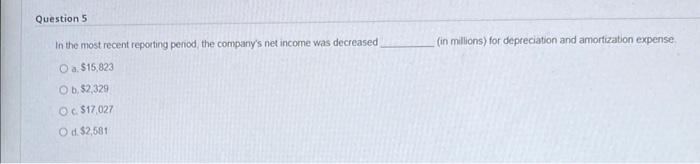

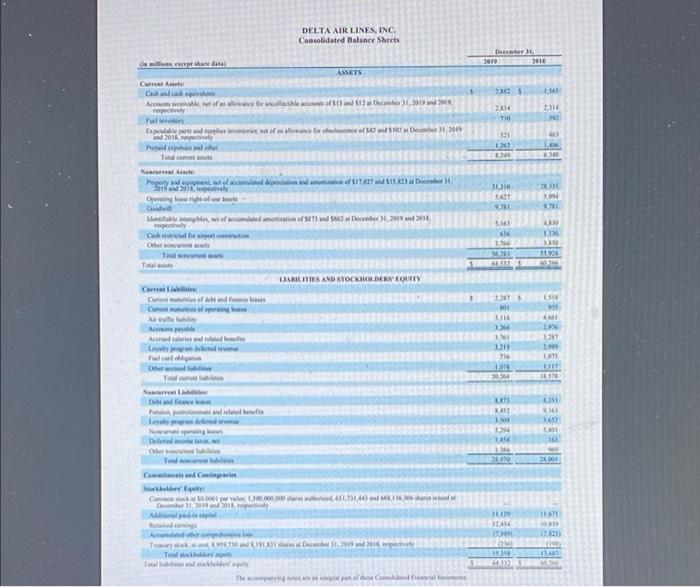

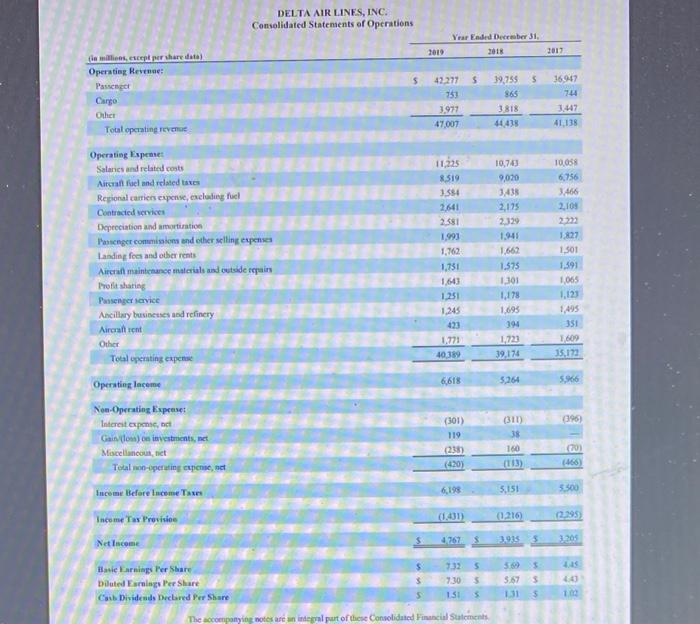

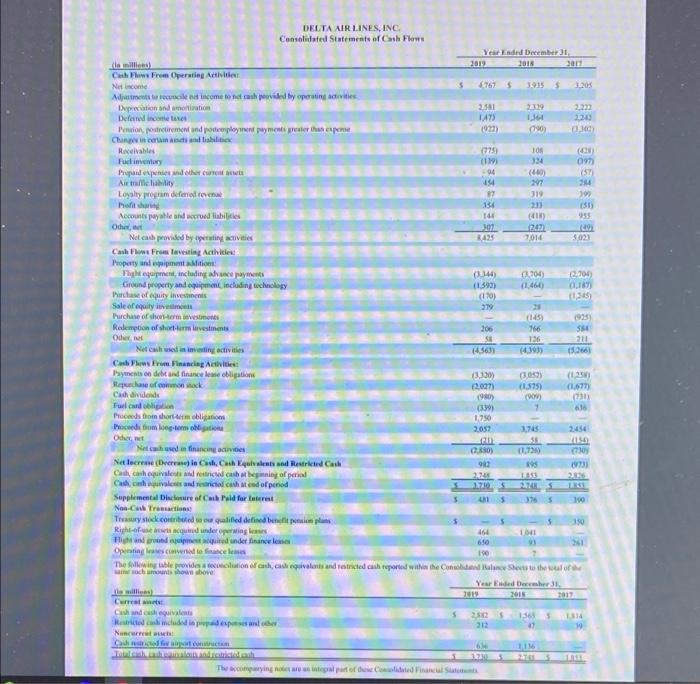

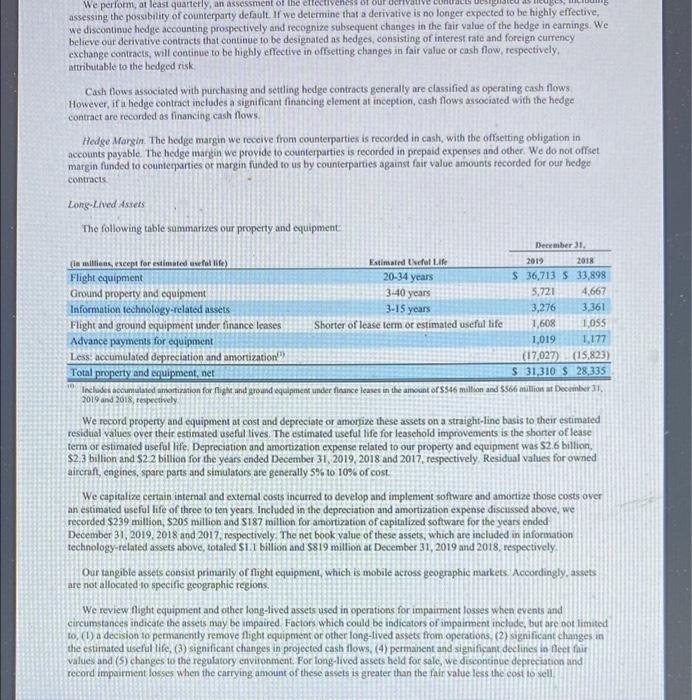

Question 5 In the most recent reporting period the company's net income was decreased (in millions) for depreciation and amortization expense O a $15.823 O b. 52329 O $17,027 O d. $2,581 DELTA AIRLINES, INC. Consolidated Balance Sheets ther 1019 2018 ASSETS Carreal Cook 20$ SY Artigolle , not of an art cej( ew0 tis = 11 517 200 254 3514 01 ch det er for 50 Dec 19 2018.apely hean 22 000 News regatywny 2010 Opening how Jade TENGOESIS GENES OICI 2011 33 11 Metion of the 2011 App INT LUS Cotcom ON OS 3. SANI 1 VES LIABILITIES AND STOCKHOLDERS FOUNTY MISI SUS 100 Carre Cara Curipe Array A And when La 16 VRE RUST I 2 HOT HE ME HE PS 20 1857 New 11 2.4 . COM 10 CE TA 13 10 1.300.000.000,00 CHI M MO Acecom Te Today 3. KULI HMS 395 DELTA AIRLINES, INC. Consolidated Statements of Operations Year Ended Deber 31, 2018 2010 2011 s s $ 3697 families, peshare data Operating Revenue: Passenger Cargo Other Total operating revenu 744 42.277 753 3.977 47.007 39,755 865 3.818 44438 3.447 41,138 10,743 9,020 3438 2,175 2.329 1.441 10.058 6,756 3.466 2,109 Operating Espelet Salaries and related costs Aircrafael and related taxes Regional carriers expense, eselling fuel Contracted services Depreciation and amortization Pessenger commissions and other selling expenses Landing fees and other rents Aircraft maintenance materials and outside requin Profit sharing Passenger service Ancillary businesses and refinery Aircraft rent Other Total operating expertise Operating Income Non-Operating Expenses Interest exponent Gain) en investments, et Miscellaneous, net Total operating expense net Income Before Income Taxe Income Tax Provision Net Income 11.225 8.519 1.584 2641 2.381 1.991 1,72 1,751 1.643 1.251 1,245 423 1.771 40389 1.575 1301 1,178 1.695 394 1,723 39,174 1.827 1.501 1,391 1065 1.121 1,495 351 1,609 15.172 6,618 5.264 5,666 395) (301) 119 (238) (420) (311) 38 160 (113) (466) 6,198 3.151 5500 (1.431) (1.2169 2.295 3767 3.915 5 $ Hasle Earnings Per Share Diluted Earnings Per Share Cns Dividends Declared Per Share 7:32 7.30 15 5 $ 3 516) 5 5.67 3 1315 40 10 S 5 The paying notes are nel put of these Consolidated al Salements 15 5023 DELTA AIRLINES, INC. Consolidated Statements of Cash Flows Year Ended December clinico 2018 301 Chow From Operating Activities Net Income 5.7675 30155 3205 Altereomacie et lilcome to cash povilid