Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 5 of 6 . Pushkin, LLC is your tax client. In addition to preparing Pushkin's returns, you also prepare the individual tax returns of

Question of

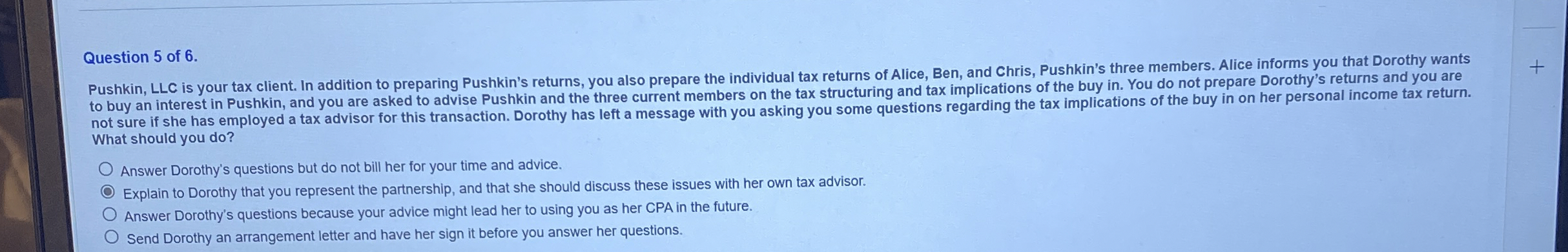

Pushkin, LLC is your tax client. In addition to preparing Pushkin's returns, you also prepare the individual tax returns of Alice, Ben, and Chris, Pushkin's three members. Alice informs you that Dorothy wants to buy an interest in Pushkin, and you are asked to advise Pushkin and the three current members on the tax structuring and tax implications of the buy in You do not prepare Dorothy's returns and you are not sure if she has employed a tax advisor for this transaction. Dorothy has left a message with you asking you some questions regarding the tax implications of the buy in on her personal income tax return. What should you do

Answer Dorothy's questions but do not bill her for your time and advice.

Explain to Dorothy that you represent the partnership, and that she should discuss these issues with her own tax advisor.

Answer Dorothy's questions because your advice might lead her to using you as her CPA in the future.

Send Dorothy an arrangement letter and have her sign it before you answer her questions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started