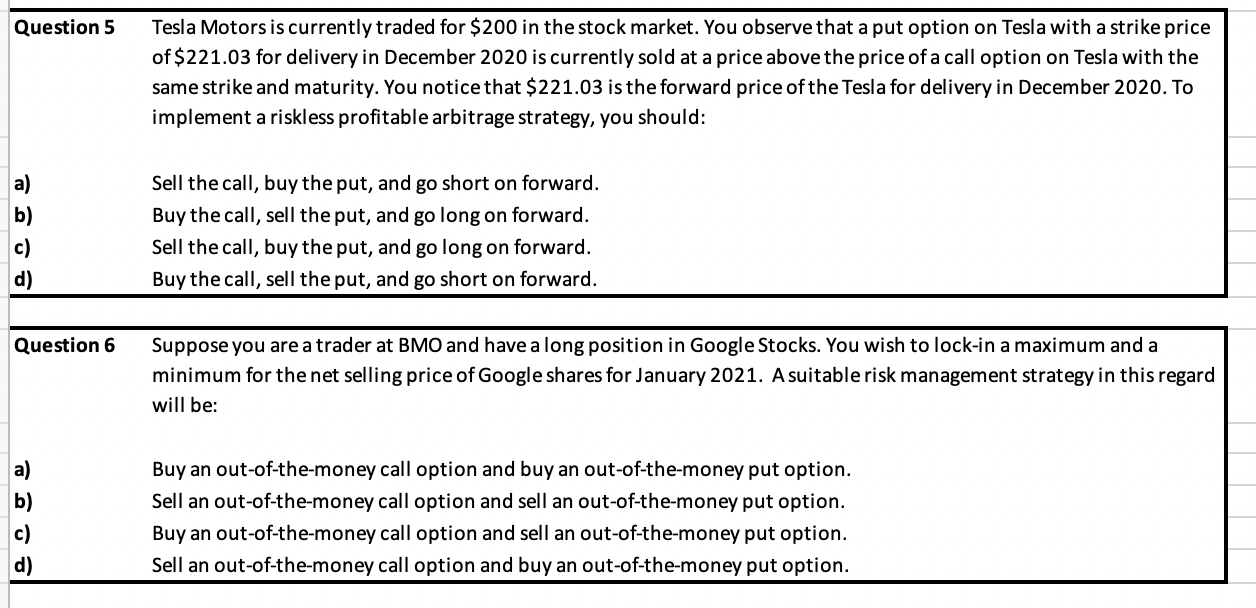

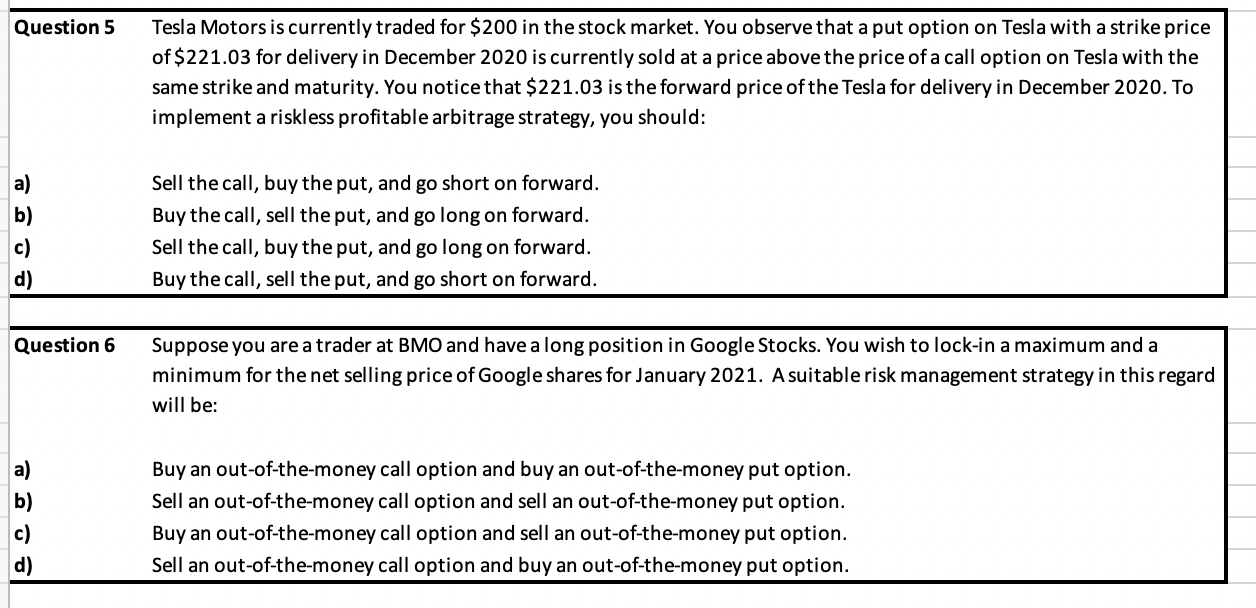

Question 5 Tesla Motors is currently traded for $200 in the stock market. You observe that a put option on Tesla with a strike price of $221.03 for delivery in December 2020 is currently sold at a price above the price of a call option on Tesla with the same strike and maturity. You notice that $221.03 is the forward price of the Tesla for delivery in December 2020. To implement a riskless profitable arbitrage strategy, you should: 5 Sell the call, buy the put, and go short on forward. Buy the call, sell the put, and go long on forward. Sell the call, buy the put, and go long on forward. Buy the call, sell the put, and go short on forward. 0 Question 6 Suppose you are a trader at BMO and have a long position in Google Stocks. You wish to lock-in a maximum and a minimum for the net selling price of Google shares for January 2021. A suitable risk management strategy in this regard will be: Buy an out-of-the-money call option and buy an out-of-the-money put option. Sell an out-of-the-money call option and sell an out-of-the-money put option. Buy an out-of-the-money call option and sell an out-of-the-money put option. Sell an out-of-the-money call option and buy an out-of-the-money put option. Question 5 Tesla Motors is currently traded for $200 in the stock market. You observe that a put option on Tesla with a strike price of $221.03 for delivery in December 2020 is currently sold at a price above the price of a call option on Tesla with the same strike and maturity. You notice that $221.03 is the forward price of the Tesla for delivery in December 2020. To implement a riskless profitable arbitrage strategy, you should: 5 Sell the call, buy the put, and go short on forward. Buy the call, sell the put, and go long on forward. Sell the call, buy the put, and go long on forward. Buy the call, sell the put, and go short on forward. 0 Question 6 Suppose you are a trader at BMO and have a long position in Google Stocks. You wish to lock-in a maximum and a minimum for the net selling price of Google shares for January 2021. A suitable risk management strategy in this regard will be: Buy an out-of-the-money call option and buy an out-of-the-money put option. Sell an out-of-the-money call option and sell an out-of-the-money put option. Buy an out-of-the-money call option and sell an out-of-the-money put option. Sell an out-of-the-money call option and buy an out-of-the-money put option