by permite Duration and ration 2.51 2119 Deleted income 1473 1360 20 Pation, tretirement and poteployment rate this page 1921) 000 01.10 Clinishi Revates 025 JOS Fully 19 334 09 Propandexpend the current wa -04 (4) Altri ability 194 207 344 Loyalty program for 7 319 30 Porn 134 2013 1513 Accounts payable and accrued liabiljekes 141 Othe 107 207 Net cathod by perting activities 435 7014 Cash From lavesting Acthien Property and entition Flequipment, including payment (3140 0.700 2.000 Ground property and equipment including technology (1.392) (1.466 0.187 March of ity investments (170 11.345 Sale of equity 21 30 Purchase of her bestens (145 935 Relemption of shrivestments 200 766 554 Oder SI 136 Nel case in investing activities (4563) (439 26 Cabresinancing Activities Payments on debt and finance me obligation (125 chase of cowock 2.007 (1.575 Chi du luan (1977) (90) con 030 Fue cando 0339 16 Proceeds to shorter obligations 1.750 econd from botom obligation 2,057 3.75 2454 Oder met PU 58 Netched in financies 14 .830) 11,7200 (730 Netlocrete (Deere Cash Cash quests and Red Cash 980 295 0233 Cachequivales restricted cash athening of peria 2248 Catch vived end of period 1210525 Supplemental Disor of Cul Paid for lateret 5 5 NooCub Trento Toy stock cord to qualified defined benci 5 150 Right quand underpering 464 1011 Hunder finance 650 361 Operating sa facem 190 Then we provide tecilition of canh, ca equivalent and forced cash reported within the Sheets the real of Year Ended December is will Curre BAT Cand equivalent 1.561 Rincluded in 47 Nunc Cach 211 000 The crying negat of the Coded in 20-34 years We perfom, at least quarterly, an assessment of the electiveness of our de assessing the possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts will continue to be highly effective in offsetting changes in fair value or cash flow, respectively, attributable to the hedged risk Cash flows associated with purchasing and settling hedge contracts generally are classified as operating cash flows However, if a hedge contract includes a significant financing elementat inception, cash flows associated with the hedge contract are recorded as financing cash flows Hedge Margin. The hedge margin we receive from counterparties is recorded in cash, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in prepaid expenses and other. We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts recorded for our hedge contracts Long-Lived Assets The following table summarizes our property and equipment December 31 (in millions, cept