question 5 part (c), it should be rephrased to:

Determine the units required (for 12 pizza and 16 pizza) in order for the company to achieve its target profit of $500,000 (net of the marketing budget of $150,000).

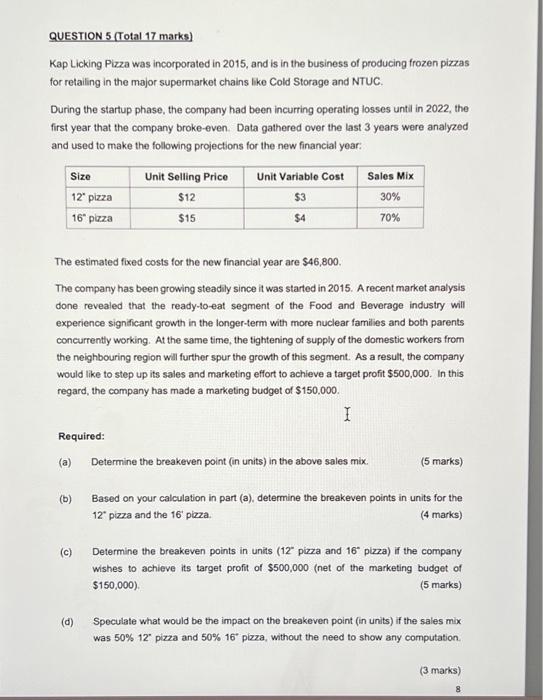

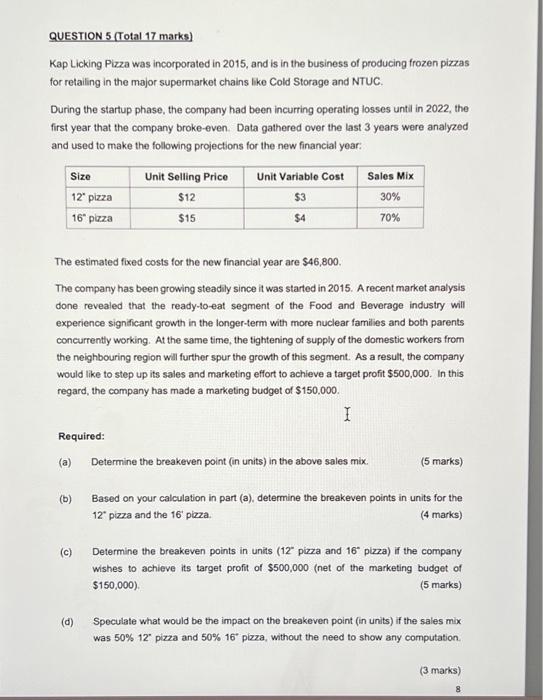

QUESTION 5 (Total 17 marks) Kap Licking Pizza was incorporated in 2015, and is in the business of producing frozen pizzas for retailing in the major supermarket chains like Cold Storage and NTUC. During the startup phase, the company had been incurring operating losses until in 2022, the first year that the company broke-even. Data gathered over the last 3 years were analyzed and used to make the following projections for the new financial year: The estimated fixed costs for the new financial year are $46,800. The company has been growing steadily since it was started in 2015. A recent market analysis done revealed that the ready-to-eat segment of the Food and Beverage industry will experience significant growth in the longer-term with more nuclear families and both parents concurrently working. At the same time, the tightening of supply of the domestic workers from the neighbouring region will further spur the growth of this segment. As a result, the company would like to step up its sales and marketing effort to achieve a target profit $500,000. In this regard, the company has made a marketing budget of $150,000. Required: (a) Determine the breakeven point (in units) in the above sales mix. (5 marks) (b) Based on your calculation in part (a), determine the breakeven points in units for the 12 pizza and the 16 pizza. (4 marks) (c) Determine the breakeven points in units (12 pizza and 16 pizza) if the company wishes to achieve its target profit of $500,000 (net of the marketing budget of $150,000) (5 marks) (d) Speculate what would be the impact on the breakeven point (in units) if the sales mix was 50%12 pizza and 50%16 pizza, without the need to show any computation. (3 marks) QUESTION 5 (Total 17 marks) Kap Licking Pizza was incorporated in 2015, and is in the business of producing frozen pizzas for retailing in the major supermarket chains like Cold Storage and NTUC. During the startup phase, the company had been incurring operating losses until in 2022, the first year that the company broke-even. Data gathered over the last 3 years were analyzed and used to make the following projections for the new financial year: The estimated fixed costs for the new financial year are $46,800. The company has been growing steadily since it was started in 2015. A recent market analysis done revealed that the ready-to-eat segment of the Food and Beverage industry will experience significant growth in the longer-term with more nuclear families and both parents concurrently working. At the same time, the tightening of supply of the domestic workers from the neighbouring region will further spur the growth of this segment. As a result, the company would like to step up its sales and marketing effort to achieve a target profit $500,000. In this regard, the company has made a marketing budget of $150,000. Required: (a) Determine the breakeven point (in units) in the above sales mix. (5 marks) (b) Based on your calculation in part (a), determine the breakeven points in units for the 12 pizza and the 16 pizza. (4 marks) (c) Determine the breakeven points in units (12 pizza and 16 pizza) if the company wishes to achieve its target profit of $500,000 (net of the marketing budget of $150,000) (5 marks) (d) Speculate what would be the impact on the breakeven point (in units) if the sales mix was 50%12 pizza and 50%16 pizza, without the need to show any computation