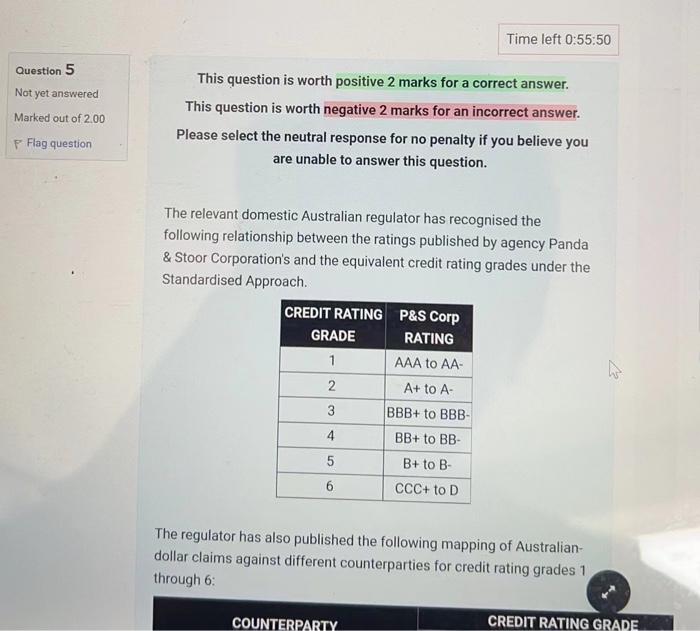

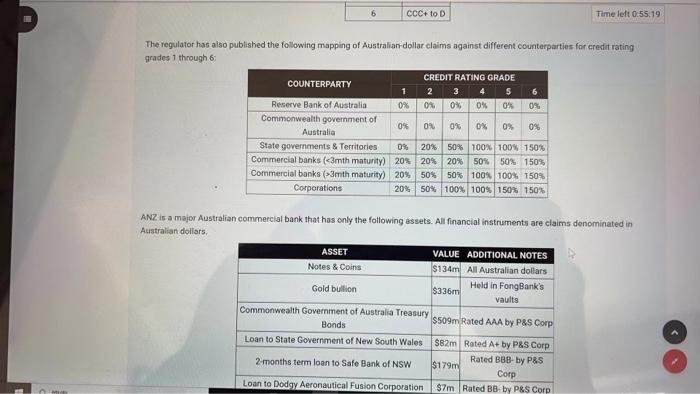

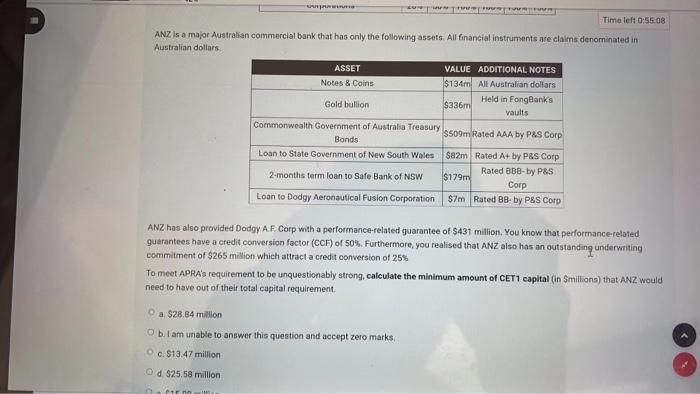

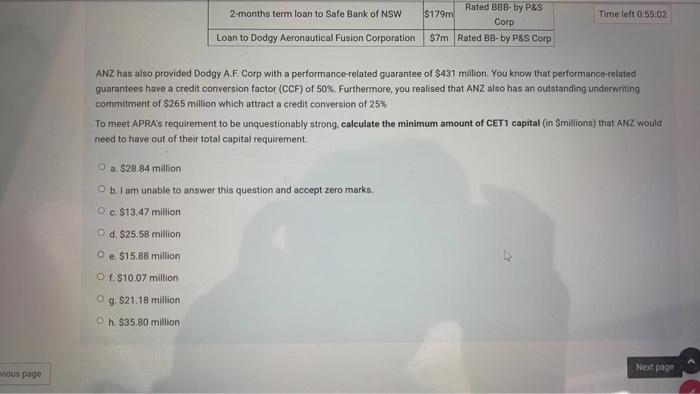

Question 5 Not yet answered This question is worth positive 2 marks for a correct answer. This question is worth negative 2 marks for an incorrect answer. Please select the neutral response for no penalty if you believe you are unable to answer this question. The relevant domestic Australian regulator has recognised the following relationship between the ratings published by agency Panda \& Stoor Corporation's and the equivalent credit rating grades under the Standardised Approach. The regulator has also published the following mapping of Australiandollar claims against different counterparties for credit rating grades 1 through 6: The regulator has also published the following mapping of Australian-dollar claims against different counterparties for credit rating grades 1 through 6 : ANZ is a major Australian commercial bank that has anly the following assets. All financial instruments are claims denominated in Australian dollars. ANZ is a major Australian commercial bank that has only the following assets. All financial instruments are claims denominated in Australian dollars. ANZ has also provided Dodgy A.f. Corp with a perfarmance-related guarantee of $431million. You know that performance-related guarantees have a credit conversion factor (CCF) of 50%. Furthermore, you realised that ANZ also has an outstanding underwiting commitment of $265 million which attract a credit conversion of 25% To meet APRA's requirement to be unquestionably strong, calculate the minimum amount of CET1 capital (in Smillions) that ANZ would need to have out of their total capital requirement. a. $28.84 mililion b. I am unable to answer this question and accept zero marks. c. $13.47 million d. $25.58 million ANZ has also provided Dodgy A.F. Corp with a performance-related guarantee of $431 million. You know that performance-celated guarantees have a credit conversion factor (CCF) of 505 . Furthermore, you realised that ANZ also has an outstanding underwriting commitment of $265 million which attract a credit conversion of 25% To meet APRA's requirement to be unquestionably strong. calculate the minimum amount of CET1 capital (in Smillions) that ANZ would need to have out of their total capital requirement a. $28.84 million b. I am unable to answer this question and accept zero marks. c. $13.47 million d. $25.58 million e. $15.88 million f. $10.07 million g. \$21.18 million h. $35.80 million