for estimated seal life) Estimated Useful Life 2019 2018 Flight equipment S 36,713 S 33,898 Ground property and equipment 3:40 years 5,721 4,667 Information technology-related assets 3-15 years 3,276 3,361 Flight and ground equipment under finance leases Shorter of lease term or estimated useful life 1,608 1.055 Advance payments for equipment 1,019 1.177 Less: accumulated depreciation and amortization! (17,027) (15.823) Total property and equipment, net $ 31,310 $ 28,335 Teclades accumulated amortization for flight and ground equipment under finance temes in the amount of $545 million and $566 million at December 31 2019 and 2018, respectively We record property and equipment at cost and depreciate or amortize these assets on a straight-line basis to their estimated residual values over their estimated useful lives. The estimated useful life for leasehold improvements is the shorter of lease term or estimated useful life. Depreciation and amortization expense related to our property and equipment was $2.6 billion, $2.3 billion and $2.2 billion for the years ended December 31, 2019, 2018 and 2017, respectively Residual values for owned aircraft, engines, spare parts and simulators are generally 5% to 10% of cost. We capitalize certain internal and external costs incurred to develop and implement software and amortize those costs over an estimated useful life of three to ten years. Included in the depreciation and amortization expense discussed above, we recorded S239 million, $205 million and S187 million for amortization of capitalized software for the years ended December 31, 2019, 2018 and 2017, respectively. The net book value of these assets, which are included in information technology-related assets above, totaled $11 billion and $819 million at December 31, 2019 and 2018, respectively Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific geographic regions. We review flight equipment and other long-lived assets used in operations for impairment losses when events and circumstances indicate the assets may be impaired Factors which could be indicators of impairment include, but are not limited to, (1) a decision to permanently remove flight equipment or other long-lived assets from operations, (2) significant changes an the estimated useful life, (3) significant changes in projected cash flows, (4) permanent and significant declines in fleet fair values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discontinue depreciation and record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell