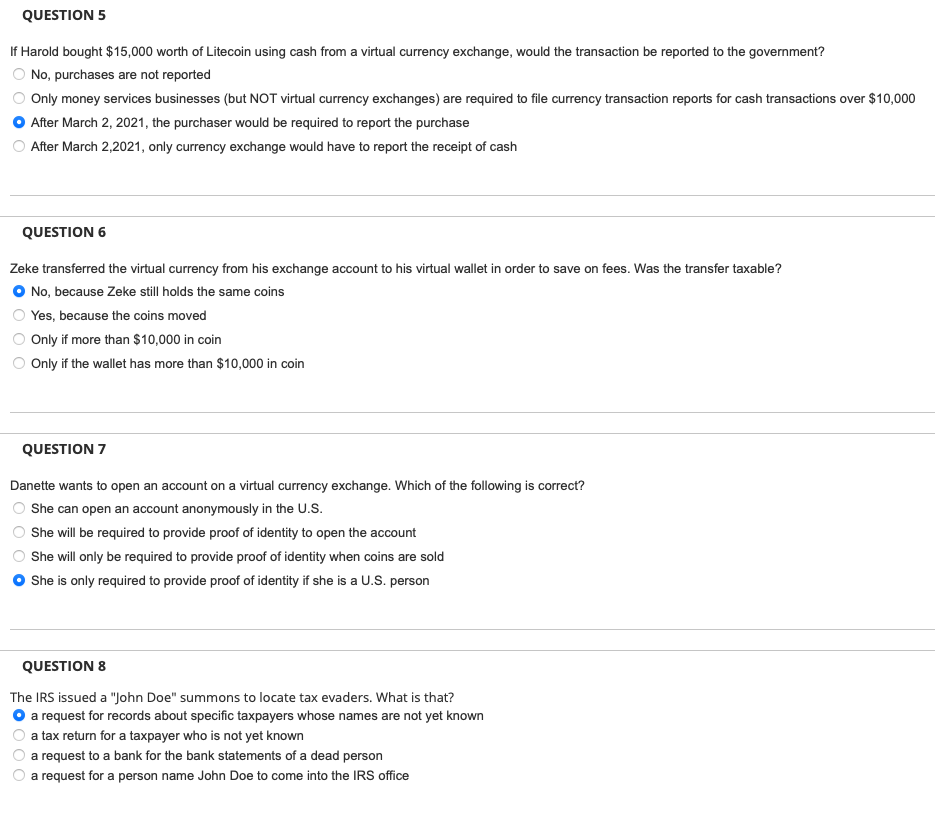

QUESTION 5 If Harold bought $15,000 worth of Litecoin using cash from a virtual currency exchange, would the transaction be reported to the government? No, purchases are not reported Only money services businesses (but NOT virtual currency exchanges) are required to file currency transaction reports for cash transactions over $10,000 After March 2, 2021, the purchaser would be required to report the purchase After March 2,2021, only currency exchange would have to report the receipt of cash QUESTION 6 Zeke transferred the virtual currency from his exchange account to his virtual wallet in order to save on fees. Was the transfer taxable? O No, because Zeke still holds the same coins Yes, because the coins moved Only if more than $10,000 in coin Only if the wallet has more than $10,000 in coin QUESTION 7 Danette wants to open an account on a virtual currency exchange. Which of the following is correct? She can open an account anonymously in the U.S. She will be required to provide proof of identity to open the account She will only be required to provide proof of identity when coins are sold O She is only required to provide proof of identity if she is a U.S. person QUESTION 8 The IRS issued a "John Doe" summons to locate tax evaders. What is that? O a request for records about specific taxpayers whose names are not yet known a tax return for a taxpayer who is not yet known a request to a bank for the bank statements of a dead person a request for a person name John Doe to come into the IRS office QUESTION 5 If Harold bought $15,000 worth of Litecoin using cash from a virtual currency exchange, would the transaction be reported to the government? No, purchases are not reported Only money services businesses (but NOT virtual currency exchanges) are required to file currency transaction reports for cash transactions over $10,000 After March 2, 2021, the purchaser would be required to report the purchase After March 2,2021, only currency exchange would have to report the receipt of cash QUESTION 6 Zeke transferred the virtual currency from his exchange account to his virtual wallet in order to save on fees. Was the transfer taxable? O No, because Zeke still holds the same coins Yes, because the coins moved Only if more than $10,000 in coin Only if the wallet has more than $10,000 in coin QUESTION 7 Danette wants to open an account on a virtual currency exchange. Which of the following is correct? She can open an account anonymously in the U.S. She will be required to provide proof of identity to open the account She will only be required to provide proof of identity when coins are sold O She is only required to provide proof of identity if she is a U.S. person QUESTION 8 The IRS issued a "John Doe" summons to locate tax evaders. What is that? O a request for records about specific taxpayers whose names are not yet known a tax return for a taxpayer who is not yet known a request to a bank for the bank statements of a dead person a request for a person name John Doe to come into the IRS office