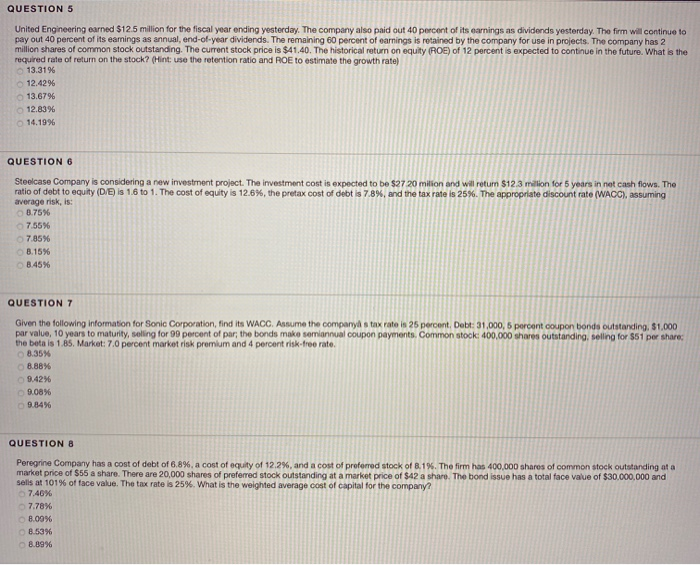

QUESTION 5 United Engineering earned $12.5 million for the fiscal year ending yesterday. The company also paid out 40 percent of its earnings as dividends yesterday. The firm will continue to pay out 40 percent of its earnings as annual end-of-year dividends. The remaining 60 percent of earnings is retained by the company for use in projects. The company has 2 million shares of common stock outstanding. The current stock price is $41.40. The historical return on equity (ROE) of 12 percent is expected to continue in the future. What is the required rate of return on the stock? (Hint: use the retention ratio and ROE to estimate the growth rate) 13.31% 12.42% 13.67% 12.83% 14.19% QUESTION 6 Steelcase Company is considering a new investment project. The investment cost is expected to be $27 20 milion and will return $12.3 million for 5 years in net cash flows. The ratio of debt to equity (D/E) is 1.6 to 1. The cost of equity is 12.6%, the pretax cost of debt is 7.8%, and the tax rate is 25%. The appropriate discount rate (WACC), assuming average risk, is: 0.75% 7.55% 7.85% 8.15% 8.45% QUESTION 7 Given the following information for Sonic Corporation, find its WACC. Assume the company s tax rate is 25 percent, Debt: 31,000, 6 percent coupon bonds outstanding, $1,000 par value, 10 years to maturity, soling for 90 percent of par, the bonds make semiannual coupon payments. Common stock: 400,000 shares outstanding, selling for $51 per share the bota is 1.85. Market: 7.0 percent market risk premium and 4 percent risk-free rate. 8.35% 8.88% 9.42% 9.08% 9.84% QUESTION 8 Peregrine Company has a cost of debt of 6.8%, a cost of equity of 12.2%, and a cost of proferred stock of 8.1%. The firm has 400,000 shares of common stock outstanding of a market price of $55 a share. There are 20,000 shares of preferred stock outstanding at a market price of $42 a share. The bond issue has a total face value of $30,000,000 and sells at 101% of face value. The tax rate is 25%. What is the weighted average cost of capital for the company? 7.46% 7.78% 8.00% 8.53% 8.89%