Answered step by step

Verified Expert Solution

Question

1 Approved Answer

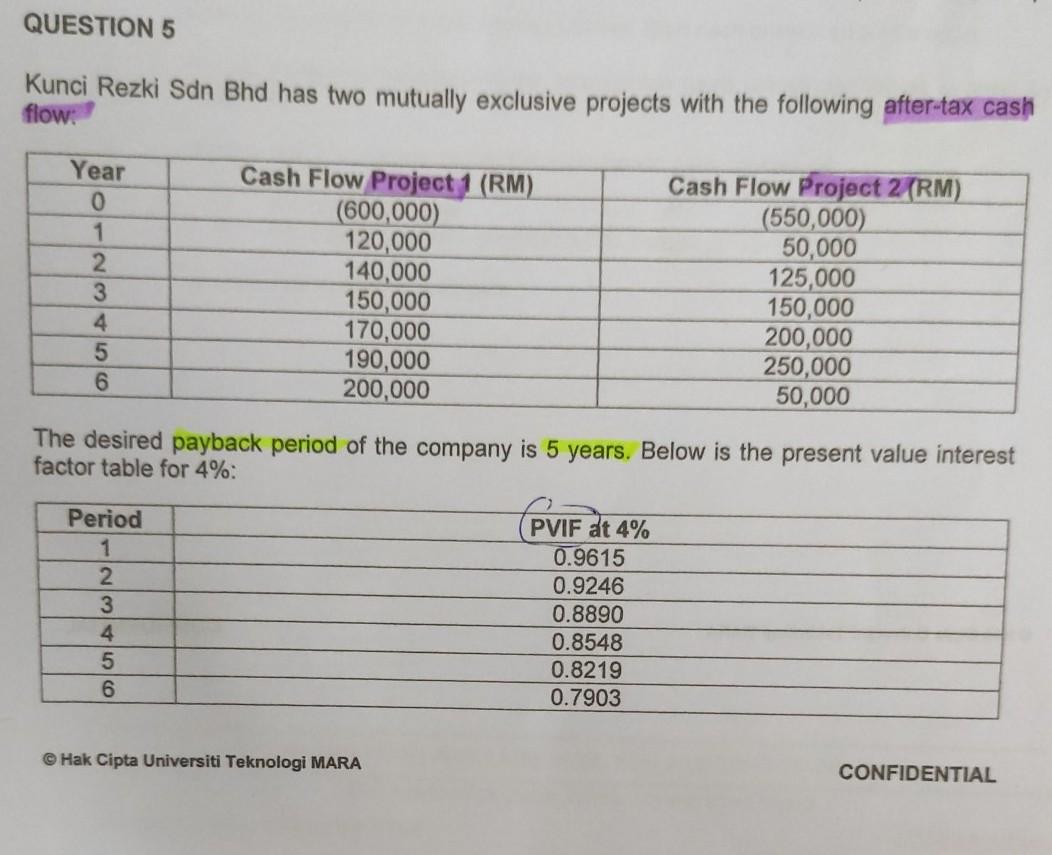

QUESTION 5 Kunci Rezki Sdn Bhd has two mutually exclusive projects with the following after-tax cash flow: Year 0 1 2 3 4 5 6

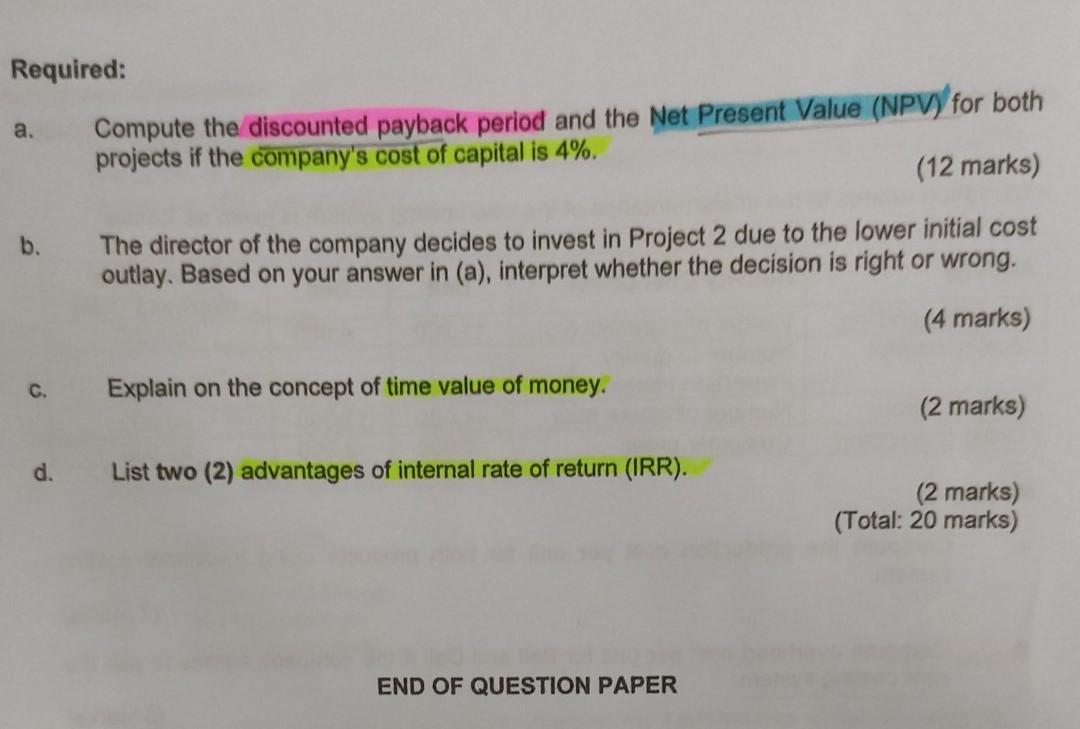

QUESTION 5 Kunci Rezki Sdn Bhd has two mutually exclusive projects with the following after-tax cash flow: Year 0 1 2 3 4 5 6 Cash Flow Project 1 (RM) (600,000) 120,000 140,000 150,000 170,000 190,000 200,000 Cash Flow Project 2 (RM) (550,000) 50,000 125,000 150,000 200,000 250,000 50,000 The desired payback period of the company is 5 years. Below is the present value interest factor table for 4%: Period 1 2. 3 4 5 6 PVIF at 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 Hak Cipta Universiti Teknologi MARA CONFIDENTIAL Required: Compute the discounted payback period and the Net Present Value (NPV) for both projects if the company's cost of capital is 4%. (12 marks) a. b. The director of the company decides to invest in Project 2 due to the lower initial cost outlay. Based on your answer in (a), interpret whether the decision is right or wrong. (4 marks) C. Explain on the concept of time value of money. (2 marks) d. List two (2) advantages of internal rate of return (IRR). (2 marks) (Total: 20 marks) END OF QUESTION PAPER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started